The Federal Reserve did not raise interest rates in line with expectations. This is normally supposed to be positive for the cryptocurrency market. However, the hawkish speech of Fed Chairman Jerome Powell slammed the market. After that, the crypto market, especially Bitcoin, plunged deep into the red. Sales from short-term holders were instrumental in these developments, according to data from analytics platform Glassnode.

Short-term holders sell BTC at a loss!

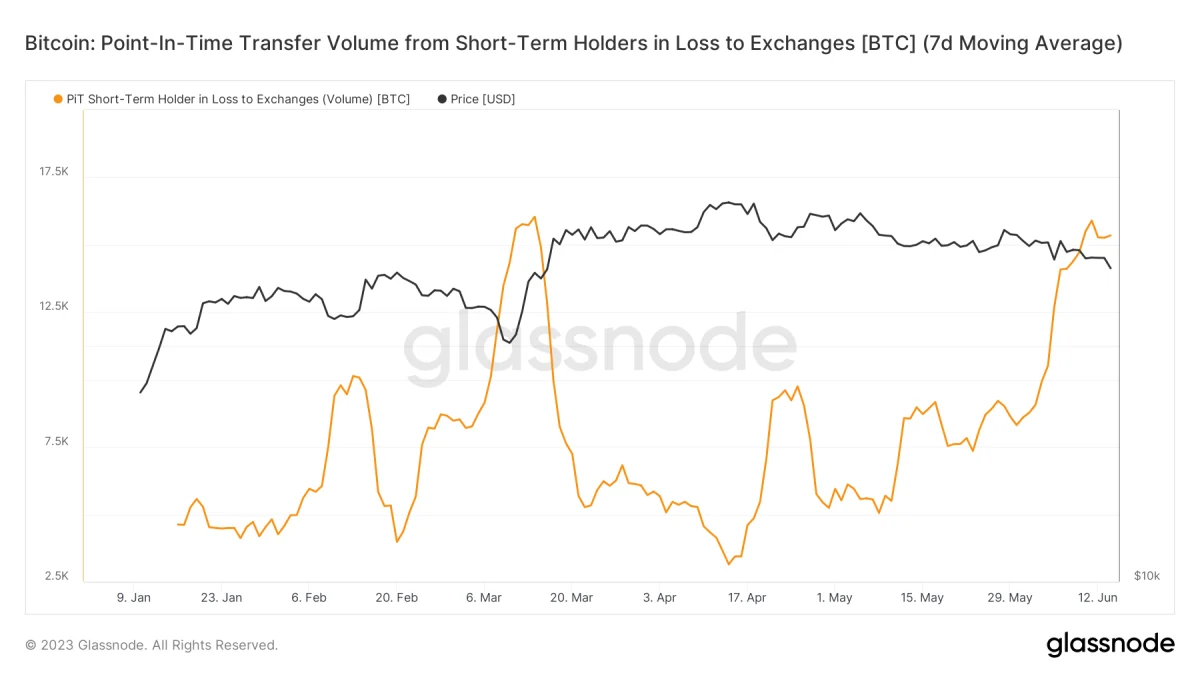

Data from Glassnode shows that on June 14, short-term holders (STH) sent 17,000 Bitcoins to exchanges. Moreover, short-term holders have agreed to dispose of the BTCs they have piled on exchanges at a loss. An important point here is that the sale in question was the second highest amount this year. So, according to the 7-day moving average, Bitcoin has reached a fairly high level of capitulation.

Source: Glassnode

Source: GlassnodeMeanwhile, the analytics platform includes people who hold BTC for less than 155 days in its group of short-term holders. Looking at the short-term holder supply, it is seen that there is an increase of 64,000 Bitcoin. Experts consider this as smart money buying cheap Bitcoin.

