Mining companies were hit hard during the crypto winter last year. Despite Bitcoin’s rise in the first quarter, some companies have yet to recover from the impact of 2022. Now the mining company Canaan is divesting its assets. Also, Litecoin miners are also selling. Crypto whales, on the other hand, continue to store Ethereum.

Canaan Mining divests Bitcoin

In the fourth quarter of 2022, Canaan had 757 BTC on its balance sheet. The company had been increasing its assets every quarter since Q2 2021. However, Canaan reduced its Bitcoin holdings for the first time compared to the previous quarter. Currently, the mining company has 623 BTC on its balance sheet. The company earned a capital gain of $2.6 million by selling Bitcoin. This helped reduce operational expenses and ultimately gross loans.

Also, due to various other measures, Canaan reduced its gross loss by 25% in Q1 2023. The mining company posted a gross loss of $47.5 million compared to $64.1 million in Q4 2022. However, it has a long way to go to reach the figures in the first quarter of 2022. In the first quarter of last year, Canaan had a gross profit of $123.5 million. Most recently, Canaan’s shares fell 5.49% in premarket trading.

Source: TradingView

Source: TradingViewLitecoin miners are selling

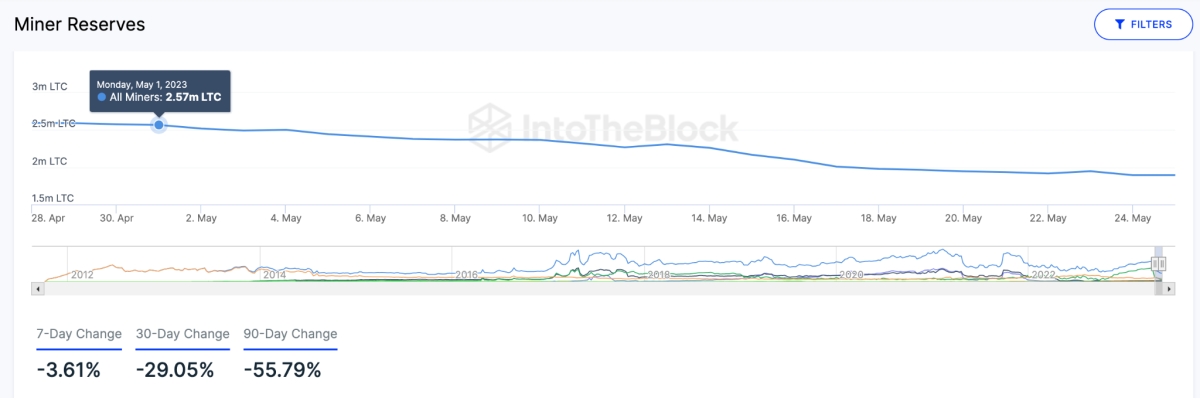

cryptocoin.com As you follow on , the upcoming halving event will reduce the block rewards given to Litecoin miners for validating transactions from 12.5 LTC to 6.25 LTC. Typically, when a halving date approaches, crypto miners try to stock up on their reserves. Interestingly, however, this did not happen on the Litecoin network. Less than 70 days until the next halving. However, on-chain data shows that LTC miners are still depleting their reserves. According to the chart below, Litecoin miners drained about 680,000 coins from their reserves in May 2023.

Litecoin Miner Reserves, May 2023 / Source: IntoTheBlock

Litecoin Miner Reserves, May 2023 / Source: IntoTheBlockAs you can see above, miners take some profits by taking advantage of the current high prices. Likewise, rising global energy prices and regulatory pressure on crypto mining activities have also caused mining costs to skyrocket in recent months. If these factors do not subside, LTC miners are likely to continue selling ahead of the halving. Ultimately, this could slow a potential Litecoin rally in the coming weeks despite bullish momentum from other investors.

Ethereum whales continue to store ETH!

In recent months, the Ethereum ecosystem has witnessed a notable increase in the number of Ethereum whales. These whales are accumulating Ethereum at an impressive rate. Increasing interest in ETH in this way points to a potential accumulation trend. According to data from blockchain analytics platform IntoTheBlock, Ethereum whales now collectively hold a staggering 30.07 million ETH. Thus, they exceeded the 26.56 million ETH they held at the beginning of 2023. This increase among addresses holding more than 0.1% of the total Ethereum supply is a clear indication of continued accumulation.

🐋 Ethereum whales are on the rise! They now hold 30.07 million $ETH, up from 26.56 million $ETH in early 2023. The increasing holdings of addresses holding over 0.1% of the supply suggest ongoing accumulation. Check out the details 👇 https://t.co/TisVKZ9Qjg#Ethereum #Whales pic.twitter.com/xBP2hgrUBV

— IntoTheBlock (@intotheblock) May 26, 2023

The growing presence of Ethereum whales underlines the growing appeal of the Ethereum Blockchain and ETH.