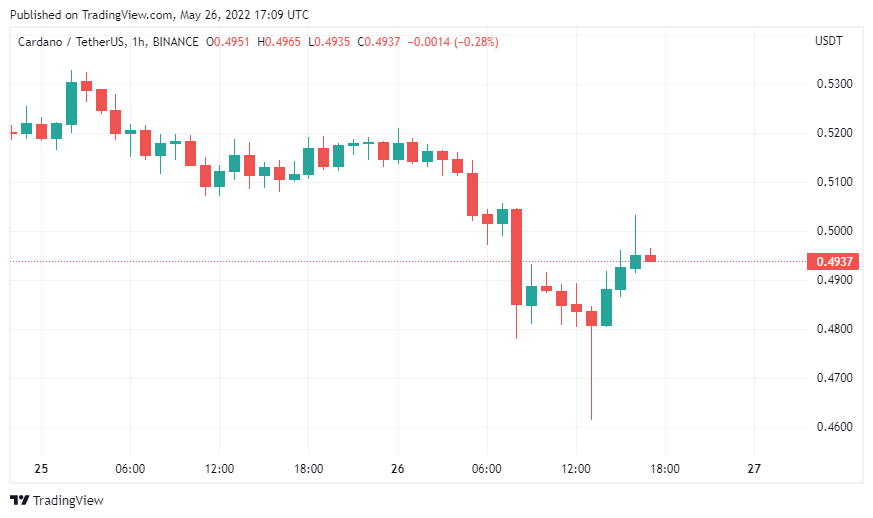

Cardano also started Thursday in bearish mode after falling below a vital support level. The lack of trading volume in the altcoin market indicates that more losses can be expected, according to analysts.

Cardano in danger after falling below $0.50

Cardano came under pressure after breaching a key support area. The eighth-largest cryptocurrency by market cap has seen a 7% drop at one point in the past 24 hours. The sudden drop pushed ADA below the vital $0.50 support level and resulted in liquidation of over $1.40 million on crypto derivatives exchanges. Further selling pressure around current price levels could increase the chances of a steeper correction, according to the analyst Financial Deli. As we have seen in the analysis of

Kriptokoin.com , Cardano is emerging from a developing symmetrical triangle on its four-hour chart. The height of the Y-axis of the pattern indicates that ADA entered a 33.5% downtrend once it broke below the $0.50 support level. A four-hour candlestick below the 50% Fibonacci retracement level at around $0.48 is likely to confirm the pessimistic view.

In this case, Cardano could continue to decline towards $0.34 or even $0.32. It is worth noting that the ADA swing low of $0.38 on May 12 could act as potential support during the decline.

Altcoin may see these bottoms

As can be seen from the above analysis, Cardano has dropped below a crucial support area. Analyst Financial Crazy identifies the following levels in a scenario where Cardano price gains downward momentum:

As long as ADA continues to trade below 0.55, rates will likely continue to support the bears. However, a four-hour candlestick close above this resistance barrier could invalidate the pessimistic view. Breaking this supply wall could accelerate the number of buy orders behind Cardano and push the price towards $0.61.

Meanwhile, the Fear and Greed Index has been on the side of fear, uncertainty and doubt in recent weeks. Also, on-chain and technical indicators show that the current negative sentiment has not yet taken its full effect on Bitcoin and a market bottom is yet to appear. While investing while sentiment is low has historically served crypto investors well, current conditions seem ripe for a steeper decline.