In May, the Bitcoin (BTC) price experienced a small drop, fluctuating between $25,800 and $30,000. However, the monthly opening and closing prices were significantly close to each other. Which brings us to the BTC price forecast for May. While BTC price action is under control, the future trajectory remains uncertain and intriguing. The four analysts used different methods to predict market volatility, but got accurate results.

Elliott Wave Theory correctly predicts Bitcoin price drop

Elliott Wave theory involves the analysis of recurring long-term price patterns and investor psychology to determine the direction of a trend. In May, this trading method accurately predicted the local peak and subsequent decline. At the beginning of May, Elliott Wave expert TheTradingHubb said that the price will reach a local top of around $30,000 before dropping to $26,500. The price bounced on May 1 (green icon) and hit a local top near $30,000 (red icon) as predicted.

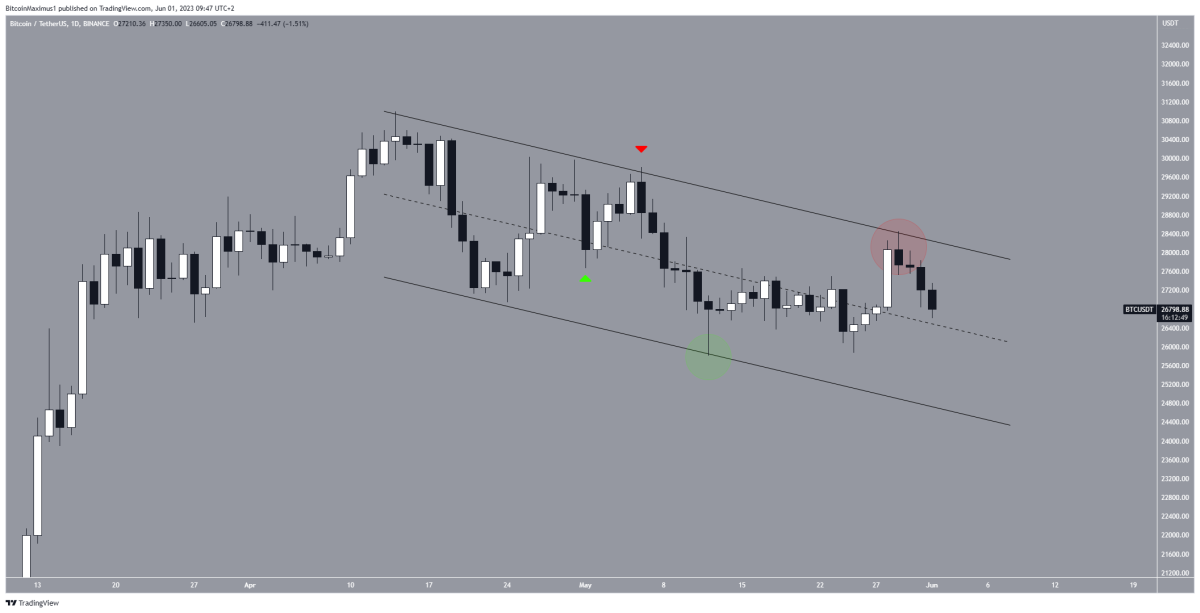

Later, famous trader Altstreetbet suggested that the price will initiate another bounce (green circle) before the final capitulation towards $20,000. Sharp capitulation has not yet occurred. However, the weak bounce and drop (red circle) in BTC has already happened.

BTC Daily Chart / Source: TradingView

BTC Daily Chart / Source: TradingViewAccording to crypto analyst Valdrin Tahiri, due to the descending parallel channel, the support line is likely to drop to $25,000. However, this will need to be broken for the price to drop to $20,000. In the event of a breakout from the channel, this bearish BTC price prediction will be invalid. In this case, an upward move to $30,000 is possible.

Head and Shoulder Formation catalyzes breakage

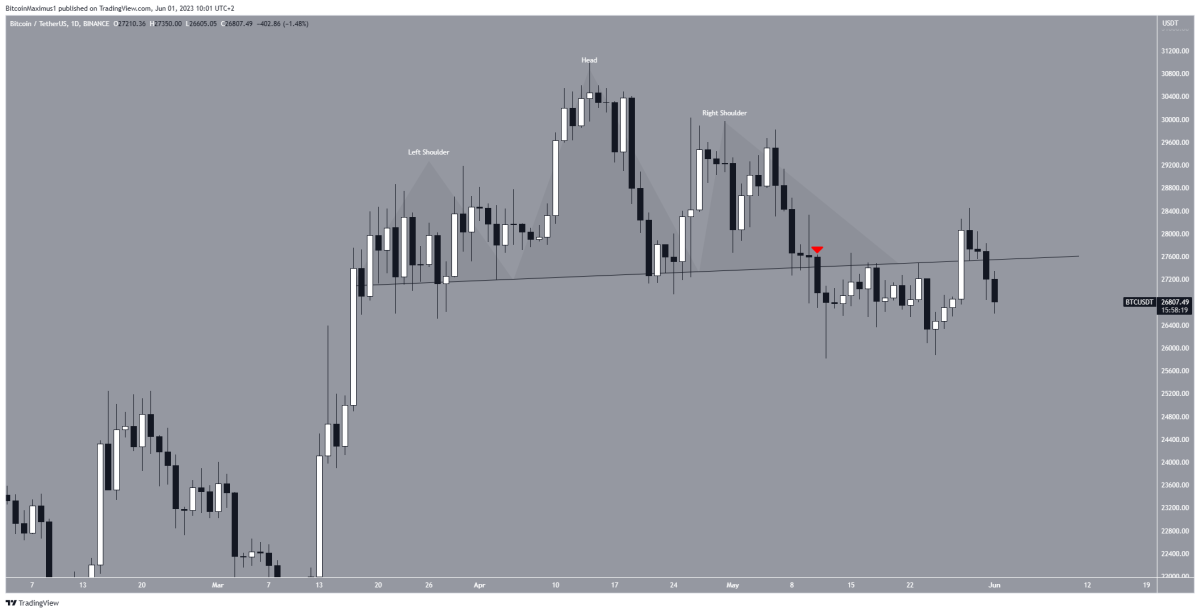

Cryptocurrency trader Anbessa100 shared a head and shoulders model. The pattern suggests that the BTC price will decline and fall towards $25,000. Although the price did not reach the $25,000 target, it was broken down to the $25,800 level (red icon). A similar view was given by LomaCrypto, which uses only horizontal levels to determine the trailing bottom.

cryptocoin.com As you follow, the price jump that followed was strong. But it was insufficient to reclaim the neckline of the formation. As long as BTC is trading below the line, the trend is bearish. This view also fits into the descending parallel channel outlined earlier.

BTC Daily Chart / Source: TradingView

BTC Daily Chart / Source: TradingViewBitcoin price will still be below the resistance line of the channel. Therefore, a move above the neckline will not confirm a bullish reversal. Therefore, a close above $28,500 would confirm a bullish reversal.