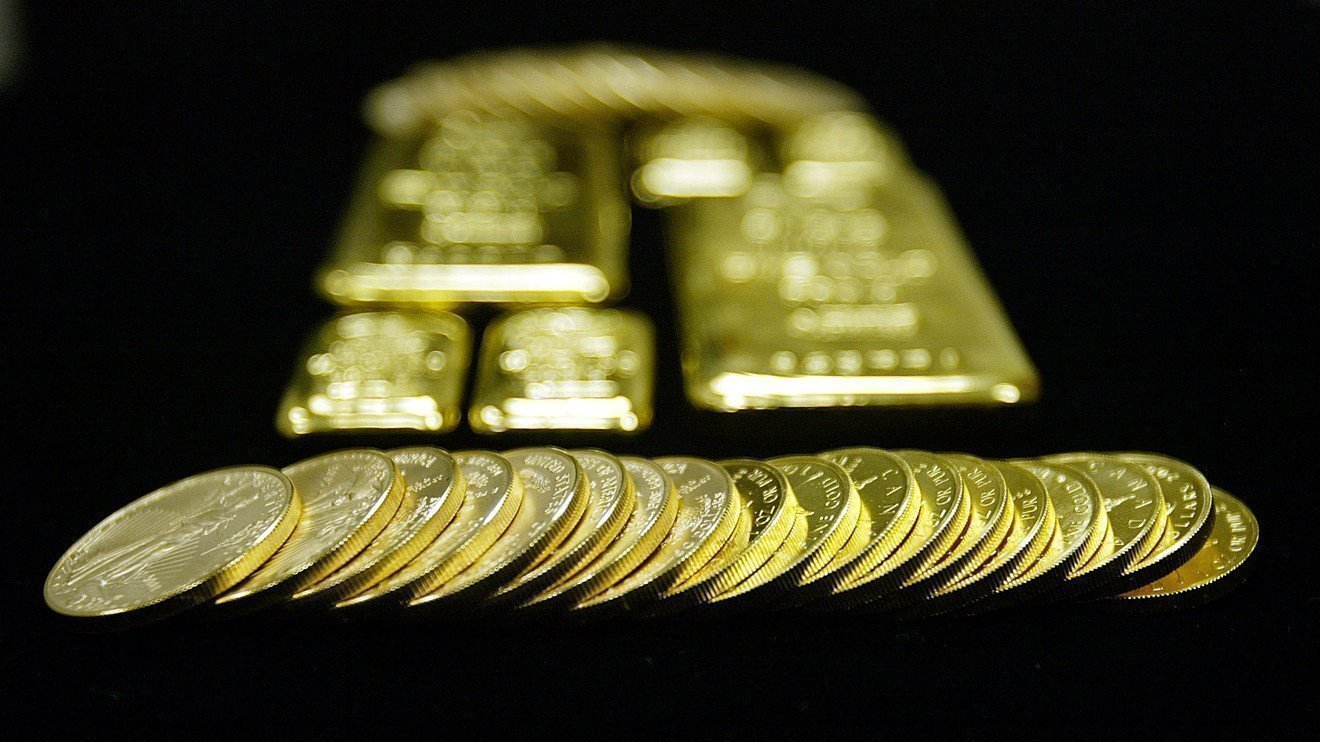

The gold market remains outside first-quarter highs and is well on its way to ending the year at over $2,000 an ounce and approaching $5,000 an ounce by the end of the decade, according to the latest In Gold We Trust Report.

Analysts forecast bullish for gold

On the annual gold outlook, Incrementum AG analysts remain bullish on gold as rising inflation threatens to push the global economy into recession and create a stagflationary environment . The European investment firm has issued a warning, saying that the normalization of monetary policies around the world is beginning to reveal significant problems in the global economy that remain on paper by loose monetary policies and large amounts of liquidity. Incrementum noted that only three of the Fed’s last 20 tightening cycles did not result in recessions.

With the huge threat of stagflation, analysts are in the position that most investors are insufficiently positioned to protect their capital as the traditional 60/40 portfolio structure is expected to see negative returns for only the fifth time in 90 years. noted that. With inflation expected to stay above 5% through 2022, Incrementum said equity markets could see more losses this year. Analysts have proven that holding precious metals provides a buffer for these losses. As we reported on Kriptokoin.com , so far this year, the S&P 500 has dropped 18% to below 4,000 points; however, gold prices were up 1% year-on-year as prices climbed above critical resistance at $1,850 an ounce.

Can precious metal be a reserve currency?

Analysts said, “Historical performance of gold, silver and commodities during past stagflation periods indicates that these assets are positioned higher than normal. But at the same time, the valuation of tech companies relative to commodity producers is an argument for a cyclical investment.”

Gold will continue to perform well as a major risk and inflation hedge in the near term. Analysts also see long-term potential as Russia’s war in Ukraine draws new geopolitical lines around the world. Analysts use the following statements:

We consider it reasonable that gold as a neutral currency reserve emerged as one of the commodities that benefited from the troubling conflict between East and West. Gold will likely find itself more accepted as a reserve currency in many countries, making itself increasingly a safe.