Three Arrows Capital co-founder Su Zhu admitted on Twitter that the Bitcoin Supercycle price thesis was misleading. The CEO, who also apologized for the LUNA and UST predictions in the past weeks, made predictions that the Bitcoin price could go up to $ 2.5 million.

Su Zhu apologizes for erroneous Bitcoin and LUNA predictions

In the tweet below, Su Zhu says he believes the crypto market will ‘continue to evolve and influence the world every day’ . The super cycle was an idea put forward by Zhu, who suggested that the crypto market would gradually rise during this market cycle, avoiding a perpetual bear market. He apologized on Twitter today:

The super-cycle price thesis was unfortunately wrong, but crypto will still evolve and change the world every day.

Supercycle price thesis was regrettably wrong, but crypto will still thrive and change the world every day

— Zhu Su 🔺 (@zhusu) May 27, 2022

Su Zhu’s Bitcoin Supercycle thesis

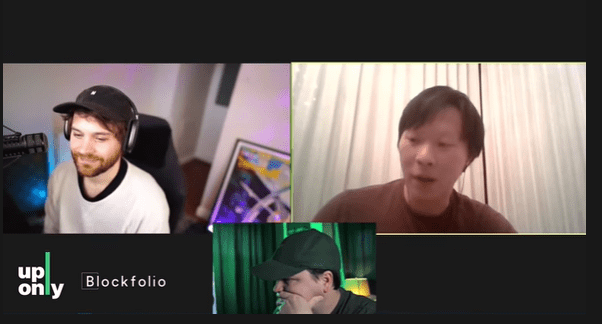

Su Zhu’s theory of Bitcoin supercycle goes back to an interview he gave on the UpOnly podcast in February 2021, where he predicted that BTC would reach $2.5 million if Gold could capture a large market share. . For the $2.5 million Bitcoin target, he made the following statement:

I mean, I believe there is a case of gold depreciation. If it were the largest store of wealth since its value about 1,700 years ago… If gold were 5 times, without Bitcoin, we would be looking at a market capitalization of $50 trillion. So you’re currently halfway through $100 trillion, and that would get you $2.5 million per BTC, which I believe is pretty doable.

Bitcoin’s price has lost almost 50% since the above interview. At the time of the interview in February 2021, Bitcoin was trading at around $50,000 and would go on to post an all-time high of $69,000 in November of the same year. However, Bitcoin has since slumped as low as $26,700 earlier this month due to the crypto market panic caused by the UST. The CEO, who previously told his followers to buy UST, apologized for these predictions after the collapse.