The US regulator SEC has recently classified a number of altcoins as securities. The most interesting was Filecoin (FIL), which he included in a letter yesterday. This decision has some negative consequences for traders and investors.

What the SEC’s securities label means for altcoin investors

The SEC claims that many altcoins are securities, enforcing the standards established under the Securities Act of 1933 and taking into account a few more important court decisions.

This accusation of the SEC comes through the application of the “Howey Test” criterion. This test questions whether a transaction invests in a joint business. It also mainly checks whether others expect profits from their efforts.

Applying these criteria to the cryptocurrency market, the SEC highlights the possibility that several altcoins fit this definition. This makes it difficult for these projects to comply with established securities laws. In a significant move, the US regulator recently designated several altcoins as securities.

Here are those altcoins that the SEC calls securities

cryptocoin.com We have covered numerous securities lawsuits since last year. One of the highlights is 7 altcoins that qualify as securities under the SEC-Coinbase lawsuit. The SEC currently considers the 37 altcoins listed below as securities.

- XRP

- Telegram Gram Token (TON)

- LBRY Credits (LBC)

- Decentraland (MANA)

- DASH (DASH)

- Power Ledger (POWR)

- OmiseGo (OMG)

- Algorand (ALGO)

- Naga (NGC)

- TokenCard (TKN)

- IHT Real Estate (IHT)

- Kik (KIN)

- Salt Lending

- Beaxy Token (BXY)

- DragonChain (DRGN)

- Tron (TRX)

- BitTorrent (BTT)

- Terra USD (UST)

- Luna

- Mirror Protocol mAssets (Multiple Symbols)

- Mirror Protocol (MIR)

- Mango (MNGO)

- Ducat (DUCAT)

- Locke (LOCKE)

- Ethereum Max (EMAX)

- Hydro (HYDRO)

- BitConnect (BCC)

- Meta 1 Coin (META1)

- Rally

- DerivaDAO (DDX)

- XYO Network (XYO)

- Rari (RGT)

- Liechtenstein Cryptoasset Exchange (LCX)

- DFX Finance (DFX)

- Chromatica (CHROM)

- FlexaCoin (AMP)

- Filecoin (FIL)

The SEC today suggested that Filecoin is a security

The US regulator described Filecoin as a security in a letter to Grayscale. Grayscale has filed an application with the SEC to register the trust product. The SEC referred to the FIL as a security in its response to the company.

“Grayscale has received a letter from SEC personnel that the core asset of trust products, the FIL, meets the definition of a security under federal securities laws,” the company said in a later statement.

Consequences of trading with Securities

The sale of unregistered securities is generally a violation of US law. This regulation mandates that securities be registered with the SEC before being sold to the public. While there are exemptions to this rule, such as sales to accredited investors or private placements, the sale of unregistered securities can result in significant penalties, including fines and lost profits.

In light of the SEC’s new classification, exchanges that specifically list these altcoins may be subject to regulatory scrutiny. Some US exchanges currently list more than a dozen cryptos that the SEC has classified as illegal for sale, which could trigger regulatory action and subsequently affect their operations.

For investors in these newly classified securities, the situation is undoubtedly getting more complicated. The regulatory compliance required for trading securities means that investors must consider factors such as securities laws and regulations. Also, given their new legal status, the marketability and liquidity of these altcoins may be affected.

Crypto exchanges listing these securities face their own challenges. From a regulatory perspective, they could face sanctions and legal consequences if they continue to list these securities without the necessary registration or exemptions.

‘Legal advice’ to reduce risks

Given the legal complexities surrounding the sale of unregistered securities and the specific exemptions that may apply, it has become imperative for all stakeholders in this field to seek professional legal advice. Critics argue that the SEC’s recent enforcement actions and interpretive decisions could hinder blockchain and crypto industry innovation.

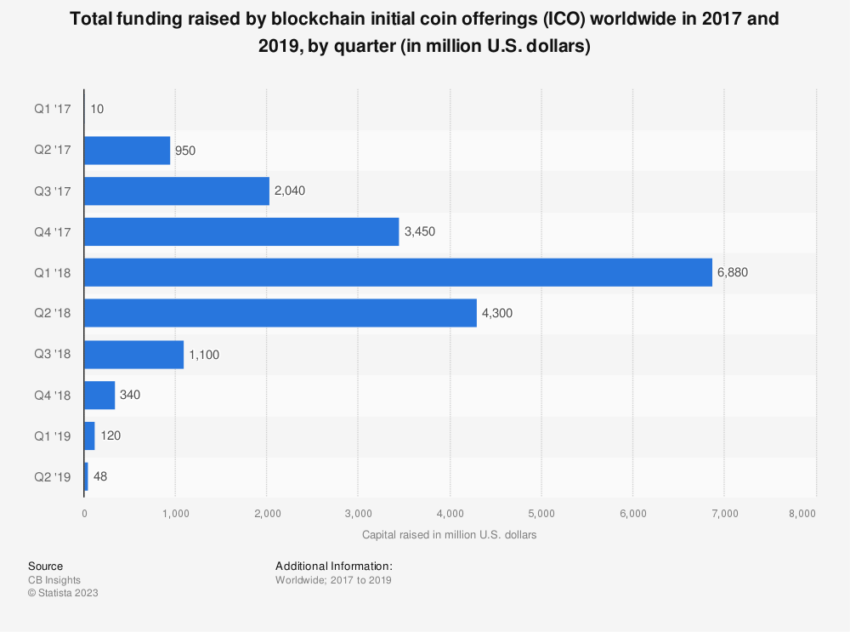

Blockchain projects often raise funds through ICOs, which are considered securities offerings according to the SEC. As such, these projects must comply with stringent regulatory requirements, which are often cumbersome and expensive, discouraging smaller innovative projects.

The SEC’s approach may shift some of its activities to softer jurisdictions. However, given the global nature of crypto, US investors are still indirectly affected.

For example, a project may prevent US investors from participating in an ICO to stay outside the scope of US securities laws. This limits the opportunities for US investors to participate in innovative blockchain projects.

Looking beyond securities laws

The SEC’s recent actions to classify as securities represent a significant shift in regulatory practice. Reclassifying these cryptos as securities leads to reduced liquidity, limited market access, and potential legal ramifications for unregistered securities trading. Not only does it present challenges for individual investors and exchanges, it also impacts innovation in the industry.

The intertwining of cryptos and securities laws underscores the importance of understanding the regulatory environment in which these projects operate. While recent SEC decisions add additional complexity to the equation, they also underscore the need for regulatory clarity in this rapidly evolving field.