As Bitcoin battles for its bull trend, BTC’s decline to its lowest level in the past two months has caused many investors to worry. On the other hand, Bitcoin still continues its struggle. A relatively quiet week for macro triggers means less chance of volatility from outside sources. So what factors will be effective for BTC and cryptocurrencies next week?

Weekly closing in Bitcoin; giving mixed signals!

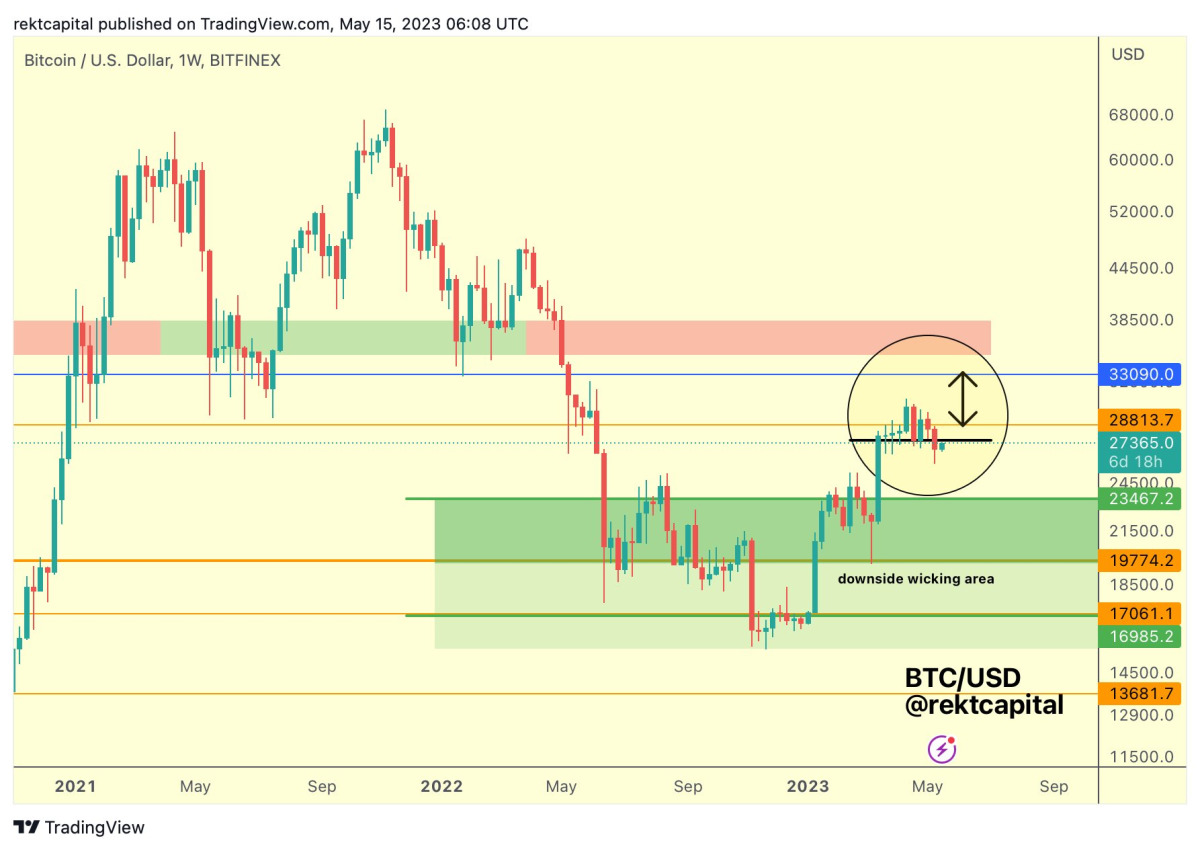

TradingView data reveals that BTC, which closed the week at $ 26,900, rose to $ 27,550 overnight. While this was promising for many investors, the close was BTC’s weakest close since mid-March. Pointing to BTC levels, Rekt Capital said, “BTC failed to retrace the $28800 Weekly level. Then, BTC closed below $27600 on the weekly charts and failed to hold this level as support.” in his words. However, the analyst said, “turning $27600 into resistance may enable further declines below $20,000.” He also conveyed his words.

