This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

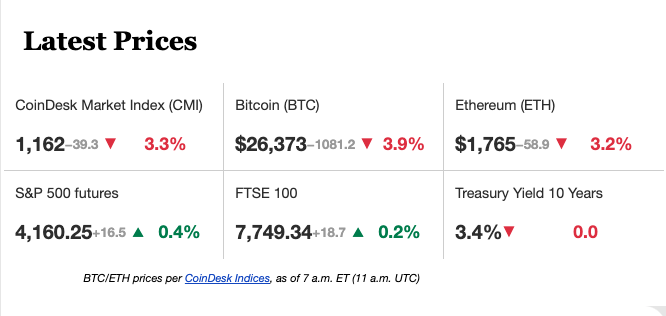

Latest Prices

Top Stories

Cardano’s scaling tool Hydra Head has gone live on the blockchain’s mainnet in the latest DeFi-focused upgrade to the network. Each Hydra Head works as a “mini ledger” shared among a small group of participants, thereby helping to speed up transactions significantly. The hope is that developers will be able to use the tools to add specialized DeFi protocols on top of Cardano, giving the network utility comparable to that of the likes of Ethereum. Cardano’s native token ADA has seen a slight uptick following the upgrade, currently ahead 1.45% in the last 24 hours, outperforming the broader crypto market, which has fallen 3.16%, according to the CoinDesk Market Index.

The Milady NFT collection spiked as much as 60% following an acknowledgement from Elon Musk, which drew parallels with the Twitter owner’s past praise for dogecoin. Miladys feature cartoon profile pic-like images with wide-eyed childlike faces, one of which Musk tweeted overlaid with the words, “There is no meme, I love you.” Following the tweet, the collection trended among the most in-demand NFTs on marketplace OpenSea, with prices as high as $13,700 worth of ether at the peak and trading volumes of over $22 million in the last 24 hours. The comparisons with dogecoin should prompt caution among traders however. While Musk’s supposed endorsement of DOGE in the past has triggered jumps in the memecoin’s price, they have often proved short-lived.

Crypto miner Hive Blockchain is planning to sell up to $100 million in common shares through an at-the-market sale in order to fund the goal of doubling its computing power. Hive is aiming to increase its hashrate from 3 exahash/second (EH/s) to 6 EH/s, part of which it says it can achieve by the end of Q2 with machines already purchased. No further details have been offered on the timeline of the sale, for which Canadian investment firms Canaccord Genuity and Stifel are to act as agents. Following the turbulence of 2022, of which several miners did not live to tell the tale, firms are now taking advantage of a modest rebound in crypto prices so far this year to set new growth and operational targets.

Chart of the Day

Recommended for you:

- Crypto Investors Can Rely on ‘Frankly Nothing’ in Current Regulatory Environment, Says Former FDIC Official

- Trump Digital Trading Card Project Mints NFTs for Winners of Prizes

- U.S. CFTC Chief Behnam Reinforces View of Ether as Commodity

Trending Posts