One of the ways to earn in the cryptocurrency market is to follow VC-backed projects. In this article, we took a look at 3 low-volume crypto projects backed by Binance Labs.

Here are 3 high-potential crypto projects backed by Binance Labs

seascape

Powered by Binance Labs, Seascape is a next-generation Web3 gaming platform. Players can collect rewards through various missions through the platform. This is one of the popular systems that improves and encourages the player experience. Apart from that, Seascape is trying to make development easy on its platform. The crypto project is currently planning to launch its games on the following platforms:

- Ethereum

- Binance Chain

- polygon

- Immutable X

- moonbeam

Speaking of games, there are a total of 8 projects under the Seascape ecosystem. These games are progressing in development stages. Game genres range from strategy to mini-games. Besides games, Seascape has other offerings. These include:

- NFT marketplace: The Scape Store allows NFT enthusiasts to buy and sell NFTs.

- Launchpad: Seascape acts as a ramp for investors to support early-stage projects.

- DAO: Decentralized Autonomous Organizations oversee the development and future plans of Seascape. CWS owners can collectively vote on proposals to decide Seascape’s path forward.

Why CWS is expected to explode

According to altcoinbuzz analysts, there are several factors supporting the rise of CWS price going up:

- The team is expanding the project. This feature is commendable as many projects are weakening in this bear market. Some new events for Seascape include:

- Mini Miners (a game in Seascape) starts on Sui Network.

- Blocklords (another game) is launching its open beta soon.

- Seascape has all the tools to succeed. Besides the support of Binance Labs, Seascape knows what its users want. It has an NFT marketplace, launchpad, and cross-chain strategy for its games. Therefore, it is on the right track to attract more players in the future.

How about the CWS price?

CWS is currently trading at $0.2584. It gained more than 5% in value compared to the last 24 hours. The token has a market cap of $1.24 million with a maximum supply of 10 million. Currently, 4.8 million CWS of this are in circulation.

Melos Studio

Melos Studio is next among the projects supported by Binance Labs. In his own words, it is the “Decentralized Music Studio for Web 3.0”. Melos Studio’s goal is to use Blockchain to build a good music app. With this app a musician’s work can be represented through NFTs. As of now, Melos Studio is active on Ethereum, Binance and Flow networks.

For more details, the highlights of Melos Studio are as follows:

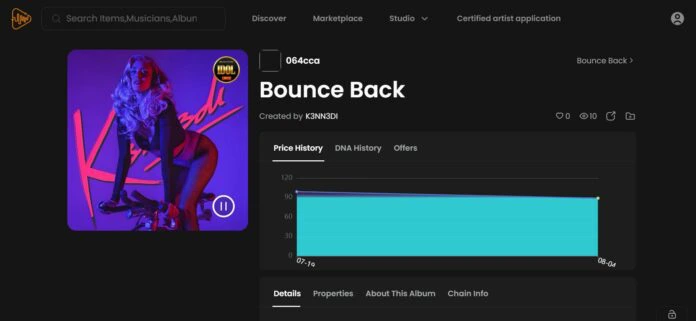

- Marketplace: Melos Studio has a music NFT marketplace to bring together musicians and NFT buyers.

- Sonus: With Sonus you can add music to “upgrade” your favorite existing NFTs.

- Metis: An AI music creation tool that allows anyone to create their own music NFT.

- Virtual Band: An online collaboration tool. It allows musicians to create music together.

Besides the great features above, Melos Studio is managed by a DAO. In this respect, it is quite similar to Seascape. Additionally, it has its own cryptocurrency MELOS. Investors who stake MELOS can vote on proposals within the DAO. Also, MELOS has other use cases. This includes tipping musicians for special benefits, fundraising for musicians, etc. are included.

How will MELOS rise?

Altcoinbuzz analysts answer this question with a few items:

- It offers artists more use cases and tools than its competitors.

- Eliminates middlemen for musicians. In other words, they get a larger share of their sales. In short, they earn more than $ 0.80 on the dollar. In traditional music, getting 0.20 is luck. By involving more musicians, more platform users will join Melos Studio.

How about the price of MELOS?

MELOS is currently trading at $0.00289863, down 7% intraday. It has a self-reported market capitalization of $1 million with a maximum supply of $1 billion. Of this, 327 million MELOS are in circulation.

OpenLeverage

OpenLeverage is the last of 3 small-scale projects supported by Binance Labs. OpenLeverage is a lending margin trading protocol. Simply put, it allows users and applications to long or short any crypto pair. Today you can access its platform on Ethereum, Binance Chain, Kucoin Chain and Arbitrum.

⚡️#OpenLeverage is happy to receive a strategic investment and strong support from industry leader @BinanceLabs.

We'll continue to #BUIDL with the support from #BinanceLabs to bring permissionless lending and margin trading to all in the crypto ecosystem.https://t.co/jyqcaHF2jb

— OpenLeverage | Live on Arbitrum 💙 (@OpenLeverage) June 21, 2022

So OpenLeverage wants to empower anyone who wants to build a margin trading market. Here’s what you can do on the platform:

- lending pools

- Rewards: You can do this by investing your assets in lending pools. Rewards come in the form of invested assets or native OLE tokens.

- Leveraged trades on hundreds of crypto pairs

Factors supporting OLE price

For a DeFi project like OpenLeverage it’s all about collecting more TVLs. A higher TVL indicates more users are included on the platform. Analysts predict that OpenLeverage will reach higher TVL levels. The main features that will support the project in this way are:

- It positions itself on the right Blockchains. OpenLeverage is preparing to pull TVL by launching on Arbitrum. Note that Arbitrum is still a home for DeFi.

- Its TVL has been increasing steadily from year to year. Despite a big drop from its peak, TVL is slowly increasing in 2023. Analysts expect OpenLeverage to continue attracting more TVLs with its innovative features.

The reason altcoinbuzz analysts see the future in these projects is because they are backed by Binance Labs. cryptocoin.comOn this page, you can take a look at the projects that Binance Labs has invested in in recent years.