On the other hand, with these comments, the current warnings made over the weekend are getting stronger. However, Rekt Capital was generally more optimistic about Bitcoin, looking beyond the current correction and its potential target, saying:

Bitcoin has already broken the downtrend. Now it’s all about maintaining the new uptrend. Whether retesting is necessary is a question. But history shows that the medium and long-term outlook is bullish.

On the weekly timeframes, the key trendline that looks big remains the 200-week moving average (WMA) and it took its first retest at $26,200.

Altcoins breathe as Bitcoin slows

Some altcoin projects, on the other hand, entered the new week with a short-term recovery movement. With Litecoin leaving BTC behind in terms of performance, Eight founder Michael Van de Poppe stated that BTC is “ready to continue rising”. On the subject, Poppe stated that an important movement could start at the level of 27 thousand dollars in a Twitter post, and also made comments about Litecoin. LTC has risen over 8 percent in the last 24 hours, reaching its highest level since May 6th. This proves its performance.

On the other hand, analyst Mustache cites that the weak price action in Bitcoin occurs so that many altcoins can breathe. However, the expert name warned the bears, “I will say it once and I will never say it again. You can’t compare a monthly chart with a daily chart.” conveyed his words.

On the other hand, Trader Tardigrade made similar bullish predictions based on Bitcoin’s weekly relative strength index (RSI) values. Even the weekly close is cause for optimism, according to the analyst.

FED officials’ statements may cause volatility in prices

On the other hand, events in the United States are preparing to calm down day by day, so macroeconomic risk price triggers may not work this week. After a few macro data released the previous week, the highlight of the coming days will be the speech by Federal Reserve Chairman Jerome Powell on May 19. As The Kobeissi Letter points out, a total of 14 Fed officials will comment in the coming days and there will be many potential conflicts.

You can't make this up, here the Fed members speaking this week:

