BTC price action gives analysts reasons for bearish bias for Bitcoin predictions. Bitcoin’s loss of the 200-week trendline put $20,000 into play.

Bitcoin predictions of master analysts scare!

While there is little excitement in the spot markets, traders and analysts are looking for potential volatility catalysts. cryptocoin.comAs you can follow, today’s macroeconomic reports from the USA, which include the second quarter GDP forecasts and unemployment claims, did not shake the status quo.

News:

GDP comes in at 1.3%, while 1.1% forecasted.

Unemployment claims are also coming in more positive than expected at 229K, while 249K forecasted.Economy is still 'strong'.

— Michaël van de Poppe (@CryptoMichNL) May 25, 2023

“As we retest this support area from below, the bears are failing to push the price down,” popular analyst Jelle summed up in a portion of her Twitter update during the day. Jelle says recovering $26,600 would be the “ideal scenario.” He also notes that this will act as a springboard for BTC to regain its previous range.

Bears failing to push price lower, as we retest that support area from below.

All eyes on the daily close still, #Bitcoin needs to hold 26.3 in order for that daily bullish div to lock in.

Ideal scenario; reclaim 26.6 and back into the previous range.

Let's see! https://t.co/12TnVsclWd pic.twitter.com/sayjIeGHb1

— Jelle (@CryptoJelleNL) May 25, 2023

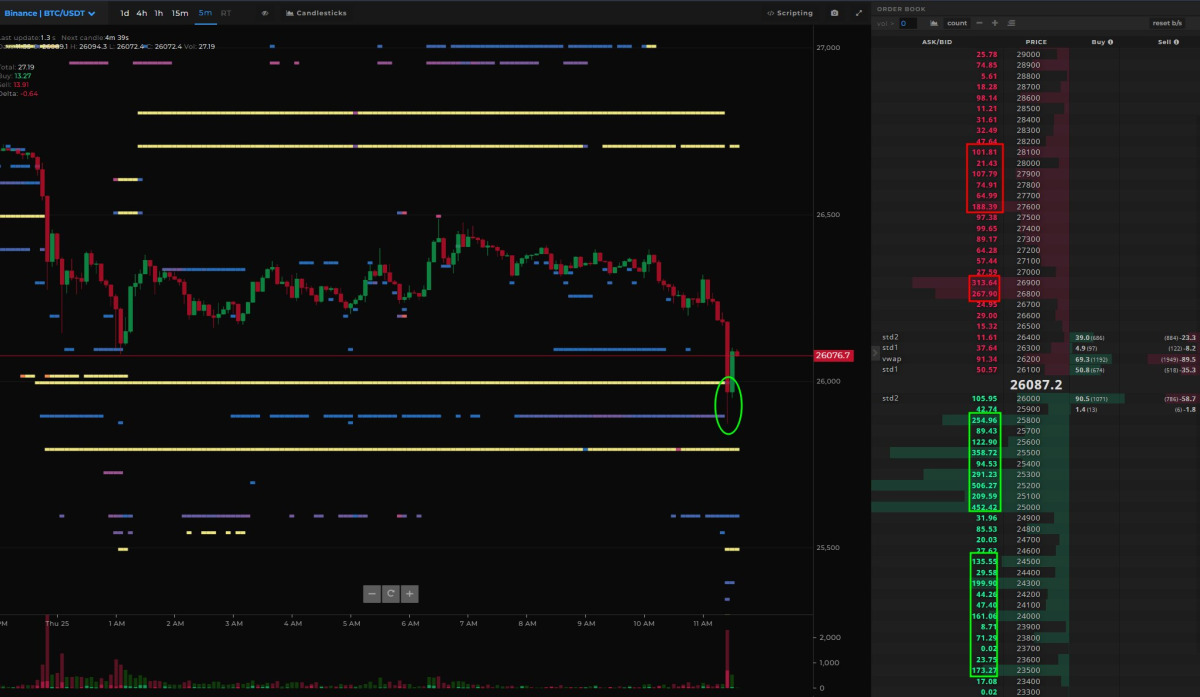

Fellow analyst Crypto Tony is repeating a popular downside target of around $25,000 in case Bitcoin “falls” lower. Trader Skew analyzes the short ride below the $26,000 level. Accordingly, he attributes the blame to a sweeping engineering of Binance traders. In this context, Skew makes the following statement:

It has the usual Binance liquidity engineering pump and carpet. Perps caught the liquidity now and tested the $26,000 spot limit orders.

Then, he says, prices have risen thanks to the fulfillment of limit buy orders and improved order book liquidity.

Binance order book data overview / Source: Skew/Twitter

Binance order book data overview / Source: Skew/TwitterBitcoin predictions: BTC going below $20,000?

Meanwhile, on weekly timeframes, analyst Rekt Capital highlights the importance of current spot price levels. He notes that just above $26,000 is the 200-week moving average. He also notes that a break that turns this into resistance will mean long-term challenges for the bulls.

If #BTC loses the ~$26200 support (blue) then price would drop into the lower $20000s (green)

The ~$26200 happens to be a confluent support with the 200-week MA (orange)$BTC #Crypto #Bitcoin pic.twitter.com/jM6qmrmLvw

— Rekt Capital (@rektcapital) May 25, 2023

Further analysis shows that Bitcoin’s multi-month highs of $31,000 in April were actually rapidly shifting in favor of the bears. So the analyst warns it fulfills a ‘head and shoulders’ pattern. Rekt Capital makes the following assessment for the current situation:

So far, BTC has broken out of the Head and Shoulders pattern. BTC also recently turned the Neckline of this formation to a new resistance (red box). Slowly but surely, this bearish pattern is confirming itself. This could mean a deeper drop below $20,000.

BTC explanatory chart / Source Rekt Capital/Twitter

BTC explanatory chart / Source Rekt Capital/TwitterBitcoin’s ‘Ichimokou cloud’ signals a deep decline

According to technical analysis by alternative asset management firm Valkyrie Investments, Bitcoin (BTC) could be the legs of the latest price drop. According to Valkyrie, it is possible for Bitcoin to see another drop towards $24,000 as the daily chart Ichimoku cloud, a momentum indicator, is bearish.

The graphic below shows a green Ichimoku cloud. This indicates a constructive general outlook. However, the BTC price has recently fallen back into the cloud. Also, Tenkan-Sen (blue line) crossed below Kijun-Sen (red line), confirming the downtrend. In a note to clients, Valkyrie analysts, led by Chief Investment Officer Steven McClurg, highlight:

This indicates a sustained high timeframe bullish trend with a drop in bullish momentum and the potential for a short-term pullback.

BTC price drops back into the cloud / Source: Valkyrie Investments

BTC price drops back into the cloud / Source: Valkyrie InvestmentsThe Bitcoin pullback of early March evaporated at the lower end of the cloud. The ensuing leap pushed prices to $31,000 by mid-April. Analysts point to the following level for Bitcoin predictions

A price close in the cloud indicates the loss of cloud support. It also triggers the possibility of moving to the opposite [bottom] edge of the cloud. In this case, an End-to-End transaction would bring prices around $24,000.