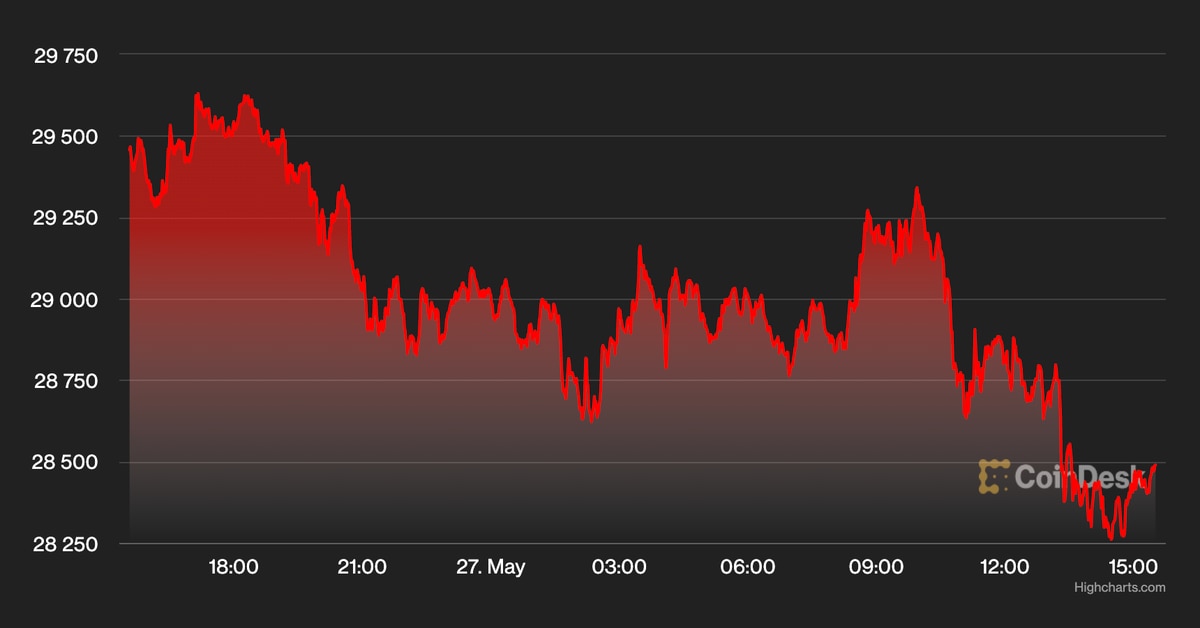

Bitcoin (BTC) and other cryptos traded lower on Friday despite another move upward in stocks.

Crypto traders are still in risk-off mode after experiencing almost nine consecutive weeks of negative returns. BTC is on track for a 27% decline this month, although it is up 10% from its recent extreme low at $25,840 on May 12.

The cryptocurrency is still down by 40% so far this year, compared with a 13% drop in the S&P 500 and a 22% dip in the Nasdaq 100 over the same period. So far, it has been a tough year for all speculative assets.

Just launched! Please sign up for our daily Market Wrap newsletter explaining what happens in crypto markets – and why.

Over the short term, however, prices could stabilize. “There’s been massive short selling over the last few weeks, which may presage a short squeeze in the weeks ahead. Month-end rebalancing flows may also help,” David Duong, head of institutional research at Coinbase, wrote in a Friday newsletter.

And on the macro front, MRB Partners, a global investment research firm, expects equity markets to rebound should global growth conditions prove resilient. The firm is”[a]ssuming interest rate expectations and bond yields stay calm for a period of time, which is probable as inflation will temporarily decelerate, first in the U.S. and then elsewhere. Central banks, in turn, likely will briefly cool their newfound hawkishness,” MRB wrote in an email.

The short-term rise in stocks could be a tailwind for crypto, assuming the high correlation between both assets remains intact. In contrast, perhaps the decline in cryptos signals limited upside in stocks as risk-off sentiment prevails.

Latest prices

●Bitcoin (BTC): $28,940, −1.83%

●Ether (ETH): $1,760, −4.35%

●S&P 500 daily close: 4,158, +2.47%

●Gold: $1,857 per troy ounce, +0.51%

●Ten-year Treasury yield daily close: 2.74%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

