In a week of FOMC rate decisions, TradFi decoupling and bitcoin spot ETF proposals, BTC and ETH ended the week up 0.88% and 1.75%, respectively.

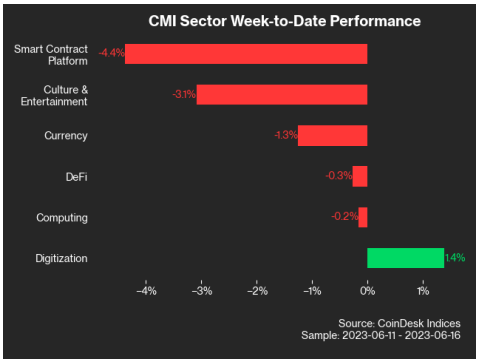

Among the five CoinDesk Market Index (CMI) sectors, Digitization led the way over the most recent seven days, with a 1.4% gain overall. The Smart Contract Platform sector trailed all, falling 4.4% over the identical time period.

A 14% increase in Galxe (GAL) and 2.2% increase in Braintrust (BTRST) fueled Digitization’s move higher. GAL is up 10.6% year to date, while BTRST has declined 35% on the year.

GAL remains 3.3% below its 20-day moving average and has a current Relative Strength Index (RSI) value of 44.06. The direction of its RSI implies an increase in bullishness, increasing 69% since June 10, relative to the 21% increase in GAL prices.

DeFi names Maker (MKR), Uniswap (UNI), and TruFi (TRU) also had strong weeks, rising 8.1%, 7.8%, and 7.5%, respectively.

Boba Network (BOBA), a Smart Contract Platform asset, was the week’s laggard, falling 5.5%.

Bitcoin and ether continued a recent decoupling from traditional finance, as their correlations with the S&P 500, Nasdaq and the Dow Jones Industrial Average (DJIA) trended negative.

BlackRock possibilities

The week’s most interesting development was BlackRock’s application to the Securities Exchange Commission (SEC) for a bitcoin spot exchange-traded fund (ETF).

Those well-steeped in the nuances of SEC applications will highlight that the application is technically for a “trust” and not a ETF.

Still, as BlackRock’s iShares Bitcoin Trust application is set to hold the asset as a commodity, it will operate in the same manner as existing commodity-based ETFs.

If approved, the ETF will offer exposure to retail investors via a third party, with the ability to enter and/or exit positions intraday.

The application’s timing coincides with an SEC crackdown on the industry, including last week’s lawsuits against crypto exchange giants Binance and Coinbase.

Given the SEC’s rejection of all prior spot BTC applications, and the perception of an agency that is hostile to digital assets markets, investors will be eager to see how it decides on the BlackRock filing.

With $9 trillion in assets under management, BlackRock is the largest asset manager in the world. Some observers may consider the application an endorsement of the asset class, as it will create a potentially sizable bitcoin buyer.

An approval would also cast doubts on previous rejections and likely spur a new wave of applications.

Since the announcement of BlackRock’s application, BTC is up approximately 4.5%.