While the cryptocurrency market has seen an uptick in altcoin projects over the past few days, investors are wondering about the next levels for the leading cryptocurrency Bitcoin (BTC). However, leading experts say that these 5 events for Bitcoin should be paid attention to! Here are the details…

Bitcoin faces a lack of liquidity

Bitcoin spot price performance is disappointing investors due to lack of liquidity. Bitcoin is momentarily trading in a narrow range, and the events that will affect the Bitcoin price in recent days have not met the expectation. However, even the statements of the Chairman of the Federal Reserve of the United States, Jerome Powell, last week were not enough to definitely push Bitcoin up or down. That’s why investors are waiting for new news. Crypto Tony, a crypto analyst on the subject, states that he will look for short positions with the loss of the $ 26,600 level.

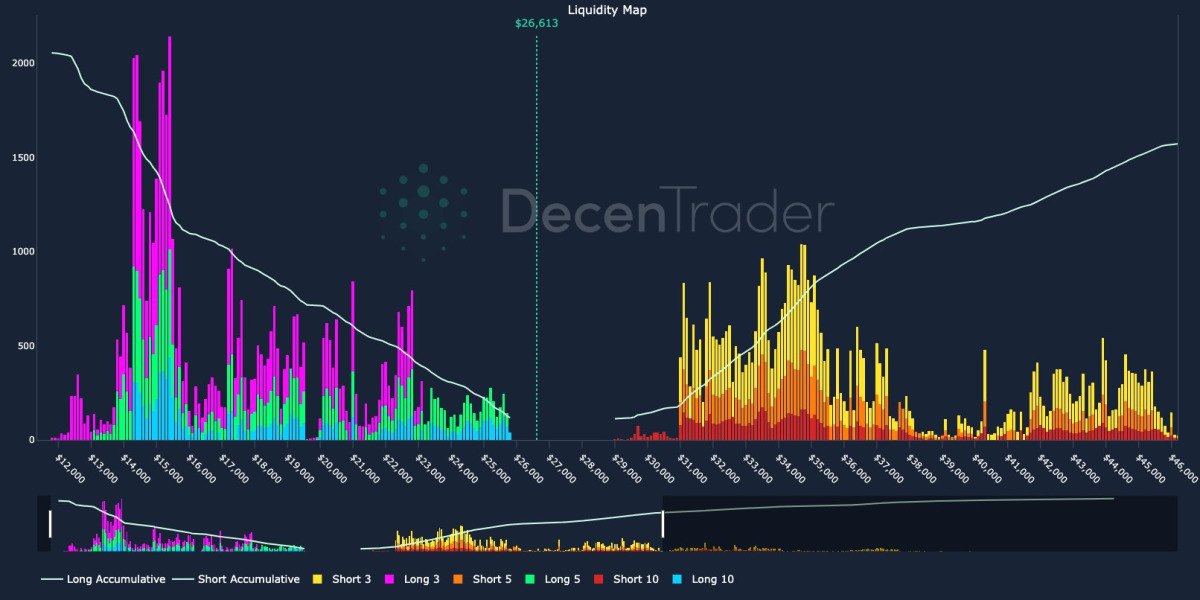

On the other hand, Bitcoin has been trading at $27,000 since May 13 and still lacks a great deal of liquidity. However, according to the analysis of one of the experts, DecenTrader, a move to $ 25,800 could be a trigger for a gradual rise.

Typically we see this type of price action clearing most of these investors as prices fall. Long Liquidity starts at $25,800.

Personal Consumption Expenditures (PCE) data could be the most important macro data of the week

