The leading crypto Bitcoin price failed to exceed the psychological support of $ 27 thousand. A Glassnode analyst states that Bitcoin bulls are sitting with their hands tied. He notes, however, that short-term sellers must struggle as they quickly lose their profitability.

Analyst: Bitcoin price is at a decision point!

cryptocoin.com As you can follow, Bitcoin price is struggling near key trend lines. That’s why BTC is making a growing number of long-term market participants uneasy this month. As bearish price predictions increase, on-chain analysts’ attention is increasingly focusing on short-term holders (STHs) as to where the price might go next.

Several metrics (defined as holding coins for 155 days or less) specifically covering STHs are approaching “reset levels” after a period of enthusiasm. For analyst Checkmate, this could be a healthy pullback necessary for the continuation of the 2023 bull market. But likewise, things are also likely to get ugly now. In this context, the analyst summarizes the situation as follows:

Bitcoin is currently at a decision point. Also, Short Term Owners are in the primary lens position to see this fix.

Several metrics covering STH profitability are on the radar

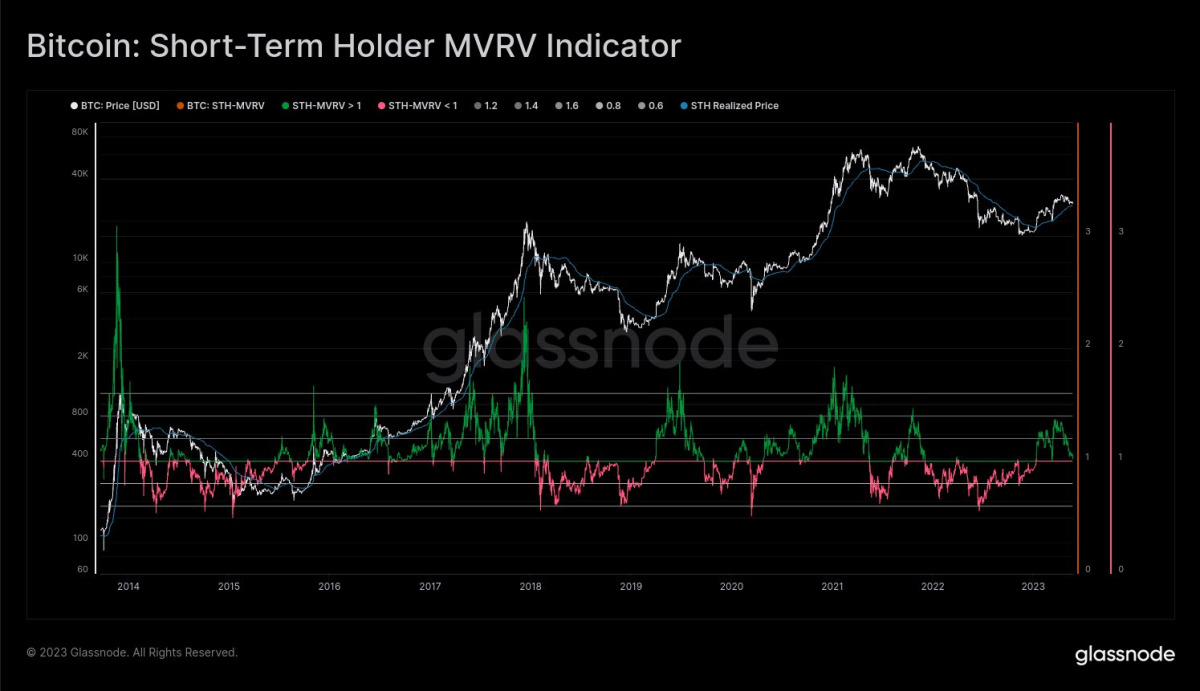

STH-MVRV

STH-MVRV measures the value of coins moved by STHs compared to the value of those coins as a fraction of the overall Bitcoin market value. When 1.0, it corresponds to the STH actual price, which is the total price at which STH coins last moved. This is the breakeven point. STH-MVRV is currently at 1,022. Also, a value of 1.0 equates to a BTC spot price of around $26,500. The analyst comments:

In bull markets, this level ($26.5k) will likely provide solid psychological support. We can trade below this level. But a quick recovery will be necessary to justify the upside continuation.