STH at a loss: Source: Glassnode

STH at a loss: Source: GlassnodeBearish sentiment prevails as Bitcoin options premiums rise

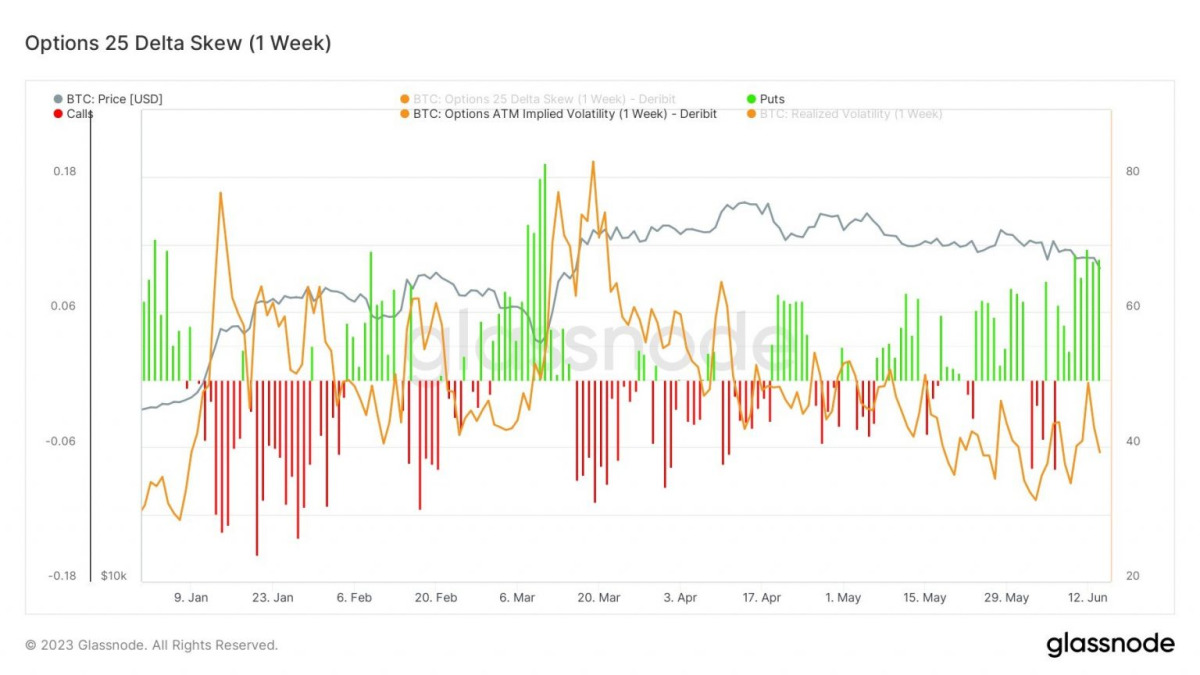

cryptocoin.com As you follow, the Bitcoin market is grappling with a series of disheartening news. The leading cryptocurrency price continues to face downward pressure. The latest data from Glassnode shows that the upward trend in Bitcoin open interest is accompanied by an increase in option premiums. This reveals that it paints a downward picture for the digital asset.

Option 25 delta skew (1-week) highlights a significant shift in market sentiment. Thus, it shows that put options are not only trading at a premium, but also poised to hit their second highest level this year. These data further reinforce the prevailing bearish outlook for Bitcoin.

Source: Glassnode

Source: GlassnodeThe growing demand for put options reflects investors’ concerns about the current state of the Bitcoin ecosystem. This shows that they are protected against potential price drops. The incessant flow of negative news casts a shadow over the market, fueling uncertainty. Also, this erodes investor confidence.

Market participants are taking a bearish position in Bitcoin

In the face of this gloomy mood, Bitcoin’s open interest continues to rise, pointing to a significant injection of around $450 million. This new liquidity flow is primarily due to leading exchanges such as Binance and Bybit. It also raises the potential for increased volatility in the market. While the liquidity injection can sometimes be seen as a positive development, current conditions suggest that it could worsen the prevailing bearish trend. Increased market volatility often accompanies increased trading activity. It is possible that this will further enlarge the price fluctuations.

It is worth noting that the options market provides valuable information about investors’ expectations and sentiment towards Bitcoin’s future performance. The increase in option premiums indicates that a significant portion of market participants are actively positioning for a possible drop in Bitcoin’s price. However, it is important to remember that market dynamics are subject to change. It’s also important to keep in mind that Bitcoin has a history that defies expectations. The cryptocurrency market is known for its volatility and unpredictable fluctuations. This is likely to quickly change the prevailing sentiment.

All in all, the recent rise in options premiums and the rise in Bitcoin open interest points to a bearish outlook for the crypto market. First of all, the new liquidity flow from exchanges such as Binance and Bybit is likely to contribute to increasing volatility in the near term. However, given Bitcoin’s historical durability and the ever-changing nature of the market, the future trajectory of the digital asset remains uncertain. This leaves room for potential surprises and unexpected shifts in sensitivity.