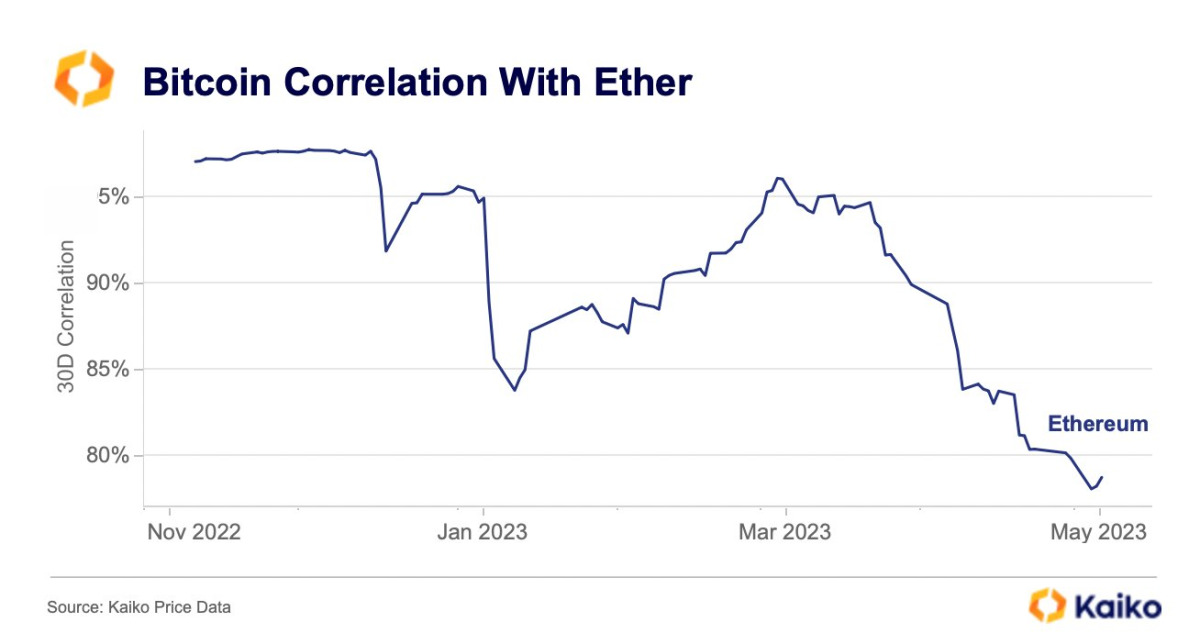

The 30-day correlation of Bitcoin and Ethereum dropped to 78 percent for the first time in 18 months. Bitcoin is outperforming other cryptocurrencies amid banking turmoil and the changing macroeconomic outlook. Ethereum and other top 30 assets are struggling to make up for their recent pullback. Here are the details…

Correlation between Bitcoin and ETH has declined

According to data from crypto intelligence tracker Kaiko, the 30-day correlation between the two largest assets by market cap has dropped below 80 percent for the first time in a year and a half. Typically, when the correlation between Bitcoin and Ethereum drops, the prices of the assets do not react similarly to macroeconomic conditions and other catalysts. While the Bitcoin price has fallen out of correlation with US equities, it has soared amid the banking crisis and increased regulatory scrutiny. Meanwhile, the 30-day correlation between Bitcoin and Ethereum dropped to 78 percent, while the altcoin lagged behind in its recovery.

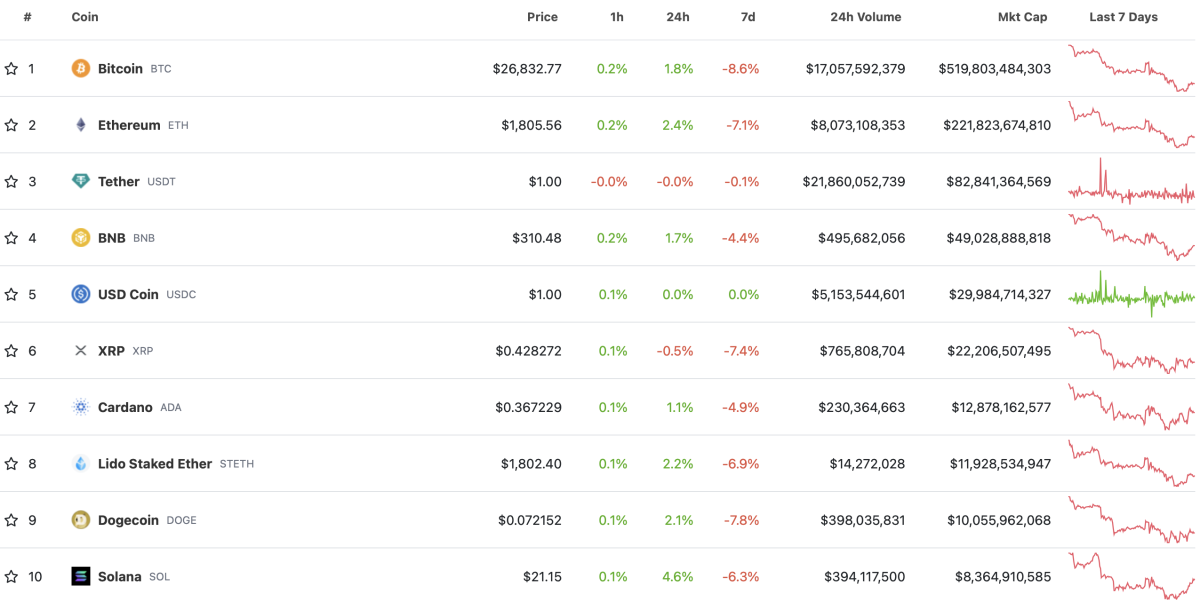

Crypto assets in the top 30 are struggling to recover from their recent pullback as Bitcoin tries to bounce back above $27,000. Generally, Ethereum ecosystem tokens and layer 2 assets also remain associated with ETH. With Ethereum’s correlation with Bitcoin decreasing, ETH and ecosystem tokens could see a drop in volatility in response to macro market events.

This is a major event as the correlation of the two cryptoassets has dropped for the first time since November 2021, and experts are watching prices and on-chain activity closely for signs of recovery. cryptocoin.com As we reported, the Bitcoin price erased its gains from the US CPI, while the Ethereum price has recorded a modest increase of 2.5 percent since Friday. Ethereum and ecosystem tokens are poised to recover with increased ETH deposits in Shanghai contract.

What is the latest situation in BTC price?

Bitcoin’s price has fallen steadily over the past week. According to some analysts, it may fall even more. However, the bearish momentum is much lower than expected and there are multiple levels of support that the market can rely on. Looking at the daily time frame, for example, according to CryptoVizArt, the price has been falling since it was rejected from the $30,000 resistance level in April. It also fell below the 50-day moving average, which was around $29,000. Judging by the recent candlestick patterns, a bullish retracement towards the broken moving average is likely. Still, the price could slide back towards the $25,000 static support level before it turns higher.

On the other hand, the Bitcoin network hit an all-time high in activity, setting a new record of 682,000 daily transactions. This marks a significant increase from the 250,000 daily transactions seen at the beginning of 2023.