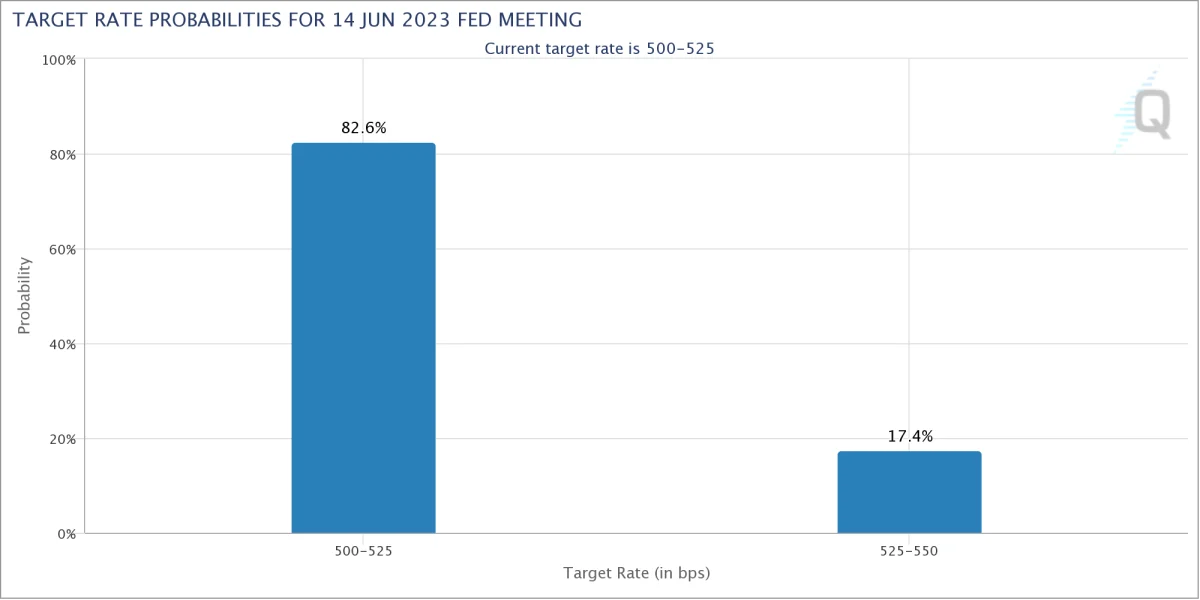

According to experts, macro triggers will increase slightly this week. Numerous economic data, including the Personal Consumption Expenditure (PCE) Index, will be released on May 26, and this data is described as a key component of the Fed’s interest rate policy. However, it can instantly reshape the market’s expectations for interest rate changes. On the other hand, this was also the case during Powell’s speech last week, and the probability of a pause in the rate hike increased from 60% to 80%. As of May 22, these rates remain high, around 86%, according to CME Group’s FedWatch tool, with three more weeks until the next policy decision.

However, the mismatch between market expectations and the Fed remains one of the key reasons Powell addressed last week. Powell said this phenomenon “seems to reflect a different forecast that inflation fell much more rapidly,” adding that there is no such guarantee.

On the other hand, Fed Board Member Philip Jefferson said in a similarly risk-free tone in his speech at the 2023 International Insurance Forum held in Washington on May 18, “Although we do not have a report on April PCE inflation yet, another measure of inflation, the Consumer Price Index. (CPI) core component showed little improvement in April”. On the other hand, on May 24, the minutes of this month’s Federal Open Market Committee (FOMC) meeting, where the latest rate hike was decided, will be released. This could profoundly affect the Bitcoin price this week.