STH market cap vs realized value (STH-MVRV) chart / Source Checkmate

STH market cap vs realized value (STH-MVRV) chart / Source CheckmateSTH-SOPR

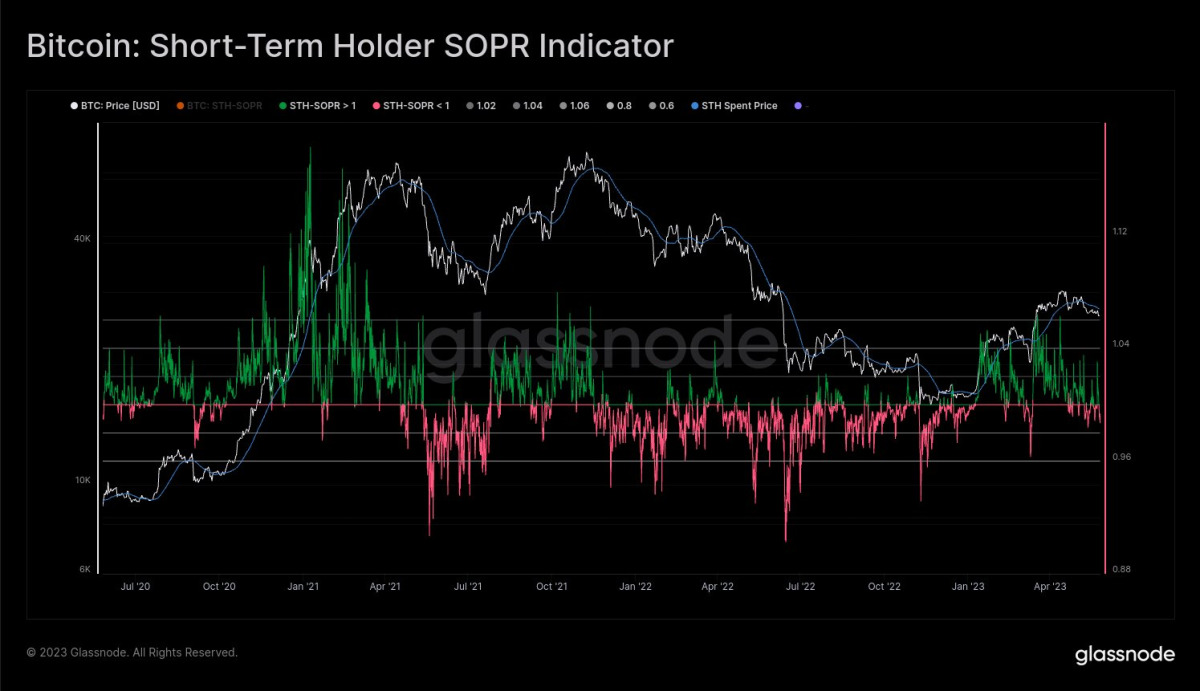

STH-SOPR, as defined by Glassnode, is a “price sold versus price paid” metric that measures the profitability of outputs spent. This value is currently below the 1.0 line. The metric shows “harm dominance” among STHs. It also demands that bottom buyers step in in the next step. SOPR does not distinguish between large and small transactions, only focusing on the number of outputs spent. Checkmate makes the following statement:

Losses of STH can only be recovered from local upstream receivers. Also, intuitively, we want to see top buyers sell the local bottom. This is what creates the FOMO bounce response.

Likewise, the short-term holder realized profit/loss ratio, the volume-accounting version of SOPR, is also in danger of falling. But for this to happen, it will need to have a “continuous” period of below 1.0.

