US Federal Reserve FED will hold its FOMC (Monetary Policy Committee) meeting on 13-14 June 2023. European Central Bank ECB On the other hand, it will announce its decision on Thursday, right after the FED. Let’s examine together how the markets started the week before the interest rate decisions, which are expected to have a significant impact on the markets.

EU Indices Start The Week With Buyers

The most important stock indices of European countries made a positive start to the critical week. German and French indices DAX-CAC 40 gained approximately 0.50%. DAX, increasing 14% since the beginning of the year, exceeding the 16,000 mark. CAC 4010% has moved up.

Italy 40 stands out today, up 0.75% since the beginning of the session. British market index FTSE 100lagged behind competing markets, gaining 0.25%.

While the average bond yields in EU countries start the week with a decrease, prices are moving upwards.

American Futures Positive

With the European markets opening in the positive direction, US futures are also giving bullish signals. Nasdaq 100 Futures started the week at 14,600 points with an increase of 0.54%. with smaller companies Russell 2000Futures index rose 0.88%, while the S&P 500 traded 0.24% higher.

While most US indices point to bullishness, Dow JonesThe week started flat and surprised the investors.

US Bonds Keep Calm

The Fed’s interest rate decision this week is undoubtedly expected to have a major impact on the bond market. Ahead of the critical meeting, 10-year bonds started the week with 0.11% rise. The US 10-year Treasury yield is currently hovering at 3.74%.

The shorter-term 5-year bond, on the other hand, promises more income to investors with a rate of 3.93%.

Will FED Increase Rates? Expectations What?

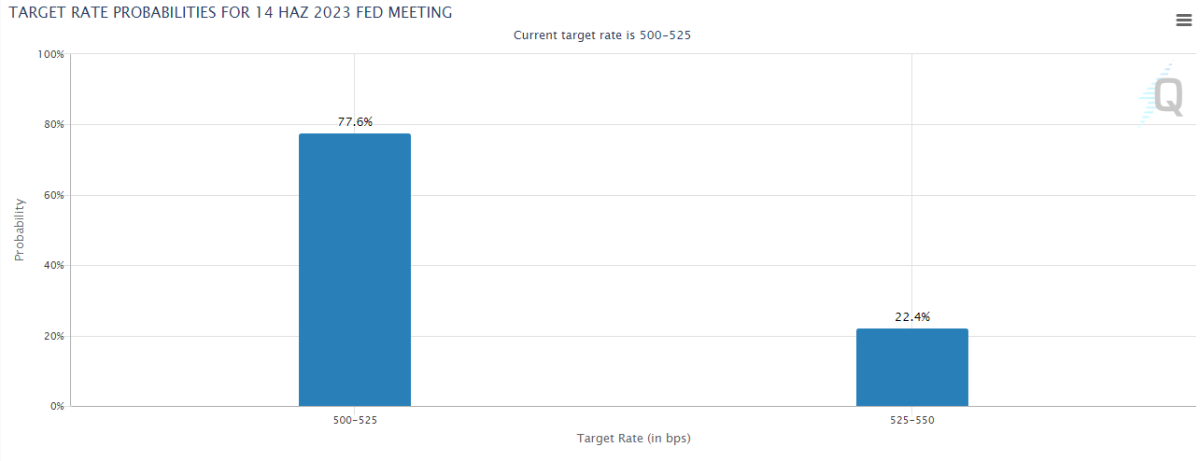

Before the critical FOMC meeting, the market in general predicts that interest rates will remain stable in the USA. While consumer inflation fell faster than expected at 4.9%, the policy rate is currently hovering at 5.00-5.25%. This situation reveals that the FED has started to give positive real interest rates since last month.

As inflation continues on a downward trend, 77.6% of investors estimate that the FED will keep interest rates constant to avoid economic contraction. But tomorrow’s new CPI data can completely change the situation. Markets expect the US annual consumer inflation, which will be announced on June 13, to drop to 4.1%.