While the analysis for Bitcoin (BTC), the largest cryptocurrency, draws attention, on-chain data also stands out. Here are analysts Ali Martinez and Crypto Capo’s predictions for BTC and important data…

Analyst: BTC could drop to $12,000

A famous crypto analyst and long-term investor using his CryptoCapo account on Twitter said that the last price rally in the cryptocurrency market is over and Bitcoin will drop to $12,000. According to the analyst, the rally that many crypto users assume to be a bull run is a pullback in an ongoing downtrend. The analyst expressed his opinion on the current crypto market situation in a Telegram channel. He noted that the upward move in crypto prices was a manipulation by organizations that minted stablecoins out of thin air. According to him, manipulators aim to trap the bulls before dumping crypto prices on them.

CryptoCapo described the rally from the bottom of December 2022 as an internal pullback and a correction. More critically, he called it a bull trap, citing some people trying to make money by polishing projects that lack core values. According to him, such people create meme coins that their followers will later buy. According to the analyst, “The sole purpose of this move is to get everyone up, sell at higher prices and have enough liquidity to exit again”.

CryptoCapo predicts that a price capitulation will occur soon in the cryptocurrency market. He noted that technical and fundamental indicators supported his prediction and set Bitcoin’s price target at $12,000. According to the analyst, the price of Ethereum will fall between $500 and $700, while most altcoins will lose 60 to 80 percent of their current value.

Ali Martinez: These levels are very important!

On the other hand, crypto analyst Ali Martinez highlights important levels to watch out for that could point the next direction for Bitcoin price. In a recent tweet, Ali states that all eyes are on the most important support at $26,490, as failure to hold above could trigger a harder correction towards $24,100 or $23,190. On the upside, Bitcoin is facing stiff resistance, especially between $28,180 and $28,990, where 1.24 million addresses bought 973,220 BTC.

All eyes on $26,490 https://t.co/L81NDnnrYH

— Ali (@ali_charts) May 17, 2023

The accumulation trend is seen among Bitcoin whales who categorically own 1,000 to 10,000 BTC. Santiment reports that these major Bitcoin holders have accumulated 84,897 over the past five weeks. “Prices rose 34.4 percent in the previous accumulation cycle in January,” Santiment analysts wrote, highlighting the potential for a price increase from current levels.

🐳 #Bitcoin's key large whale addresses tier has been on a steady accumulation run over the past 5 weeks, accumulating a combined 84,897 $BTC during this time while prices are stagnant. In their previous accumulation cycle in January, prices jumped +34.4%. https://t.co/fLhCcBOJZA pic.twitter.com/sV43UxGksj

— Santiment (@santimentfeed) May 16, 2023

Long-term Bitcoin investors sell record amounts of BTC

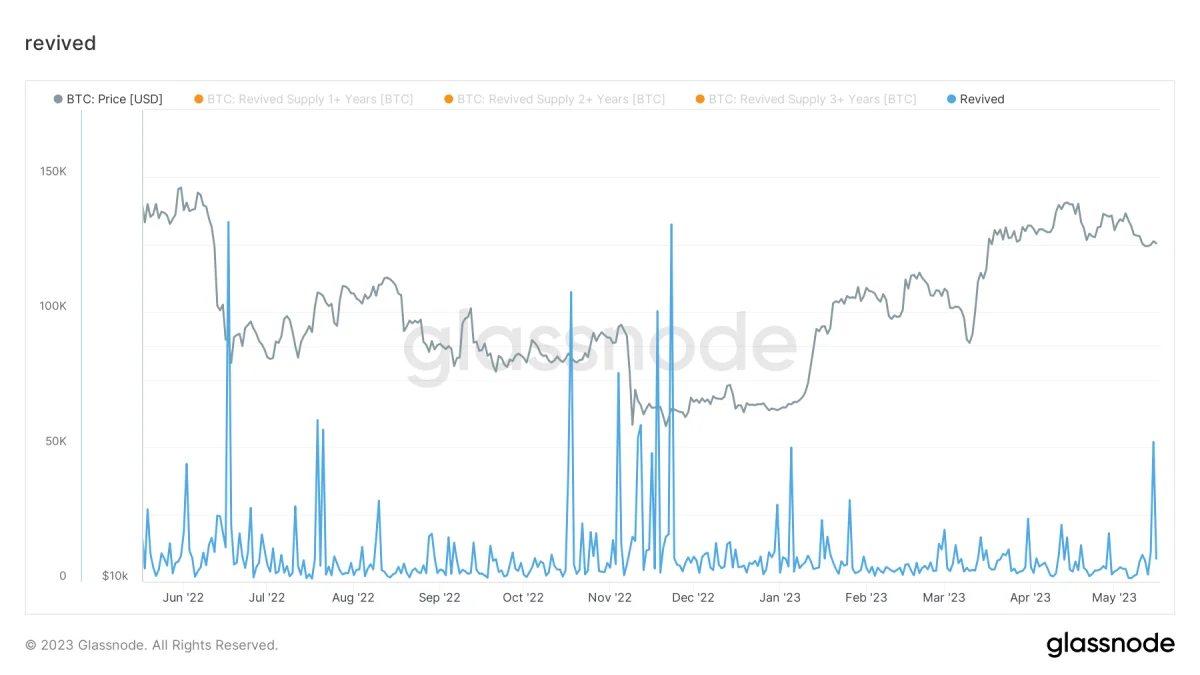

Meanwhile, long-term Bitcoin (BTC) holders sold around 50,000 BTC on May 15, setting a record for such sales this year. This metric represents the resurgent supply, or the amount of Bitcoin that re-enters circulation after remaining untouched. Addresses holding Bitcoin for more than a year sold 18,000 BTC on May 15, while addresses holding Bitcoin for more than two years sold 17,000 BTC. Addresses that have held Bitcoin for more than three years have sold 17,000 BTC.

Bitcoin has seen higher supplies in recent months. Notably, revived supplies of 110,000 BTC and 95,000 BTC, representing sales of $2 billion and $1.6 billion, respectively, in November 2022. Bitcoin also witnessed a resurgence of a 100,000 BTC supply in June 2022. This represented approximately $2.4 billion in sales. Bitcoin currently has a higher market cap than it had in those months. So the most recently revived supply (50,000 BTC) is worth more than $1 billion.