Bitcoin STH-SOPR chart / Source Checkmate

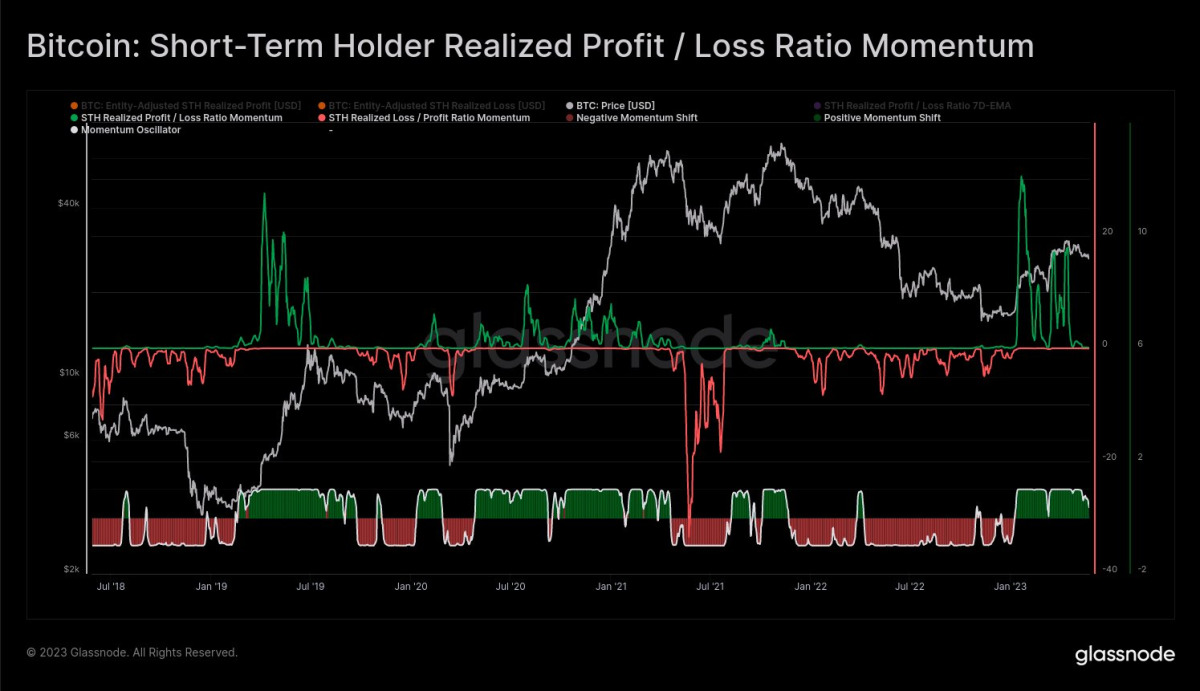

Bitcoin STH-SOPR chart / Source CheckmateSTH realized profit/loss ratio momentum

Finally, when it comes to STH profitability, the metric tends to return to “neutral” territory, which warns observers of sudden changes in trend. Momentum is retreating from Bitcoin’s “green” phase, which has been going on since January 2023, when the price recovery began. The analyst makes the following assessment:

STH P/L momentum is a tool designed to detect rapid changes in market regime and trend. Extremely responsive and reverted to neutral. If this thing starts to turn red, that will be an early signal that a deeper correction is in play. It consistently signaled a trend reversal, usually before the first breakout occurred.

Bitcoin STH realized profit/loss ratio momentum chart / Source Checkmate

Bitcoin STH realized profit/loss ratio momentum chart / Source CheckmateFinally, Checkmate urges hodlers who are currently inactive and reluctant to spend cryptocurrencies to step in. In this context, the analyst says:

The bulls need to get to work if they want higher prices. HODLers definitely want it but do nothing with their coins. There is almost ATH coin inactivity.