According to data collected by Lookonchain, DWF Labs has transferred a significant amount of altcoins to a leading centralized exchange (CEX) in a strategic move aimed at optimizing its crypto holdings. The transaction includes a wide variety of major cryptocurrencies such as RACA, CEEK. Here are the details…

Transaction for RACA and 11 coins from DWF Labs

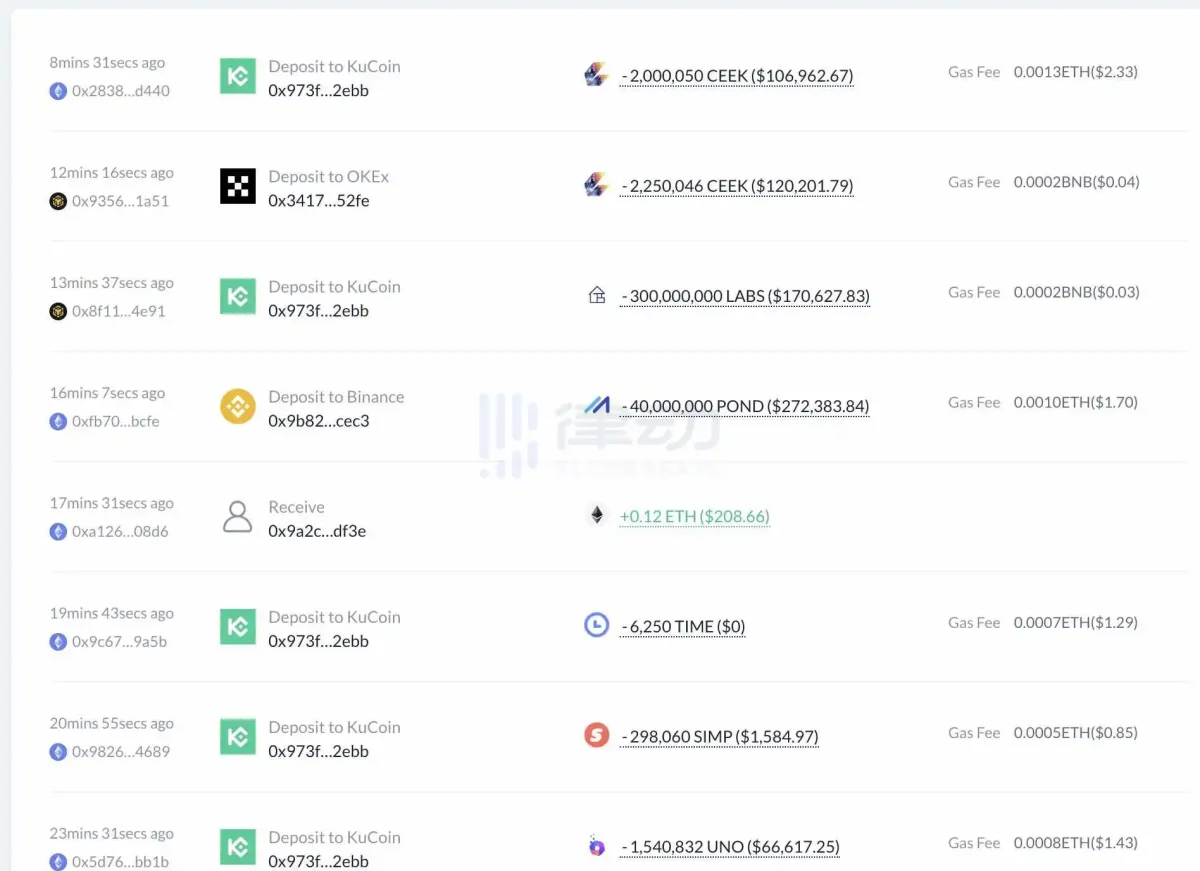

The transfer includes a list of major altcoins with their corresponding approximations in US dollars at the time of transfer. Major currencies carried by DWF Labs include 4.25 million CEEK worth approximately $227,000; 300 million LABS worth approximately $171,000; 40 million POND worth approximately $272,000; 6,250 TIMEs worth approximately $115,000; There are 298,000 SIMPs worth approximately $1,585 and 1.54 million UNOs with an approximate value yet to be disclosed.

1/ It seems that DWF labs is transferring altcoins to exchanges.

Watch out for price changes if you hold these tokens.👇 pic.twitter.com/1jF5Vuvbgv

— Lookonchain (@lookonchain) June 12, 2023

Additionally, DWF Labs has 2.5 million IXS worth approximately $42,575; 438,000 DFYN worth approximately $12,721; 0.5 million GF worth approximately $28,757; 7.26 million TOKOs worth approximately $8,587; and transferred 50 million APM with an estimated value of $457,000. Finally, the transfer included 40,000 Auctions worth approximately $151,000.

Despite the transfers, DWF Labs still has significant value in a variety of crypto assets. Specifically, the company holds 25.51 million CFX worth approximately $4.63 million. In addition, 13.65 million RACA worth approximately $1.4 million; There are also 7.3 million YGGs worth approximately $968,000. Apart from that, they continue to hold 60 trillion VINUs worth $715,000 and 7 million RSS3s worth about $677,000. Finally, DWF Labs holds 3.5 million TRADE with an estimated value of $54.2 million, 4.5 million MVs worth approximately $436,000, and 950,000 CELOs worth approximately $385,000.

DWF Labs is very active in the cryptocurrency market

This strategic move by DWF Labs to transfer altcoins to a centralized exchange demonstrates their intention to increase liquidity, capitalize on market opportunities, and potentially streamline the cryptocurrency portfolio. The transfer allows the company to take advantage of the advanced trading infrastructure and liquidity provided by centralized exchanges, providing greater flexibility in managing crypto assets.

Known for its innovative approach to blockchain technology and cryptocurrency, DWF Labs continues to navigate the ever-changing crypto landscape. The company aims to strategically position itself for future growth and success by adapting to market conditions. The decision to transfer key altcoin holdings demonstrates DWF Labs’ commitment to proactively managing crypto assets, leveraging potential gains while maintaining a diverse portfolio. Market watchers are keeping a close eye on developments with DWF Labs as the company’s actions may influence other cryptocurrency market participants to reassess their holdings and adopt similar strategies.