Gold prices retreated from $2,050, or a week’s high, late the previous day. Thus, it came under selling pressure for the second time on Thursday. We have compiled the gold forecasts and gold technical analysis of the leading banks of the sector for our readers.

UBS: Gold prices will rise to $2,200

cryptocoin.com As you follow, the Fed increased the interest rates by 25 bps and implied that it is taking a break from the hikes. In this environment, UBS economists predict that the US dollar will weaken further. He predicts that this will likely push gold to $2,200 by March 2024. In this context, economists make the following assessment:

The Fed opened the door to suspend interest rate hikes. Also, other central banks, including the ECB, continue to tighten. However, we expect the USD to weaken further this year as the US interest rate and growth premium erode. The Fed is likely to cut interest rates sooner than other major central banks…Weakening dollar will be supportive for gold prices. Thus, we predict that the price of the yellow metal will rise to $2,200 by March 2024.

TDS: The countdown continues in the gold markets!

TD Securities economists expect the gold price to rise towards an all-time record after the US inflation report came in line with expectations. Economists explain these expectations as follows:

There are no surprises in the inflation report. The countdown to all-time highs continues in the gold markets. The gravitational pull in the markets will continue to support higher prices in the coming months. In addition, the ongoing banking stress and debt ceiling debacle will remain in focus. In particular, the global growth outlook will continue to create headwinds for the USD as the stagflationary conditions of the past year are dusted off.

Credit Suisse: Gold prices will reach new record highs

Gold fell sharply on Friday after hitting new highs last week. Economists at Credit Suisse are predicting a final move to new record highs above $2,070/75. They support their views on this issue as follows:

As the uptrend continues, we expect the $2,070/2,075 levels to remain a tough barrier for further sideways consolidation for now. Support holds first at $1,969, then at $1,950/48, which includes the 55-DMA, which we will try to hold if reached. We believe that, after the current phase of change, the market will eventually move to new record levels supported by lower US Real Returns. On a weekly close basis, above $2,075 will be seen as an important breakout point. It will also pave the way for a move towards our initial key upside target of $2,330/2360.

ING: Fed’s interest rate path is crucial for gold orbit

ING strategists say Fed policy will be key to gold prices in the medium term. Strategists predict that the Fed will wait until the fourth quarter. But he predicts it will cut interest rates more aggressively, at least in the early stages. Accordingly, they expect the Fed funds rate to fall to 3% by mid-2024, with interest rate cuts of 50 basis points at both the November and December FOMC meetings. From this point of view, strategists make the following prediction:

We expect real yields to follow the decline in policy rates later in the year. This will also be supportive for gold prices. Given that the Fed will start cutting interest rates towards the end of this year, we think prices will rise in the second half of next year.

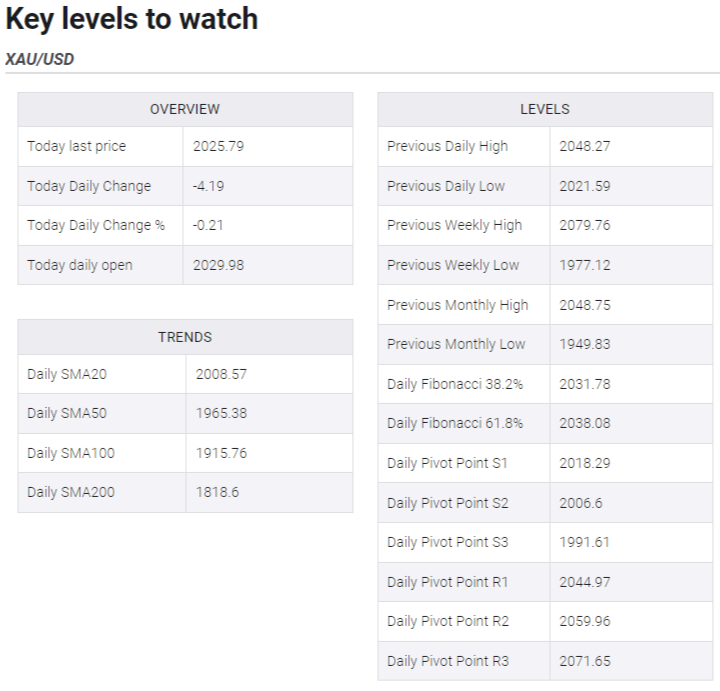

Gold prices technical view

Gold maintained its bidding tone in the first part of the European session. Currently, the yellow metal is in the $2,025-2,024 region, down about 0.35% on the day. Technical analyst Haresh Menghani points to key highs in the technical outlook for gold.

From a technical perspective, any further declines are likely to find support near the $2,014 area or the weekly top touched on Monday. This is closely followed by the psychological mark of $2,000, which could trigger some technical selling if it breaks. Gold is likely to become vulnerable later on to accelerate the decline towards the $1,980 region on its way to the strong horizontal support at $1,970. Some follow-up sales will erode the short-term positive outlook. Thus, it will change the trend in favor of bearish traders.

On the other hand, the $2,050 zone is currently emerging as a strong barrier. Some follow-on purchases have the potential to push the gold price towards all-time highs of around $2,078-2,079 reached last Thursday. It is possible to increase the momentum further. This is also likely to allow the bulls to conquer the $2,100 round figure mark.

Key levels for gold prices

Key levels for gold prices