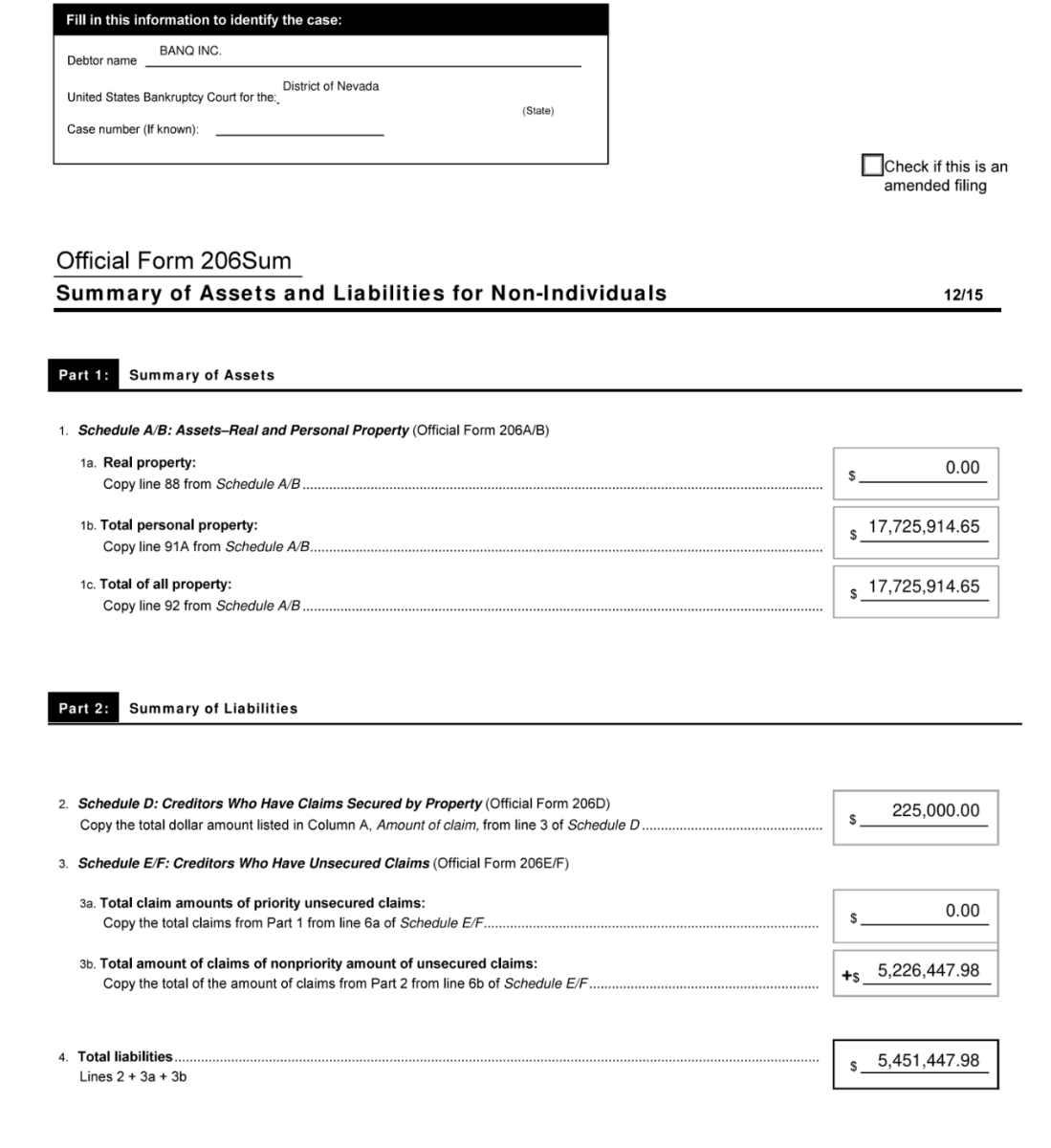

Banq, a subsidiary of embattled cryptocurrency custodian Prime Trust, has filed for bankruptcy in a US bankruptcy court in the Nevada region. In filing for bankruptcy, the company showed approximately $17.72 million in assets versus $5.4 million in liabilities. Here are the details…

Cryptocurrency company filed for bankruptcy

This came about when Banq’s parent company Prime Trust tried to enter into an acquisition deal with BitGo after facing a financial crisis as a result of Celsius bankruptcy. Meanwhile, TrueUSD, which has a banking relationship with Banq’s parent company Prime Trust, said the pause in stablecoin issuance and redemption is related to “Prime Trust’s bandwidth issues.” South Korean crypto returns firm Haru Invest has also entered an operational pause, citing difficulties with an unnamed service provider thought to be Banq or Prime Trust.

