Gold prices slumped below $2,000 as the stronger U.S. dollar, improved risk perception and investors did not rule out a new Federal Reserve rate hike in June. On the crypto front, the leading crypto Bitcoin has lost the important support level of $ 27 thousand. Now gold and Bitcoin investors have their eyes on Fed Chairman Jerome Powell.

What is hard to swallow!

Comex gold futures for June delivery fell more than $120 after testing record highs of $2,085 an ounce just two weeks ago. However, gold is still up around 7% year-to-date. Analysts warn that gold is at risk of more losses if $1,950 fails to hold.

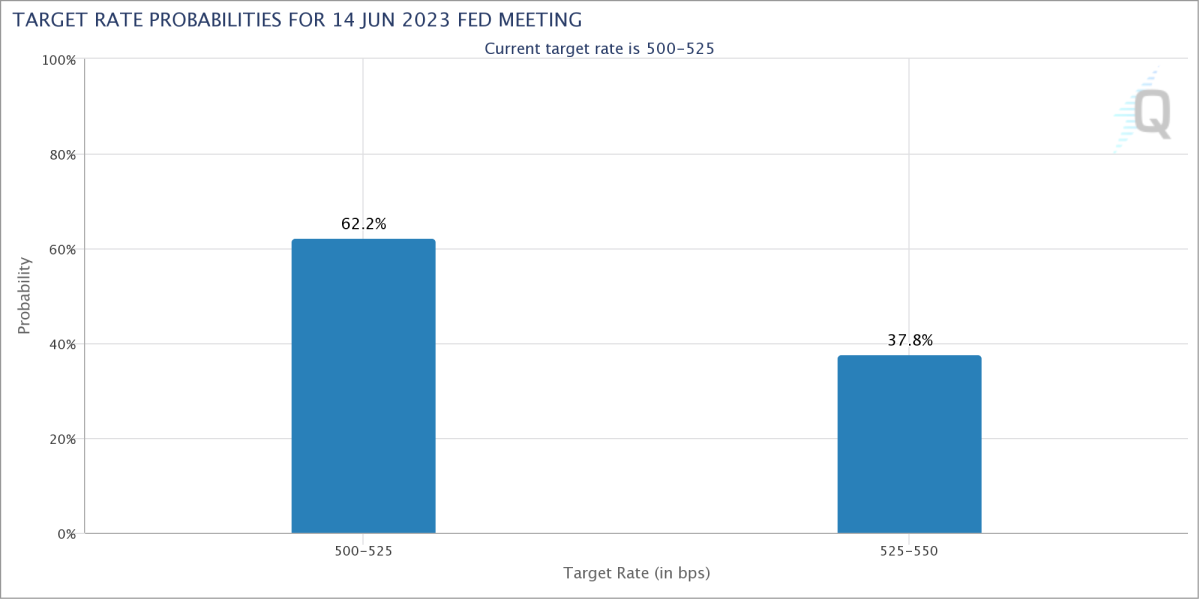

The strong US dollar is among the biggest factors pulling gold down. The dollar rallied on the resilient US macro data. This forces the market to reprice the Fed’s rate hike expectations. The CME FedWatch Tool sees a 38% probability of a 25bps rate hike in June. Phillip Streible, chief market strategist at Blue Line Futures, comments:

What’s hard to swallow is that US economic data continues to come in line with expectations. It shows a greater result for soft landing. At the same time, foreign economic data comes in weaker than expected. Therefore, the dollar index is currently on the rise.

This puts pressure on gold prices.

cryptocoin.com As you follow, at the May meeting, Fed Chairman Jerome Powell signaled a potential pause in the cycle of aggressive monetary policy tightening that caused interest rates to rise 5% in just over a year. However, the relatively hawkish tone of many Fed speakers following Powell forced markets to recalibrate their June rate expectations and withdraw hopes for year-end rate cuts.

Phillip Streible states that this week’s macro data also support this view. In this context, Streible said, “It delays expectations about when the Fed will start the first rate cut. This puts pressure on gold,” he says.

Gold will probably stabilize!

