Bitcoin (BTC) and ether (ETH) fell to the bottom ends of their recent ranges, with economic data appearing to weigh on investor sentiment.

Thursday morning’s 8:30 AM ET release of initial jobless claims showed 242,000 Americans filing for unemployment benefits, down 22,000 from last week’s reading of 264,000 and lower by 12,000 than consensus estimates of 254,000.

Lower than expected initial jobless claims are likely to be bearish for asset prices in general and crypto prices specifically as it makes it less likely the U.S. Federal Reserve will pause an historic string of rate hikes at its next meeting in June. The Fed’s Federal Open Market Committee (FOMC) has repeatedly signaled that looser labor markets are a prerequisite for lower interest rates.

Indeed, Dallas Federal Reserve President Lorie Logan later on Thursday indicated that current data points don’t yet justify a pause in interest rate hikes. “The labor market’s continued strength appears to be contributing to high inflation”, stated Logan.

In the minutes following the new jobs data, prices for bitcoin and ether modestly fell back on higher than expected volume.

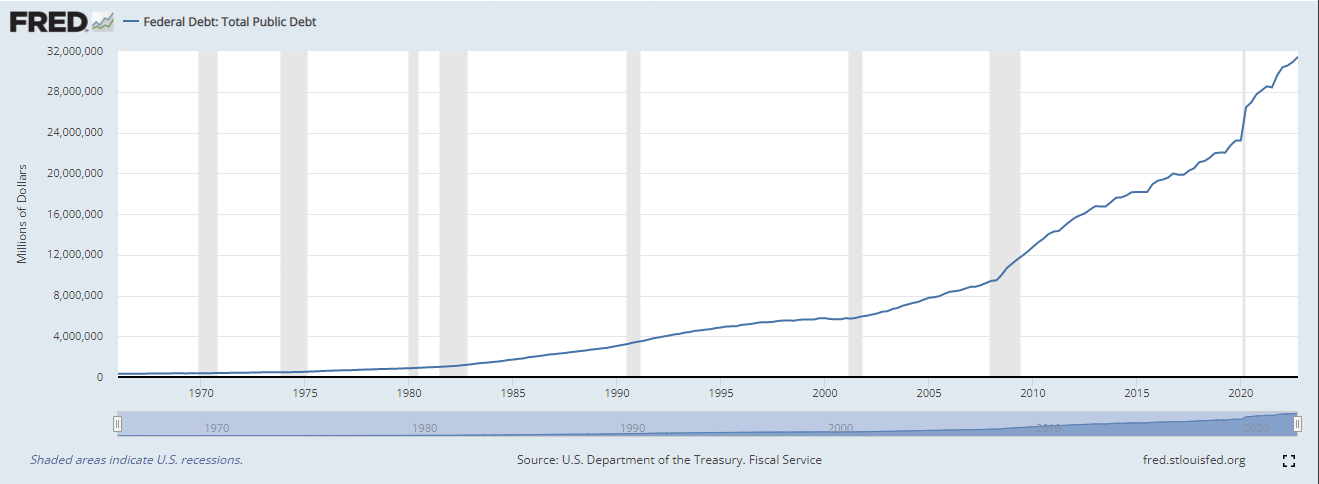

Returning serve was movement on a potential U.S. debt deal being reached between Democrats and Republicans. The United States has essentially reached its $31.4 trillion debt limit. A deal would increase that limit, allowing the U.S. to incur more debt for the payment of its obligations.

Not increasing the limit would prohibit the U.S. from paying its bills, with markets anticipating that having a deleterious impact on both the economy and risk assets. A few bitcoin bulls would counter that idea, suggesting reduced confidence in the United States’ ability to pay its debts could lead to that crypto as being viewed as a more sound currency option.

“We can agree that it (i.e. default) would be bad news all around, but perhaps would be good for bitcoin and gold as fiat economy alternatives,” wrote Noelle Acheson in her “Crypto is Macro Now” blog.

Still, both President Joe Biden, and Republican House Leader Kevin McCarthy expressed confidence that a deal will soon be reached.

McCarthy’s Thursday morning remarks on the debt deal appeared to push markets higher during the 10:00 AM ET hour, with bitcoin’s hourly chart showed an expansion in trading range as the crypto rose to $27,400

Crypto markets, however, turned decidedly lower in afternoon trade, with bitcoin tumbling to close to a one-month low at $26,580 on high trading volume.

Recommended for you:

- Crypto Game Aavegotchi to Build Custom Blockchain Using Polygon Technology

- Skyweaver Is a Great Blockchain Game, and an OK Regular Game

- OKX-Affiliated Okcoin Pauses USD On-Ramp Due to Signature Bank’s Collapse