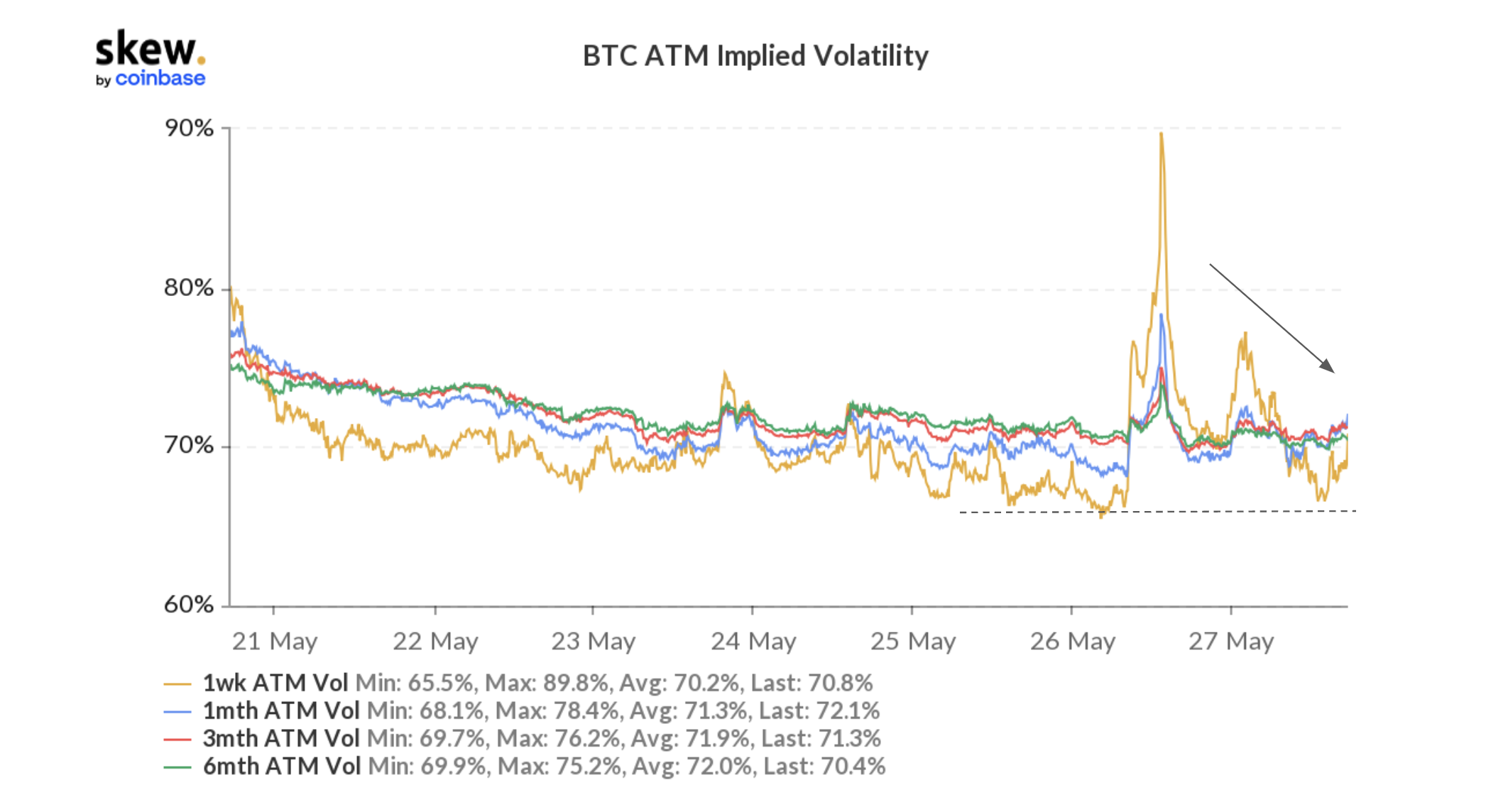

Volatility subsides, for now

The chart below shows the recent decline in BTC’s short-term implied volatility. That suggests option traders have expected price swings to stabilize after BTC briefly dipped toward $28,000 on Thursday.

