Gold fell nearly $50 this week to just under $2,000 an ounce, according to a weekly gold survey, as Wall Street analysts worried that the sell-off may not end. Individual investors’ bearish sentiment also increased significantly, but the bulls remained in the lead for the next week. Here are the gold expectations for the next week…

How has the precious metal moved this week?

Gold is having its worst week since the beginning of February. Comex contracts for June delivery fell to $1,964 on Friday morning, from over $2,013 an ounce earlier in the week. This is gold’s biggest pullback since it dropped around $70 a week in early February. One of the biggest factors pulling gold down was the rise in the US dollar. The dollar rallied on resilient US macro data, which forced the market to reprice Fed rate hike expectations. CME FedWatch now sees the probability of a 25 basis point hike in June as 44 percent.

Before that, it was almost unanimous that the Fed would pause in June after raising rates by 5 percent in a little over a year. Several Fed speakers also opposed the idea of a pause in June. However, markets began to reverse bets on year-end rate cuts. Marc Chandler, Managing Director of Bannockburn Global Forex, used the following statements:

Rising US interest rates and a stronger dollar pushed gold down. It tumbled around 2.3 percent after support around $1,950. Dollar stabilization after maintaining key resistance levels kept gold stable ahead of the weekend.

Gold survey released: These levels are expected

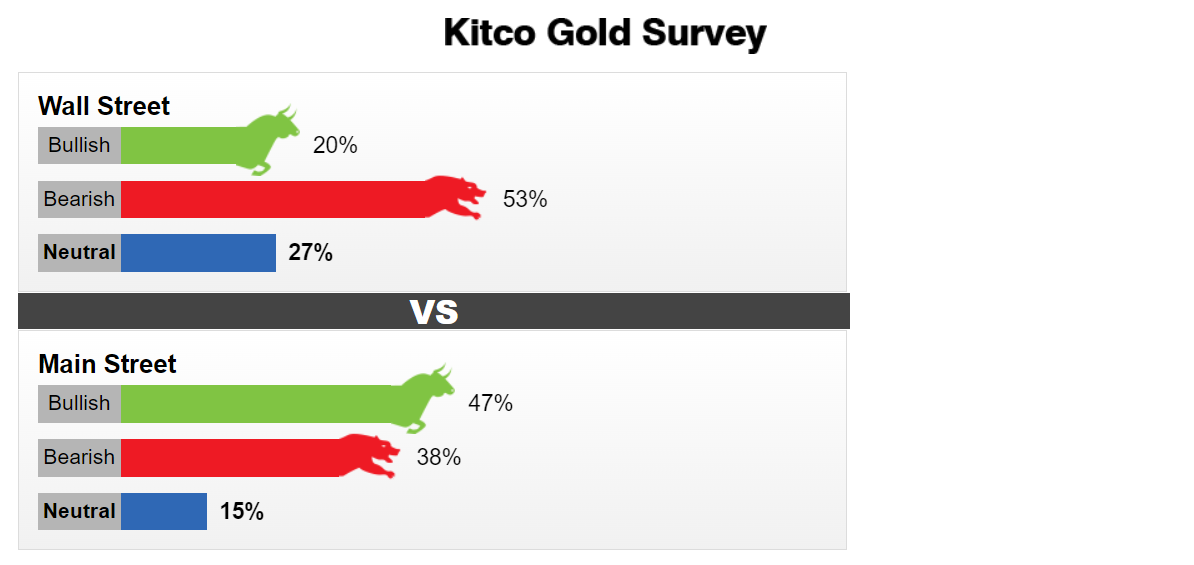

Most of the 15 participating analysts on the Wall Street side were bearish when asked about their gold price prospects for the next week, with 53 percent predicting lower levels. Only 20 percent of respondents expected a rise in prices, while 27 percent remained neutral. The individual investors side was still in an uptrend, but the downtrend showed a significant increase. 47 percent of 927 individual investors who participated in Kitco’s survey pointed to an increase in prices. Also, 38 percent expected it to drop, while 15 percent remained neutral.

Individual investors’ average gold price target for next weekend was $1,991 an ounce. That’s about $30 higher than current levels. According to Chandler, the first level of resistance is $1,979 per ounce and then $1,987. But momentum indicators leave room for another bearish. In this case, there is solid support near $1,936. “The key to the outlook is US interest rates and the dollar, and after major adjustments there could be consolidation next week,” Chandler said.

What are other analysts saying?

Michael Moor, founder of Moor Analytics, said there will be strong pressure on gold next week after the precious metal has dropped more than $100 since testing levels above $2,060 two weeks ago. Adrian Day, CEO and Chairman of Asset Management, said that optimism about resolving the debt ceiling debate is another short-term pressure on gold. However, Day noted that the long-term trend in the precious metal is bullish. Day said the following:

Central banks will find that they cannot meet their inflation targets by raising interest rates without causing serious damage to the economy and financial system. This is happening in slower motion than usual, as the enormous amount of liquidity poured into the system over the past decade provides a temporary buffer to interest rate rises, delaying the inevitable impact.