Altcoin movements of whales have been closely followed recently. They are obviously the subject of a sales wave. Therefore, the market intends to observe this movement. There is such a movement now. Let’s have a look at the details.

Which altcoin?

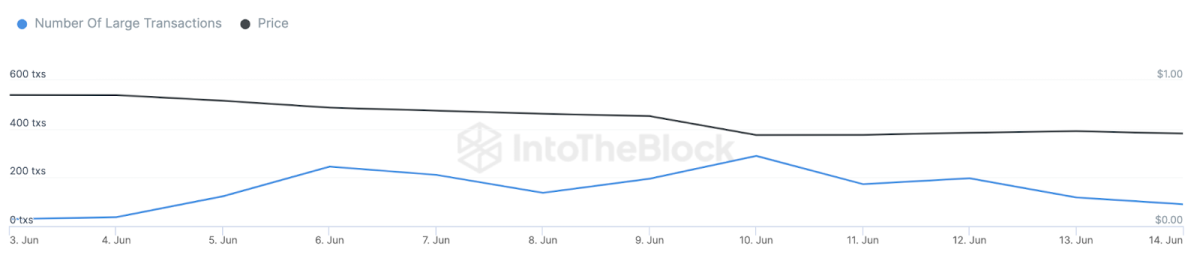

Polygon (MATIC) price fell 8% on Thursday after the Fed’s announcement of a pause in rate hikes. A bearish selling wave has a very important place. Whale investors have now lost confidence in altcoin MATIC. Accordingly, in such a situation, what are the chances of the MATIC price to recover in the coming weeks? Altcoin Polygon (MATIC) price continued its June freefall with an 8% correction on Thursday. With the on-chain data of the Polygon mesh turning red, is there any hope of an early recovery? After the price correction last week, crypto whales took advantage of the low prices to accumulate more MATIC. However, this week things took a different turn. Since June 10, Whale transactions on the altcoin Polygon network have been dropping continuously. More specifically, between June 10 and June 15, whale transactions on the Polygon network decreased by 220% from 289 to 90.

