Bitcoin (BTC) will soon surpass $30,000, according to crypto analyst Michaal van de Poppe, known for his accurate price predictions. The analyst detailed his expectations in his recent tweets.

Michaal van de Poppe charts the rally route for Bitcoin

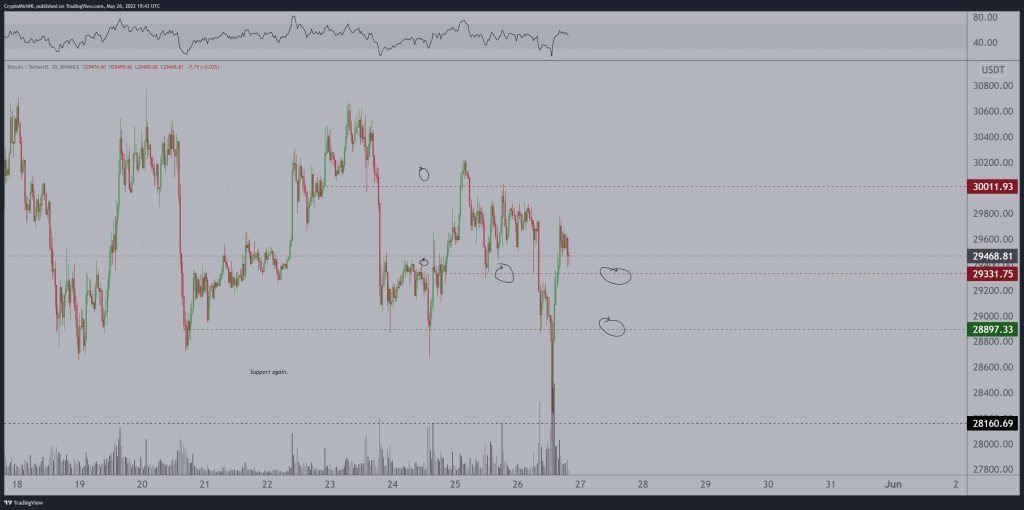

The popular crypto analyst explains to his 605,300 Twitter followers how the Bitcoin (BTC) price can reach $32,800. Sharing the technical chart below, Poppe says:

Simple, we are targeting $28,800 and/or $29,300 for Bitcoin to rise as we sweep all the bottoms and hit the $28,200 region. If things go well, we’re looking at $31,000 and potentially $32,800 in the near future.

Van de Poppe then shows a BTC chart showing his best cryptocurrency forecast by market cap up to June.

If BTC exceeds $29,300…

Van de Poppe, if Bitcoin can rise above $29,300, it’s “party time” for the leading cryptocurrency He believes it will. Marking the levels he expected with the technical chart below, the analyst says:

Bitcoin (BTC) is rebounding from the lows once again, indicating that this is still strong support for the time being. After breaking the $29,300 barrier, it’s time to celebrate.

At the time of writing, Bitcoin price has dropped slightly over the past 24 hours to trade at $28,943.00, but is still 0.65% behind Van de Poppe’s $29,300 target.

Analyst finally takes a look at the ETH/BTC pair

Van de Poppe also has Bitcoin (ETH/BTC), the second largest cryptocurrency by market cap. versus Ethereum (ETH) chart. The crypto expert predicts a reversal for the leading altcoin now that ETH/BTC has reached 0.6:

Now that we have reached 0.06 in ETH/BTC, I expect a small rally here.

As for Ethereum, it’s a mess with ETH trading below $1800 while the crypto market is on the decline. The leading altcoin, in particular, has dropped over 10% in the past seven days. On the other hand, as we quoted Kriptokoin.com , a total of 582.2 thousand unpaid option contracts will expire on 27 May. The relatively high open interest for options on May 27 indicates that new money flows to the market can be expected. This implies that the current trend may continue a little longer.