There is a close following in the movements of institutional investors in the Bitcoin and altcoin space. We see that these follow-ups give direction to the investor, both in entries and exits. So what happened this week? Which cryptocurrencies have institutional investors flown in? Let’s have a look at the details.

What did institutional investors selling bitcoin do?

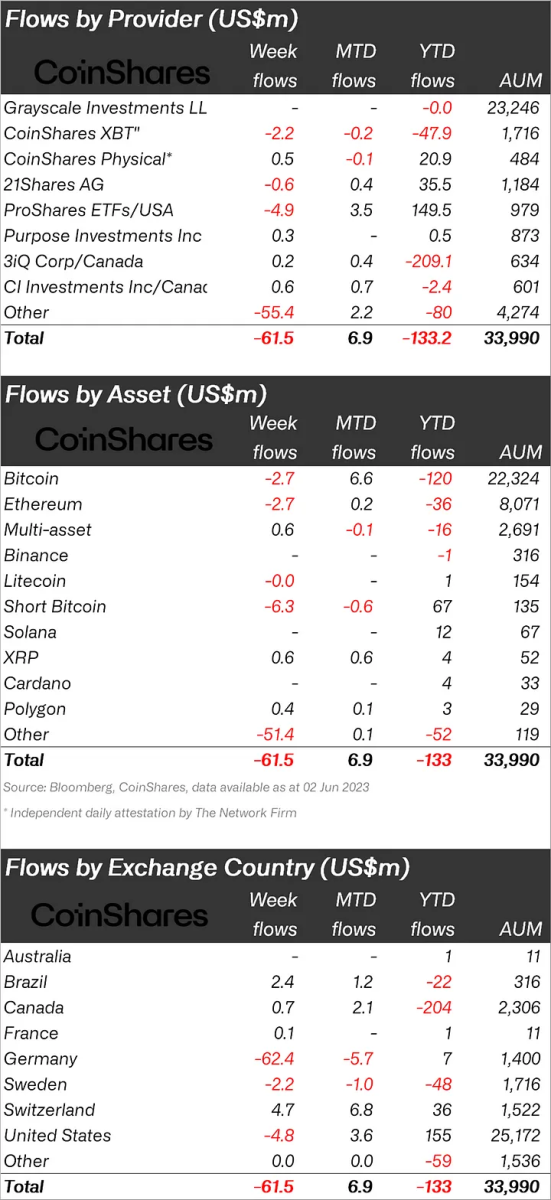

There was an outflow of 62 million USD in Bitcoin and altcoin investment products. Accordingly, the figure reached $329 million as the sum of the seventh consecutive week of debuts. Smart contract platform Tron was in focus last week, seeing a total output of $51 million. There are comments from traders that they are taking profits and exiting short positions rather than the recent exits representing a structural drop in sentiment towards Bitcoin (BTC).

There was an outflow of 62 million USD in Bitcoin and altcoin investment products. Accordingly, these exits reached US$ 329 million for the 7th consecutive week. The figure represented 1% of total assets under management (AuM). From a proportional perspective, this figure is at the same level as the outflows seen at the beginning of 2022. The fact that the change in the total AuM in this period was matched with the 1% exit reveals an interesting result. It shows that this is not due to price drops, but to profits, especially in light of prices that have increased by 56% year-to-date across investment products.

What do the last exits mean

Recent outflows are due to lower trading activity, with volumes below 60% of the year average. This is also reflected in the crypto market, which has seen a 55% drop in volumes over the past 7 weeks. Smart contract platform Tron was the primary focus last week, seeing $51 million exits representing 70% of total AuM. However, this is not alarming, of course. Because for the exit, Coinshares points to a single investment product provider. Accordingly, the outflow here is due to the outflow of seed capital. On the other hand, while there were exits for Bitcoin and Tron, there were entries for XRP and Polygon.

There were small outflows in Bitcoin BTC totaling $2.7 million. There was an outflow of $ 6.3 million for Bitcoin in a short position. The absolute exits for this position are small. However, the total outflow over the last 6 weeks represents 44% of the total AuM compared to just 0.9% for Bitcoin in long position. This indicates that investors are profiting rather than pointing to a structural decline in sentiment towards Bitcoin BTC. Moreover cryptocoin.comWhen we look at it as an indicator, it is an indication that they have also exited the short-focused positions.