The US regulator SEC filed a lawsuit against New York-based crypto exchange Coinbase on similar grounds shortly after the Binance lawsuit. In the most recent Coinbase lawsuit, 13 altcoins were labeled as ‘securities’.

Second move from SEC: 13 altcoin ‘securities’ including SOL, ADA, MATIC

cryptocoin.comThe second SEC lawsuit of the week came for Coinbase recently.

In the most recent Coinbase lawsuit, the SEC identified SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO as securities, some of which are among the top 10. The SEC said each of these tokens is available on Coinbase’s Prime or Wallet services. The lawsuit detailed the histories of these altcoins and how the SEC views them as securities.

Today we charged Coinbase, Inc. with operating its crypto asset trading platform as an unregistered national securities exchange, broker, and clearing agency and for failing to register the offer and sale of its crypto asset staking-as-a-service program.https://t.co/XPG2gDkxtV pic.twitter.com/hCdVMw8B2v

— U.S. Securities and Exchange Commission (@SECGov) June 6, 2023

The SEC also claims that Coinbase operates as an unregistered exchange and offers unregistered securities through the Staking Program. According to the SEC, Coinbase’s actions exposed investors to significant risk. Coinbase allegedly prioritized profits over investor interests and regulatory compliance.

The Coinbase lawsuit comes a day after the SEC filed similar charges against Binance for similar securities law violations.

Altcoin prices drop in double digits

After the Binance lawsuit on June 5, there was a 5% drop across the market. The second lawsuit triggered additional sales, and the fact that well-established names such as ADA and SOL were included in the securities list carried the intraday losses to double digits. Meanwhile, Coinbase’s pre-market stock price fell amid the news of the lawsuit.

Solana (SOL), in particular, took the hardest hit, depreciating 9.29% on the day and 8.99% on the week. The price is currently in a free fall below the $20 support.

With the latest developments, the price changes among the top 20 cryptocurrencies are as follows:

- Bitcoin (BTC)

- Change: -4.65%

- Price: $25,471.23

- Ethereum (ETH)

- Change: -3.42%

- Price: $1,803.51

- Binance Coin (BNB)

- Change: -8.70%

- Price: $274.36

- XRP

- Change: -5.97%

- Price: 0.5002 dollars

- Cardano (ADA)

- Change: -7.29%

- Price: $0.3454

- Dogecoin (DOGE)

- Change: -7.39%

- Price: $0.06628

- Left (LEFT)

- Change: -9.29%

- Price: $19.42

- Polygon (MATIC)

- Change: -9.95%

- Price: $0.7978

- TRON (TRX)

- Change: -4.29%

- Price: $0.07825

- Litecoin (LTC)

- Change: -6.59%

- Price: $86.22

- Polkadot (DOT)

- Change: -5.21%

- Price: $5.01

- Avalanche (AVAX)

- Change: -6.11%

- Price: $13.88

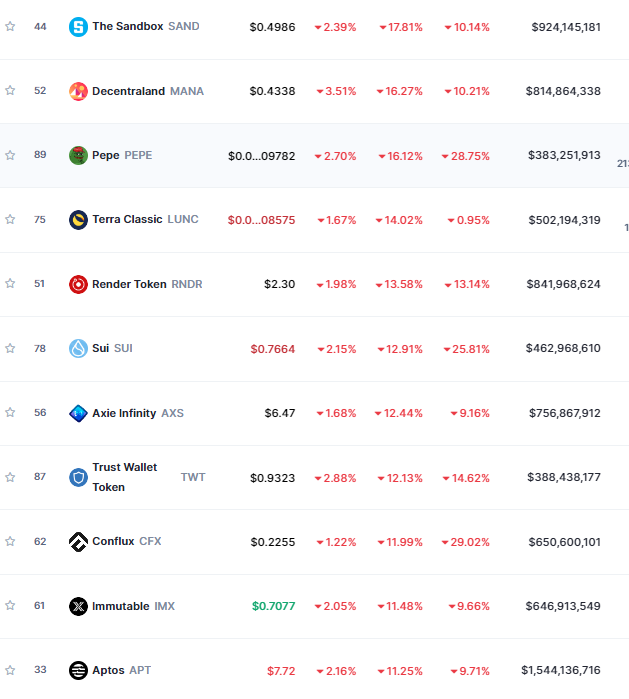

The altcoins that lost the most in the last 24 hours

Here is the list of altcoins that lost the most in the last 24 hours, according to CMC data:

SEC Chairman Gary Gensler raises concerns about Coinbase

SEC Chairman Gary Gensler said in a press release with the most recent Coinbase lawsuit that the exchange has “confused” functions, particularly those of brokers, exchanges and clearing houses.

“The alleged failures of Coinbase deprive investors of critical protections, including rulebooks that prevent fraud and manipulation, appropriate disclosure, safeguards against conflicts of interest, and routine auditing by the SEC,” Gensler said.

Finally, the SEC argued that Coinbase knew that some of the cryptos it offered to US customers could be securities, citing the Crypto Rating Council effort that the exchange has spearheaded to try and create an informal system for assessing whether it is a cryptocurrency in 2019.

According to the SEC, “During this period, Coinbase has launched crypto assets with high ‘risk’ scores on the Coinbase Platform as part of the CRC framework it has adopted. In other words, in order to realize the exponential growth of the Coinbase Platform and increase its own trading profits, Coinbase has made the strategic business decision to add crypto assets to the Coinbase Platform even where it considers crypto assets to be securities.”