Short-term Bitcoin traders profits at their lowest

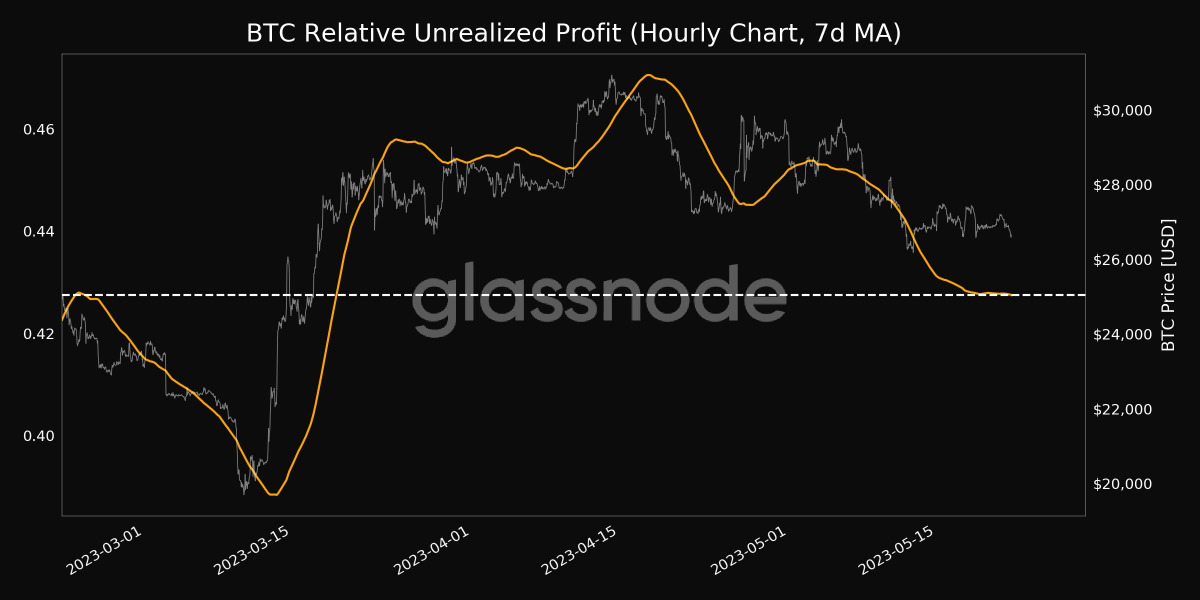

On the other hand, one of the events to be considered during the week belongs to the investors. Consolidation time for BTC supply, on-chain data shows lack of movement compared to recent months. The portion of the supply that has been active in the last three to six months is currently at a three-month low, according to figures from on-chain analytics firm Glassnode. This, which corresponds to the period from December 2022 to February 2023, marks investors in anticipation as last year’s bear market faded, marking the start of Bitcoin’s 70% first-quarter gains.

In contrast, supply, which was last active one to three months ago, now covers some of the price action, which includes three-month highs and local highs of $31,000 in April. On the other hand, experts draw attention to the effects of the subsequent decline, pointing to the unrealized profits of investors and pointing out that it momentarily remains at the lowest levels.

This latest figure could prevent the expectations of leading crypto speculators, who are classified as short-term holders (STHs) holding positions quarterly or older, from zeroing. The downward drag BTC/USD is slowly approaching the current average cost basis. Earlier in May, Glassnode noted that such a “reset” in profitability tends to offer significant price support. Research on the STH market-to-value (MVRV) metric, which was at 1.15 at the time, still warns that a reset may require a break below $25,000. STH-MVRV currently measures 1,047 as of May 21, the latest data available.