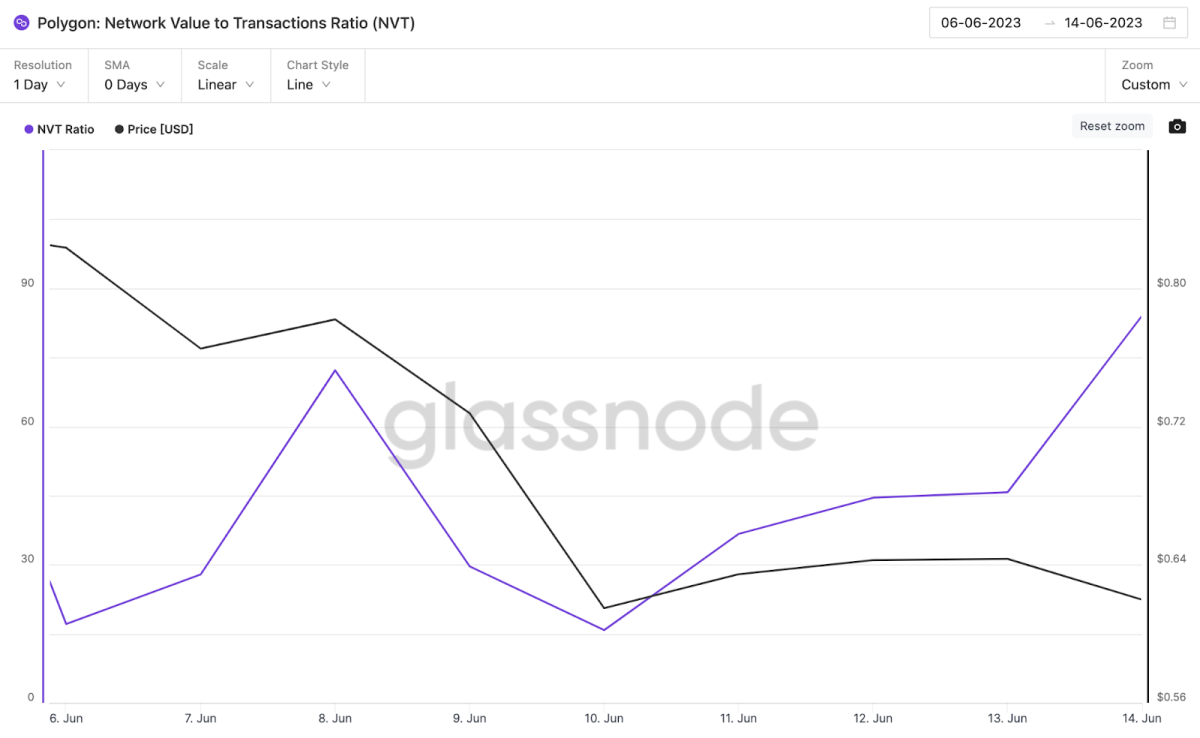

The Large Transactions metric monitors the trading activity of whale traders in real time. This metric summarizes the number of daily confirmed transactions exceeding $100,000. Typically, on the other hand, whale trading activity is positively correlated with price, largely due to the market liquidity and purchasing power they provide. The current trend suggests that major institutional investors may be losing confidence in altcoin MATIC’s price recovery prospects. In addition, Polygon’s Network Valuation to Transaction Volume (NVT) ratio increased significantly. This indicates that the coming days will get worse for the MATIC price. The NVT ratio compares a network’s market valuation to how much trading volume it has including its native token. According to the Glassnode chart below, the MATIC NVT rate has been rising since June 10. Between June 10 and June 15, it rose approximately 420% from 15.79 to 84.56.

Litecoin price approaches March lows

Altcoin Litecoin price is trading at $74 at the time of writing. Accordingly, it has declined by almost 24% over the last 14 days. The cryptocurrency was at $95 at the beginning of the month. It was also preparing to break through the resistance level at the same price. However, he could not pass this level. It then led to a correction fueled by the broad market decline.