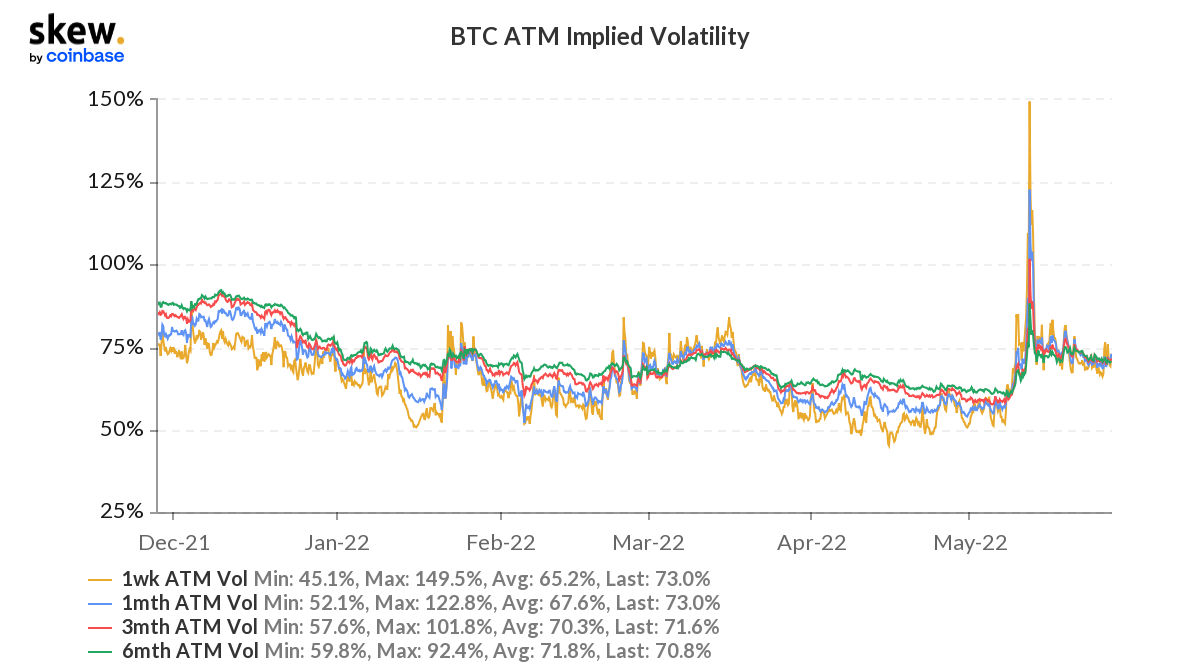

For now, bitcoin remains stuck in a tight range as volatility returned to normal levels. But over a six-month horizon (second chart), implied volatility remains elevated, and there has been stronger demand for puts (downside protection) versus calls.

Bitcoin implied volatility (Skew)

Bitcoin implied volatility, zoomed out (Skew)

Altcoin roundup

-

DOGE briefly jumped on SpaceX tweet: Tesla (TSLA) CEO Elon Musk tweeted Friday morning ET that merchandise for SpaceX, his space exploration startup, will soon be able to be bought with dogecoin, just as it can be for Tesla merchandise. The price of DOGE jumped as much as 10% to nearly 9 cents immediately following the tweet, before giving back most of those gains later in the New York trading day. Read more here.

-

Tether’s dollar-pegged stablecoin expansion via Polygon: Tether has launched its USDT token on Polygon, an Ethereum scaling platform, meaning the largest stablecoin by market capitalization is now available on more than 11 blockchains, the company said. The addition of USDT, which is tied 1:1 to the dollar and has a market cap of over $73 billion, will help support Polygon’s decentralized finance (DeFi) ecosystem. Read more here.

-

New Terra blockchain launch expected Saturday: Terra’s new blockchain will be launched on Saturday followed by an airdrop of new LUNA tokens to users as part of a broader plan to revive the ecosystem, developers confirmed Friday. “The community has been working around the clock to coordinate the new chain’s launch,” Terra developers said in a tweet on Friday morning. “Subject to potential change, we expect Terra to go live on May 28th, 2022 at around 06:00 AM UTC.” Read more here.

Relevant insight

-

Cardano’s Hoskinson: Luna Collapse Shows Need to Go Slow in Crypto: “If you move too quickly … everybody loses their money,” says Charles Hoskinson, who will speak at Consensus 2022 next month.

-

UK Crypto Hedge Fund Weathers Market Storm With Arbitrage Strategy: Nickel Digital Asset Management’s arbitrage fund is only down about 0.6% this year, compared with bitcoin’s drop of roughly 40% and the Nasdaq’s dip of 24%.

-

The Crypto Community Says the UK’s FCA Is Finally Starting to Listen: The British regulatory agency’s first CryptoSprint was focused on digital asset information disclosure, custody and other regulatory obligations.

-

Ether Accounts for Almost Half of $520M Liquidations Amid Weak On-Chain Data:Traders of ether futures saw liquidations nearly double those of bitcoin in an unusual move.

-

Top Latin American Crypto Exchange Bitso Lays Off 80 Employees: The company, which had more than 700 workers before the cuts, counts four million users in the region.

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Dogecoin | DOGE | +1.9% | Currency |

| Ethereum Classic | ETC | +1.2% | Smart Contract Platform |

| Polkadot | DOT | +0.6% | Smart Contract Platform |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Solana | SOL | −5.2% | Smart Contract Platform |

| Cardano | ADA | −5.1% | Smart Contract Platform |

| Filecoin | FIL | −5.0% | Computing |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.

Read more about

Save a Seat Now

BTC$28,898

BTC$28,898

1.47%

ETH$1,761.66

ETH$1,761.66

2.76%

BNB$303.46

BNB$303.46

1.89%

XRP$0.385958

XRP$0.385958

1.57%

SOL$42.47

SOL$42.47

3.19%

View All Prices

Sign up for First Mover, our daily newsletter putting the latest moves in crypto markets in context.