As of now, it is too early to say that gold has bottomed out. But RJO Futures senior market strategist Frank Cholly says $1,950 needs to be held first. “We could be very close to the bottom,” Cholly said. We broke some good levels and it started around $2,000. Whatever happens with the debt ceiling, the downside is now limited. Even if a deal is reached this weekend, gold will likely stabilize,” he said. Cholly notes that there is currently no catalyst to push prices above $2,000 unless we see a high risk of default. That’s why he adds that the precious metal is looking at a sideways price action. Based on this, the analyst makes the following comment:

For gold to rise above $2,000 again, the US may have to default. I don’t think we will see that. But there is enough stubbornness here between the parties that we can see safe haven trade come back.

Yellow metal will not respond well to this

But so far, there is hope that negotiations will yield results in time, according to recent statements by US President Joe Biden and House Speaker Kevin McCarthy. Cholly also does not rule out a 25 basis point increase in June. “At the moment, it is still 50/50 whether to raise another 25 basis points at the next meeting. We’re seeing rates go up. Gold is not going to respond well to that,” he says.

Gold has been overbought in the past few weeks. This partly explains the speed of the recent retreat. Walsh Trading co-director Sean Lusk said, “Investors are getting a little bit of the top. At the end of February, gold was at $1,827 in the June contract. Then it went up to $2,085. As weak longs come out, we may drop another $10,” he predicts.

Lusk is also watching the $1,950 level. He states that if it fails, gold will likely see $1,920. In line with this, the analyst said, “There was a lot of news and extreme enthusiasm that the Fed could return to rate cuts at the end of the year. Now that situation is improving,” he says.

Gold price technical analysis: The cards are falling!

Technical analyst Anil Panchal illustrates the technical outlook for gold as follows. Gold price is breaking the two-month uptrend line and the 50-DMA to the downside, forcing the $1,950 support that formed the late January high. The bearish signals from the Moving Average Convergence and Divergence (MACD) indicator add strength to the seller’s dominance. However, the Relative Strength Index (RSI) line at 14 remains well below the 50 level, indicating that gold price has bottomed out.

As a result, it is possible that the 100-DMA and the upward sloping support line from November 2022 to $1,927 and $1,920, respectively, will limit the downside movement of gold. If the gold price crosses $1,920, the possibility of witnessing a drop to the round figure of $1,900 cannot be ruled out. Conversely, the previous support line, 50-DMA, near $1,984 and $1,995, respectively, would precede the round figure of $2,000 to constrain the short-term recovery of Gold price.

If gold stays tighter beyond the $2,000 psychological magnet, the highs around $2,010 marked late March and early April could serve as an extra check before fueling the bid towards the five-week horizontal resistance of around $2,050. In summary, the gold price is likely to fall further. But it seems to have limited space to the south.

Inflation specter in Bitcoin and altcoin markets

Bitcoin price dropped as low as $26,380 on Bitstamp. A modest recovery then moved BTC into a familiar range from a few days ago. This is still in focus before the final Wall Street opening of the week. In June, market expectations that the US Federal Reserve would raise interest rates increased. Thus, Bitcoin followed a downward trend throughout the night.

Unemployment claims data announced during the week came in below expectations. Also, Fed officials would display a hawkish tone. These expectations were created thanks to them. According to CME Group’s FedWatch tool, the probability of a pause in the Fed’s rate hike next month has risen to over 95% at some point, but stood at just 62% during the day.

Fed target rate probabilities graph / Source: CME Group

Fed target rate probabilities graph / Source: CME GroupIn a detailed breakdown of events, monitoring resource Material Indicators cited holders of buy and sell liquidity trading to manipulate BTC price behavior on short timeframes. In a part of the comment on Twitter, he made the following statement in summary:

After the markets remained flat, the Unemployment Report and the Fed speakers set the tone ahead of Friday’s scheduled JPow speech, pricing in the potential for a new rate hike. As the price began to drop, a bid ladder solidified. Also, BTC price moved ~$26.5k to the previous support. But a sell wall was quickly placed to suppress the price.