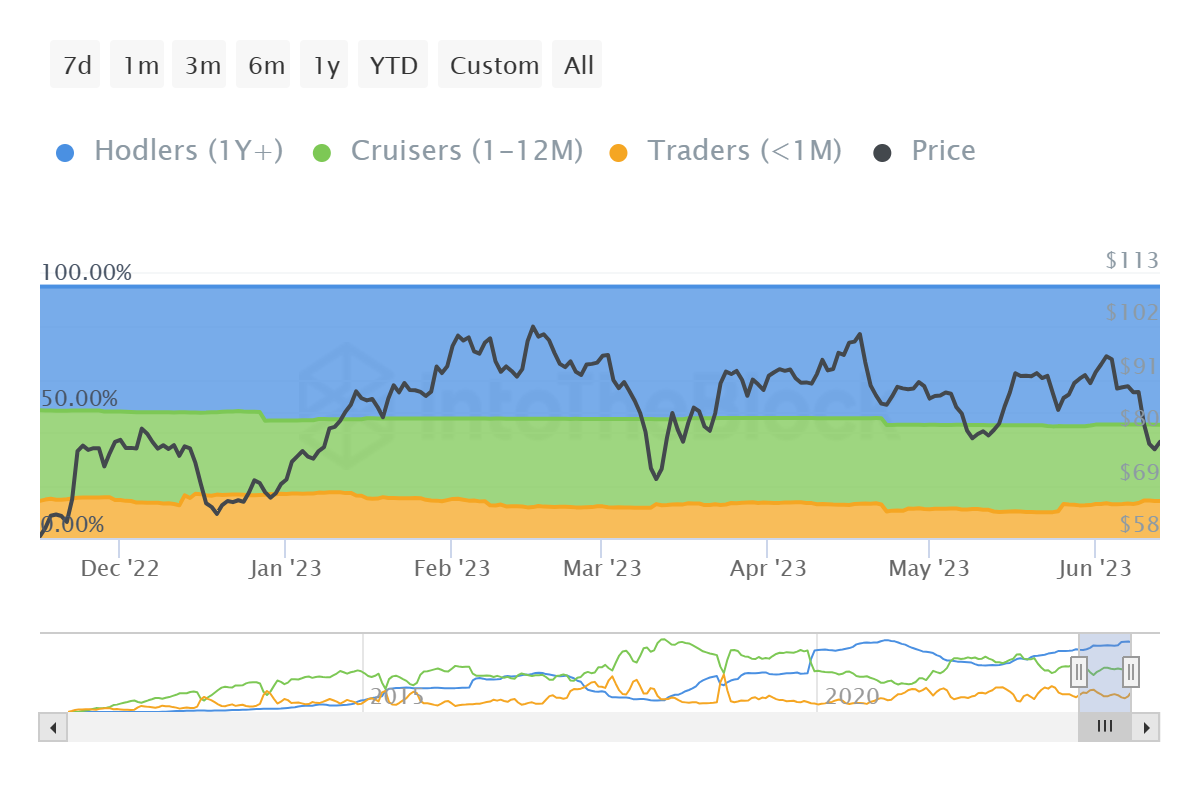

Naturally, such a significant drop has frightened altcoin LTC holders. Accordingly, recent developments have brought them to the point that their ideal preference is to take a step back. Medium-term holders (addresses that have held LTC for more than a month but less than a year) have had a decline in supply. During that time, their dominance over the circulating supply fell by 4%. This fell into the hands of short-term owners.

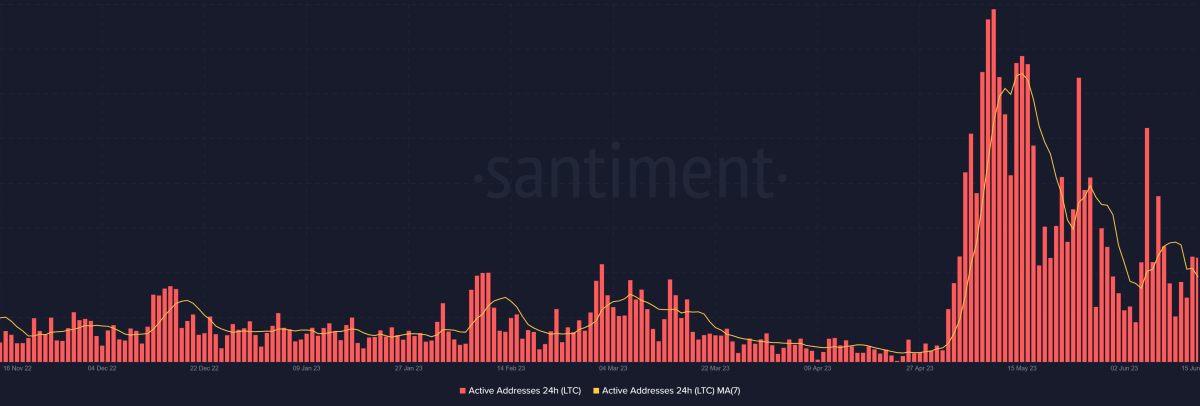

These addresses are generally considered more volatile as they have only held their altcoin LTC for less than a month. Accordingly, this makes them prone to selling. In addition, the presence of investors is also a concern at the moment. After peaking at around 880,000 last month, the number of addresses active on the chain is declining rapidly. Since then, the average number of daily active traders has halved. Accordingly, it fell to 430 thousand and seems to be on the way to fall even more.

The involvement of LTC holders is key to combating the bearish market trend and helping to prevent extreme dips in price action. When we look at Kriptokoin.com, there are only two months left until the Litecoin halving. However, network development events are only successful when they get the support of investors. This should not be forgotten either.