Stronger-than-expected US jobs data dampened expectations for rate cuts from the Federal Reserve. After that, the gold price experienced a rapid pullback on Friday.

This puts pressure on the gold price.

cryptocoin.com Spot gold rose to $2,072.19 on Thursday, just below the record high of $2,072.49, after the Fed hinted that the cycle of rate hikes could be over. However, it fell 1.7% to $2,015.33 after Friday’s data. However, it was up 1.3% weekly. Tai Wong, an independent metals trader based in New York, comments:

The data will not cause the Fed to raise rates in June. But it will probably remind interest rate cut enthusiasts to take some time off. This puts pressure on zero-yield gold.

Such data is likely to support the gold price!

Meanwhile, 10-year Treasuries rose after the jobs data. This, in turn, put pressure on the gold price, reducing the attractiveness of the non-yielding bullion. Alexander Zumpfe, precious metals dealer at Heraeus, comments:

Any economic data pointing to the cooling of the US economy and thus interest rate cuts in the medium and long term is likely to support the gold price. Conversely, positive surprises will likely put pressure on prices.

Be careful in times of severe stress!

According to City Index senior market analyst Matt Simpson, if we see more panic over the debt ceiling or US banks, it’s possible that price action will turn ugly at these highs. Therefore, the analyst warns:

This has the potential to punish the bulls and bears. Keep your hats tight, for I’m afraid of this. In times of severe stress, all markets, including gold, can fall.

US NFP data to disappoint precious metal

The government announced on Friday that the United States created 253,000 new jobs in April. He also said that wages have risen sharply. The increase exceeded the 180,000 estimate of economists surveyed by the Wall Street Journal. Meanwhile, the unemployment rate fell from 3.5% to 3.4%.

Han Tan, chief market analyst at Exinity Group, says gold prices have slumped towards the psychologically significant $2,000 level, driven by a higher-than-expected headline NFP report and a decade-low unemployment rate. In this context, the analyst said, “This data is the final proof that the labor market is still tight. Therefore, it raises new doubts about the Fed’s interruption of rate hikes. This will disappoint the zero-yield precious metal,” he says.

Gold has reason enough to attempt a new record!

According to Han Tan, expectations of peak US interest rates led to the relief of the zero-yield asset. He also says that gold is rising amid ongoing fears over US banking turmoil, which increases the likelihood of a recession. Based on this, the analyst makes the following statement:

As long as markets refuse to give up hope that the Fed will cut rates in 2023 and fears of continued financial turmoil in the US continue to cloud risk sentiment, the precious metal will remain supported.

Tan says that despite the decline in prices after the NFP data, gold has enough reason to attempt a new record. However, he notes that such price movements indicate that the nugget may not hold once it hits a new high, as previous gains above $2,070 were quickly resolved.

Gold price will rise significantly towards the end of the year

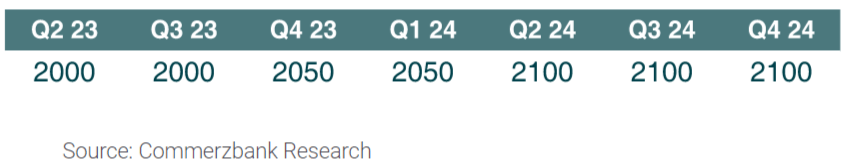

Gold price continues to hold just above the $2,000 level. Economists at Commerzbank expect the yellow metal to hold steady before rising towards the end of the year. In this context, economists make the following statement:

Over the next two quarters, we expect gold to be at roughly $2,000, and therefore only marginally below current levels. The gold price is likely to rise permanently and more prominently above the $2,000 level as the Fed makes its expectation of a return in interest rates more clear. But we expect that to happen only towards the end of this year.