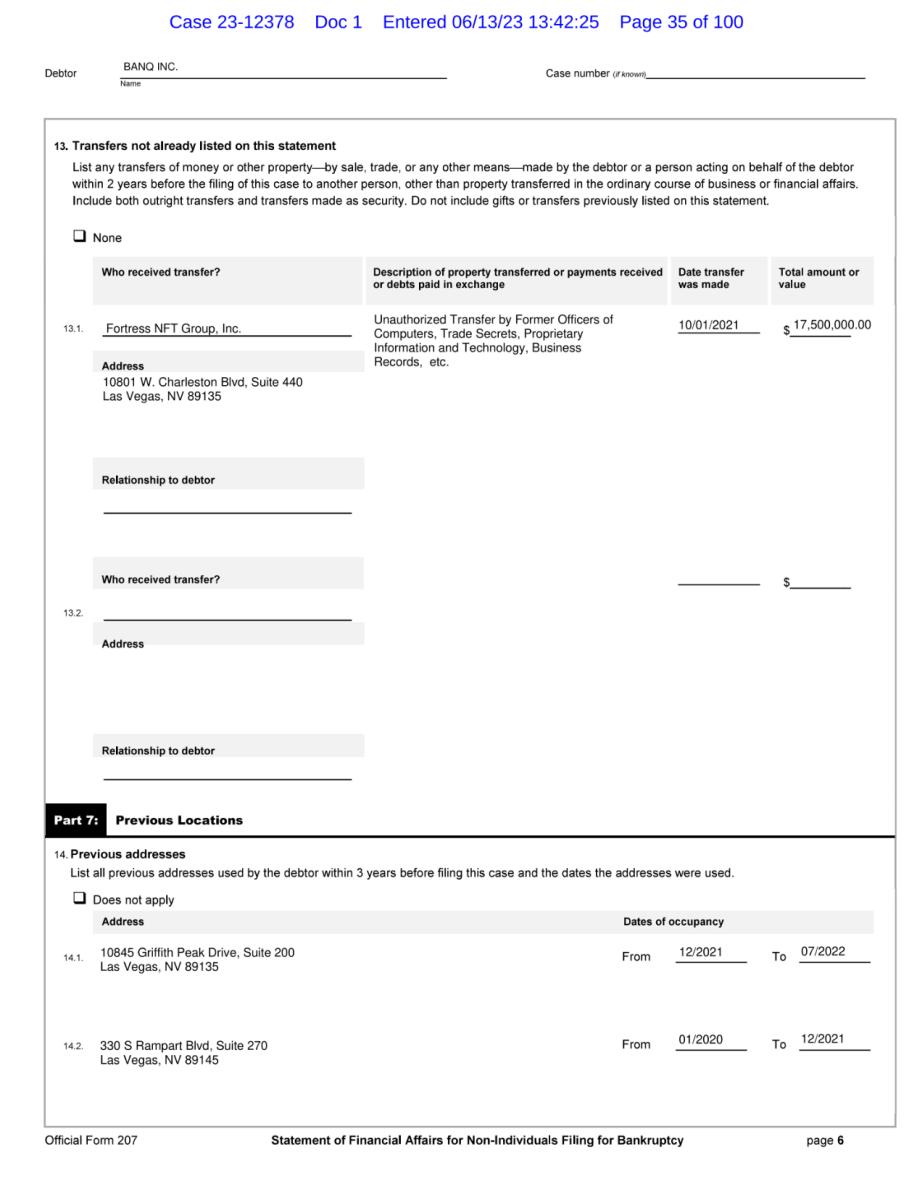

The company also states in its filing that $17.5 million in assets were acquired through an “unauthorized transfer” to Fortress NFT Group by former officials, which consisted of proprietary knowledge and technology, as well as trade secrets. Fortress NFT Group was founded by the former CEO, CTO and CPO of Banq. Banq sued Fortress for allegedly stealing trade secret information to launch rival NFT platforms Fortress NFT and Planet NFT. He also claims that they engaged in fraudulent activities to cover up their misconduct.

In its lawsuit against the trio, Banq said its former CEO, Scott Purcell, tried to direct Banq to NFTs. Faced with backlash from the board of directors and shareholders, Purcell founded Fortress NFT. He then sold Banq’s computers, intellectual property and corporate infrastructure to the new company. “The theft of Banq’s corporate assets even included obtaining the company’s seat licenses for the Las Vegas Raiders’ games at the Allegiant Stadium without Board approval or knowledge. Defendant Purcell has specifically transferred the seat licenses of Banq to itself. In early 2023, a Judge ordered the case to go to arbitration, as Purcell and the other defendants in the case had signed the terms of arbitration.