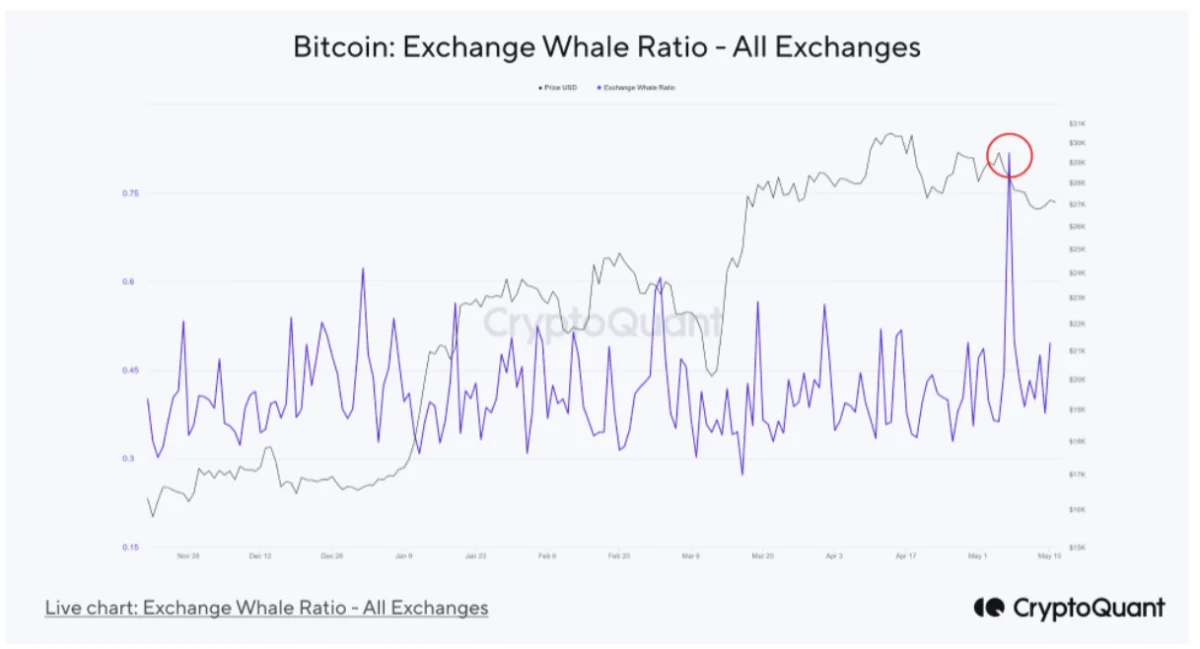

Whales’ influence on Bitcoin price diminishes

CryptoQuant data points to whale activity related to the recent BTC price action, noting that 34 percent of long-term whales benefited from yearly high profit levels. On the subject of whales, however, CryptoQuant pointed to the stock market whale rate metric, which tracks the size ratio of the top ten stock market entry transactions to total transactions, and quoted the following words:

This decline is also affected by whales taking the lead in depositing Bitcoin on exchanges, as evidenced by the surge in the Stock Whale Ratio in early May. Undoubtedly, Bitcoin transactions by these whales have soared, with transfers involving more than 40% of the coins.

Experts, in support, the research nevertheless acknowledged that the overall impact of whales on the market “was lessening” as time went on. Short-term investors, on the other hand, were responsible for maintaining $26,500, which later held as support over the weekend, revealing a key point in the recent price action.

Fear is growing in the crypto market

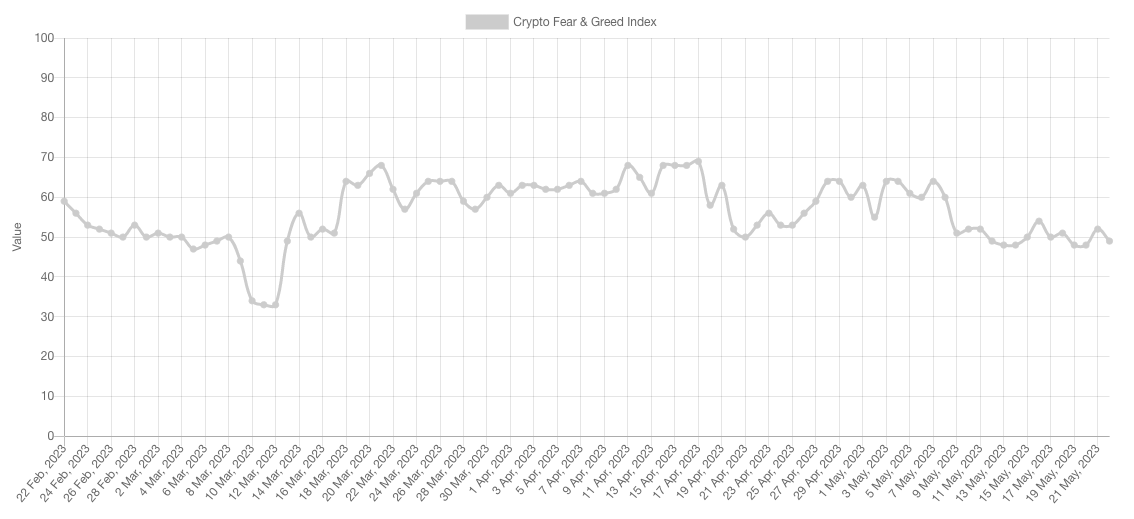

Social signals reveal that investors are starting to get scared. The Crypto Fear and Greed Index hit a two-month low at the end of last week, currently below the 50 midpoint and distinctly different from its composition in April’s local BTC price highs of $31,000.

Therefore, expectations seem skewed towards worsening conditions for markets; and while it is generally “neutral”, the Fear and Greed Index is not the only source that shows investors’ bearish expectations. “As Bitcoin revisits the $26,000 level, investors are raising concerns that prices will fall into the $20,000 to $25,000 range,” research firm Santiment wrote on May 19. However, experts pointed out that BTC social dominance has reached high levels again, pointing to a typically fear scenario and pointed out that Fear signals will increase the likelihood of recovery.