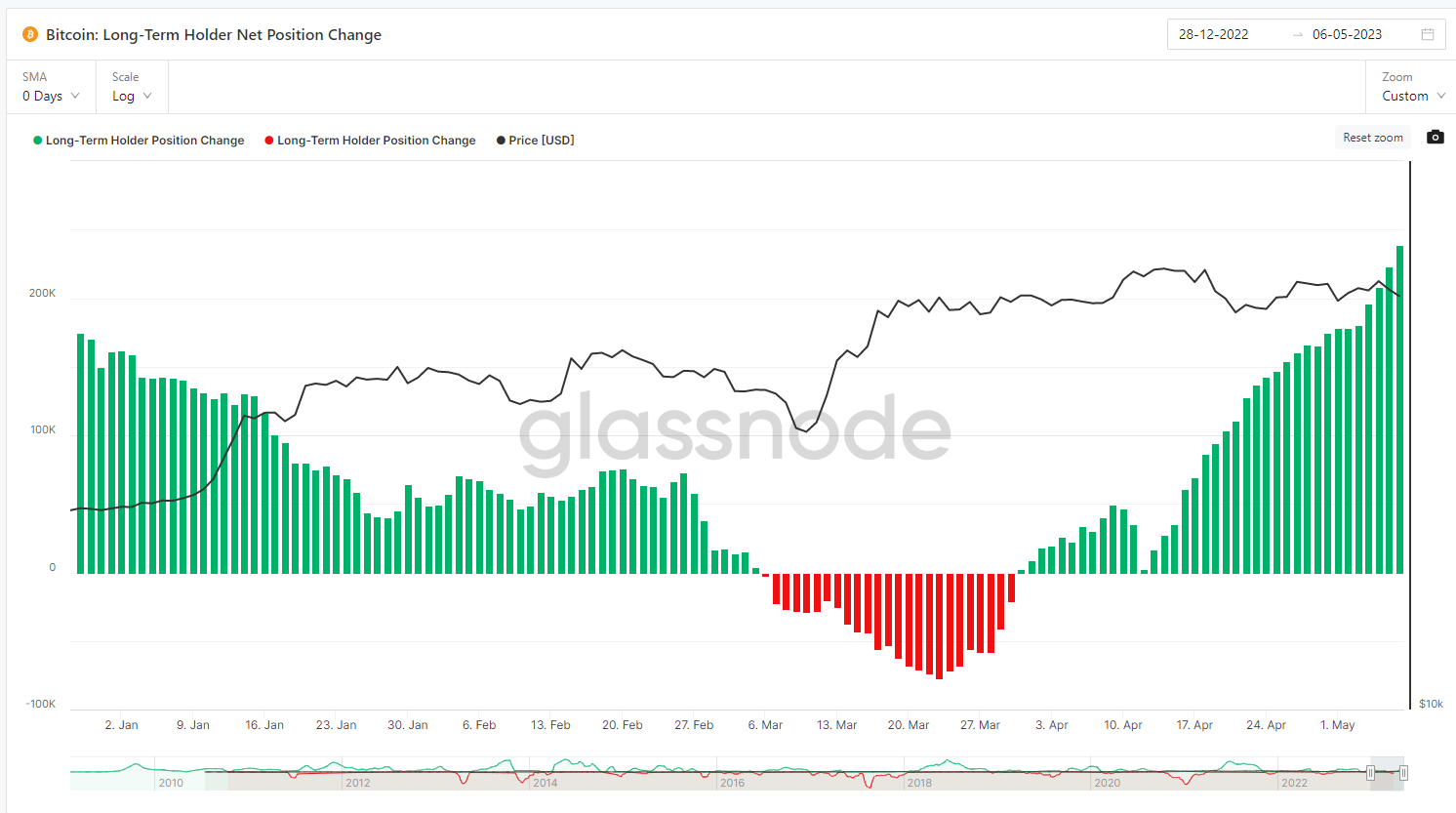

Long-term bitcoin holders are continuing to add to their bitcoin holdings, despite BTC trading at a slight premium. Meanwhile the CoinDesk Bitcoin Trend Indicator (BTI) is showing that the asset is in the middle of a significant uptrend.

Long-term holders’ 30-day change in bitcoin supply has been trending higher since March 31. Long-term supply is defined as coins that investors have been holding for 155 days or more.

As these investors are often less likely to spend older coins, an increase in the metric reflects dormant supply, as well as bullish sentiment.

The uptick is occurring as bitcoin prices have flattened over the identical period, implying that bitcoin holders view the recent pause in price movement as an opportunity to acquire more. Year-to-date, bitcoin prices are up 68%.

The increase also occurs as bitcoin’s Network Value to Transaction (NVT) value of 57 is 6% higher than its year-to-date average of 53.7. The NVT ratio is calculated by dividing BTC’s market capitalization by its transferred, on-chain volume.

Comparable to the price-to-earnings ratio in equities, higher NVT levels indicate that bitcoin is overbought, while lower values indicate that it may be oversold. In this case, the close proximity to its average implies a market trading at a slight premium, but relatively in balance at the moment.

Meanwhile, CoinDesk’s Bitcoin Trend Indicator is implying that price may move higher.

The tool, which was developed by CoinDesk Indices, produces a daily signal indicating the direction and strength of bitcoin’s price trend.

Using a series of moving average crossover windows, the tool broadcasts one of five daily values ranging from “significant downtrend” to “significant uptrend.” BTI indicates that bitcoin is in the middle of a significant uptrend.

Traders with a short-time horizon will likely note that BTI flashed the uptrend signal on April 28, following a decline into neutral territory. BTC prices are down 5% since that specific signal.

A year-to-date time horizon will show that the first uptrend signal of 2023 occurred on Jan. 13, with BTC prices increasing 40% since that date.

Recommended for you:

- IRS Seeks Court Approval to Identify Kraken Crypto Customers

- Why NFTs Are So Appealing – And How Anyone Can Start Learning for Free

- Ex-UK Chancellor Philip Hammond Urges Accelerated Efforts to Become Crypto Hub: FT