Recently, data has come to the fore that affects Bitcoin (BTC) and Ethereum (ETH) prices. US JOLTS data has caused the value of BTC and ETH to jump over 2 percent. Here are the details…

Bitcoin and ETH react positively to data

Bitcoin (BTC) and Ethereum (ETH) reacted positively after Tuesday’s Recruitment and Workforce Turnover Survey (JOLTS) data. Each increased by close to 2 percent within the hour the data was released. The report pointed out that job vacancies in the United States fell to 9.6 million in March, below the expectations of 9.775 million. Thus, it showed that the data fell to the lowest level since April 2021. Crypto market watchers have rated the weakening employment data of recent times as positive for asset prices. There were the following reasons behind this:

- The Fed will continue to raise interest rates until they feel inflation calm.

- Interest rate increases are negative for asset prices, including cryptocurrencies.

- Labor markets must cool down for inflation to fall.

In short, “bad” employment data is “good” for markets, at least in the current environment. In general, it is difficult to link price increases and decreases to macroeconomic reports with 100 percent certainty. But the timing of the spikes in Bitcoin’s price and volume on Tuesday shows that BTC is reacting to the employment report. Prices followed a moderate course for the rest of the day after the initial rise. cryptocoin.comAs we reported earlier, crypto markets may be making an early move ahead of the US Fed rate decision to be announced on Wednesday, although the expected 25bps increase is likely already priced in.

Other entities reacted differently to JOLTS data

It is an interesting development that other risk assets, especially stocks, did not react similarly to employment data. The S&P 500, Nasdaq Composite and Dow Jones Industrial Average (DJIA) fell after the data were released. Correlations between crypto and stocks have weakened this year, with the once strong correlation between BTC and the S&P 500 slumping from 0.80 to a relatively benign current correlation of 0.27.

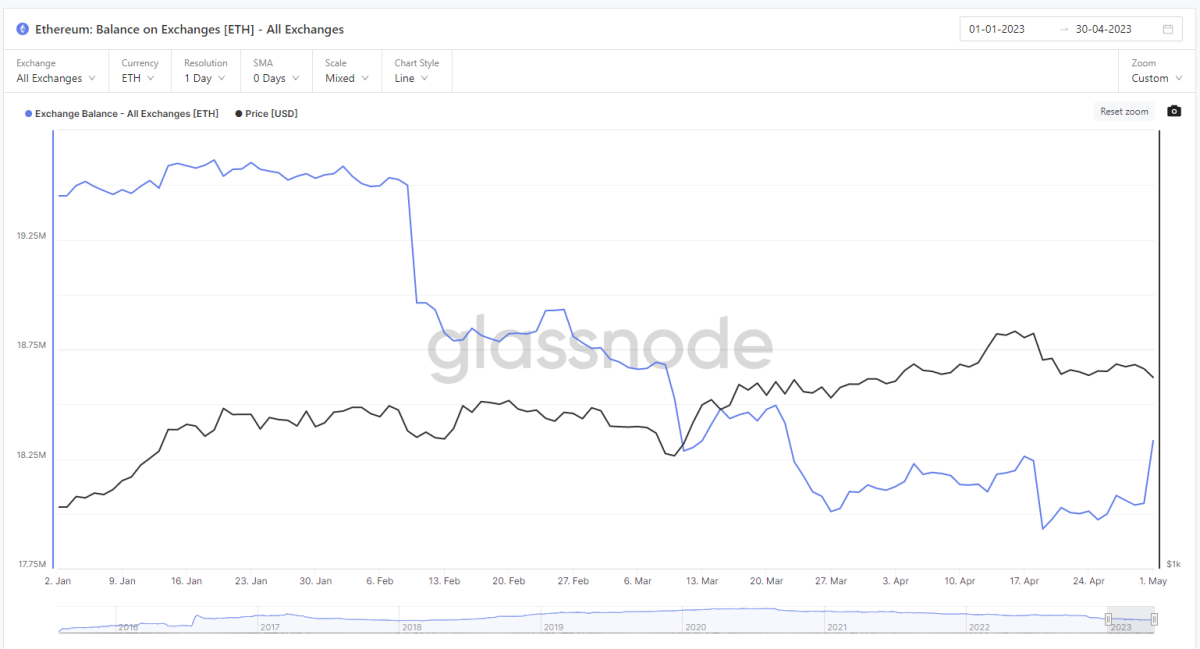

On-chain metrics suggest that markets may remain calm for the next few days as the Fed evaluates its rate decision. Exchange balances for both BTC and ETH are close to where they were at the beginning of 2023. BTC and ETH balances on crypto exchanges often increase as investors prepare to reduce their holdings in the asset. After the increases of 73 percent and 56 percent to date, the current inactivity draws attention. According to some, this indicates that investors continue to hold their positions even in the face of higher prices. While not to be confused as a definitive catalyst for even higher prices, the recession reflects resilience in the crypto markets and general support at current levels.