Popular commission-free investment platform Robinhood is re-evaluating its cryptocurrency offerings following the recent action taken by the US Securities and Exchange Commission (SEC) against two major Bitcoin and altcoin exchanges, Binance and Coinbase. Here are the details…

Robinhood may delist these altcoins

Dan Gallagher, Robinhood’s Chief Legal Officer and a former SEC Commissioner, appeared in the US Congress on Tuesday, June 6, to discuss the situation. So Gallagher recently testified before the House Agriculture Committee during a meeting focused on cryptoassets. Gallagher noted that Robinhood is actively reviewing the SEC’s analysis to determine the appropriate course of action. Unlike other crypto exchanges, Robinhood offers its customers a limited selection of cryptocurrencies.

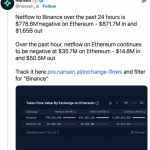

Currently, Robinhood only lists 18 cryptocurrencies on its platform. On the other hand, Coinbase supports hundreds of cryptocurrencies. However, some tokens such as Solana, Cardano, and Polygon found on Robinhood are considered unregistered securities by the SEC. cryptocoin.com Meanwhile, as we reported, the SEC took action against Binance.US. He asked the court to freeze the exchange’s assets to prevent the funds from dispersing. The regulator expressed its concerns over $2.2 billion in US client funds held by Binance.US. He then stated that these assets are at significant risk.

Changpeng Zhao accused of “unlimited control”

The SEC accused Binance and its CEO, Changpeng Zhao, of having unlimited control over billions of dollars in client assets. To prevent unauthorized transfers, SEC lawyers acted out of fear that funds could be taken out of the country. He filed a petition demanding the immediate repatriation and freezing of US customer assets. The SEC filed a lawsuit against Binance and Zhao alleging that they were selling securities without proper registration and mixing investor funds with their own funds. The filing also alleges that Zhao, as a foreign national, expressed views suggesting that he did not consider himself subject to the jurisdiction of the court.

These recent developments have brought regulatory scrutiny to the fore in the cryptocurrency industry. Because Robinhood had to carefully scrutinize its crypto offerings. In addition, these developments show the increasing importance of compliance and regulatory measures in the sector. The SEC continues to take action against the big players in the crypto space. Therefore, the landscape of cryptocurrency exchanges and offerings may undergo significant changes in the coming months. The cryptocurrency space is already reacting downwards to these developments. Many cryptocurrencies suffered a sudden drop with the lawsuit announcement.