1. Bostic – Monday

2. Kashkari – Monday

3. Barkin – Monday

4. Cook – Monday

5. Mester – Tuesday

6. Bostic – Tuesday

7. Barr – Tuesday

8. Logan – Tuesday

9. Jefferson – Thursday

10. Barr – Thursday

11. Logan -…— The Kobeissi Letter (@KobeissiLetter) May 14, 2023

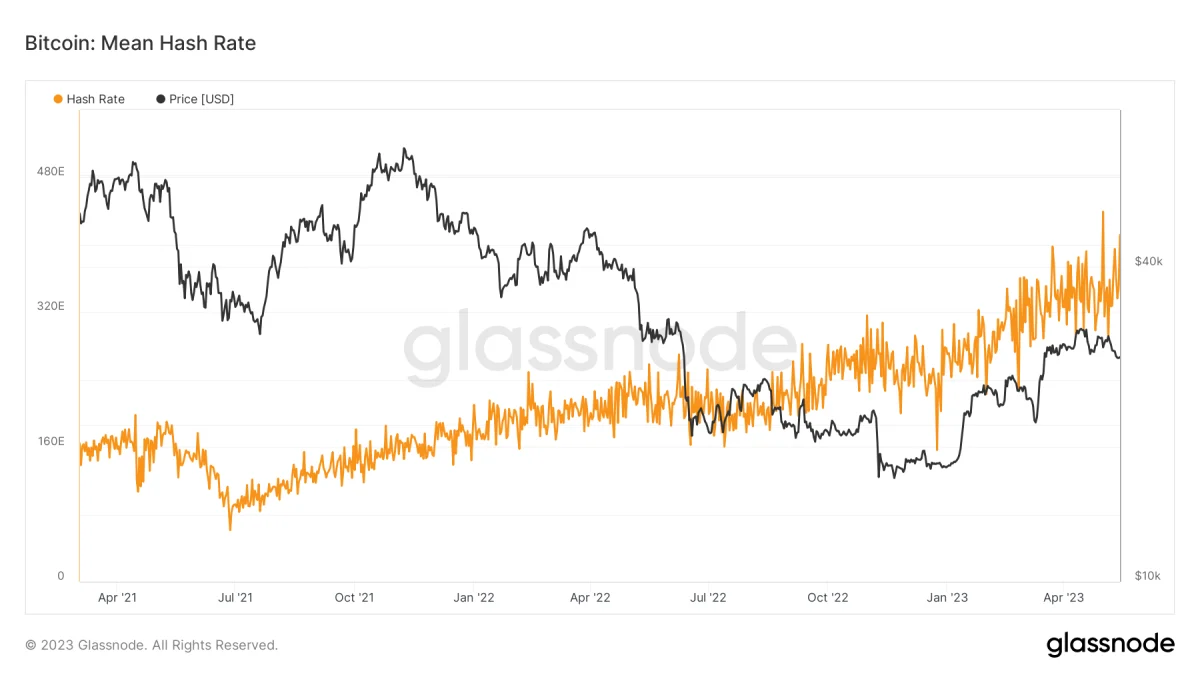

BTC mining difficulty heading towards all-time highs

Miners, who have one of the most critical roles in the cryptocurrency market, are facing a new challenge. Bitcoin mining difficulty will rise even higher. According to BTC.com’s forecasts, the difficulty will increase by about 2% this week after its previous adjustment created a slight pullback.

Thus, the tough uptrend that marked most of the year and where competition for block subsidies among cryptocurrency miners is in “increase only” mode will continue. This trend was unaffected by the recent short-term turbulence in the markets, and miner revenues increased significantly as a result.

After a tough 2022, with BTC up 65% YTD and transaction fees rising due to ordinals, Bitcoin miners are now bringing in the most revenue they have in over a year at roughly $40 million a day pic.twitter.com/kWbyIGoGRR

— Will Clemente (@WClementeIII) May 10, 2023

On the other hand, the accompanying estimates for the hash rate also reveal that the processing power allocated to mining is at all-time highs.

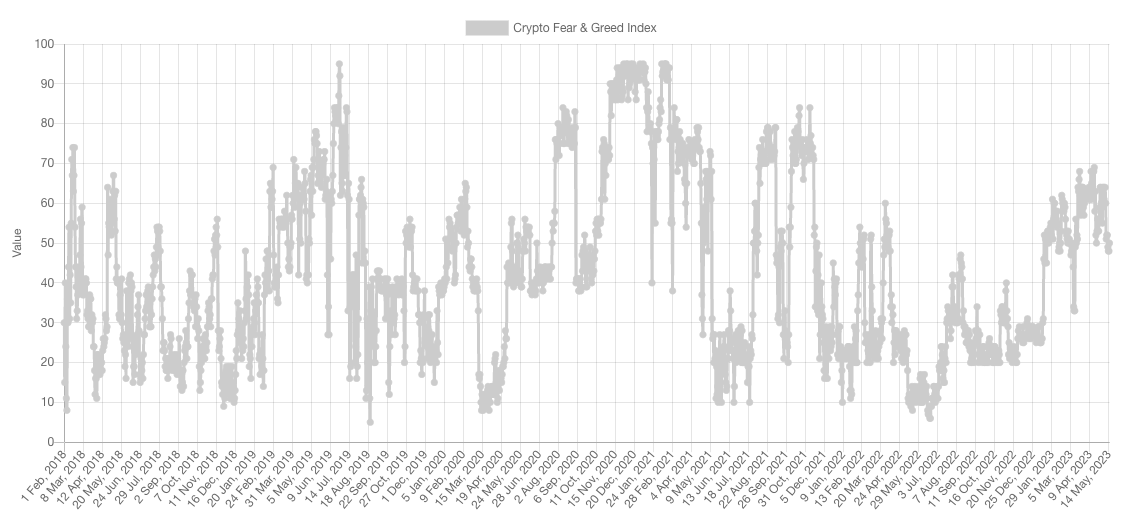

Market sentiment slows

Fear and Greed levels have been striking in recent days. After hitting its highest levels since November 2021, the Crypto Fear and Greed Index shows that irrational enthusiasm has taken a big hit thanks to the recent crash in cross-asset prices. As of May 15, Fear and Greed are at 50/100, which is halfway between the two extremes. However, it is characteristic of “neutral” market sentiment.

In the report published during the day, Santiment stated that the recent excitement about memecoins has also dissipated and the interest has returned to stablecoins with a wide cooling.