What does the ETF issue, which has caught the agenda again with BlackRock’s application, mean for the crypto industry?

Seen as one of the biggest positive actions for the crypto industry ETFapplications, BlackRock re-emerged with it. Problems such as the pressure exerted by the SEC on the industry, large companies reporting that they were selling altcoins, and the lack of liquidity of the stock markets had pushed Bitcoin (BTC) below $25,000.

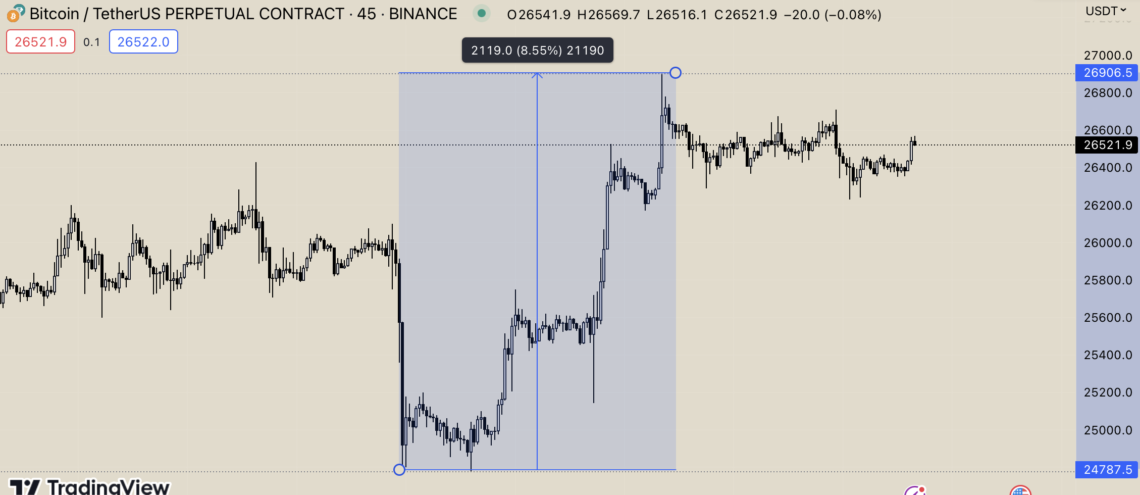

BTC The downward breakdown of this price, which is a decision on behalf of its name, created the idea that the decline will deepen in most investors. But just in time BlackRock’s BTC ETF application His news turned the tide, both fundamentally and technically. BTC, which went from $ 24,800 to $ 26,850 almost out of breath, increased by 8 percent. But what does this ETF issue mean for cryptocurrencies? How does it affect cryptocurrencies?

What Does ETF Mean for Cryptocurrencies?

popular in 2021 cryptocurrency ETFs sees virtual assets as a bridge to trade on traditional exchanges. Cryptocurrency-based ETFs represent funds created from one or more digital currencies. Crypto ETFs, which also operate like traditional ETF structures, are traded like stocks on an official exchange.

For any cryptocurrency-related ETF to be traded, it must comply with the relevant institution’s regulations and the background company must assume the responsibility. In this way, investors can buy shares that represent their rights in the exchange-traded fund.

Approval of the ETF is considered extremely important, especially as it will increase the interest of institutional investors in the crypto sector. Accordingly, as institutional investors increase the demand for BTC Futures, the issuer is forced to increase the amount of physical BTC in their portfolio to support this demand. Since this demand will positively affect the BTC price, it creates a great excitement in the market even during the application process.

How Did ETFs Impact the Industry?

One of the biggest positive developments on behalf of cryptocurrencies, the ETF issue has recently taken the field and brought Bitcoin ( BTC) almost took it off the rope. of the SECleading crypto exchanges BinanceAnd to Coinbase His filing shook the crypto industry. In addition, the announcement of large companies that they are selling altcoins reduced the confidence in cryptocurrencies and increased sales-oriented transactions.

After breaking a critical support level downwards, BTC created a panic atmosphere in investors. BTC, which lost value rapidly with the negative news one after another, BlackRock’s ETF Finding strength from his statement, he exploded. The leader of cryptocurrencies, which reached $ 26,850 in a short time from $ 24,800, showed an increase of 8 percent. With this situation, investors and the market took a sigh of relief.

ETF news, which are usually released at key moments, has become one of the biggest supporters of cryptocurrencies. In the past, major mutual funds such as Grayscale, ARK 21 Shares, VanEck, Proshares, Galaxy, Advisorshares Managed and Invesco have reported applying for ETFs. The most notable of these upward-firing moves of Bitcoin was seen at the time of ATH.

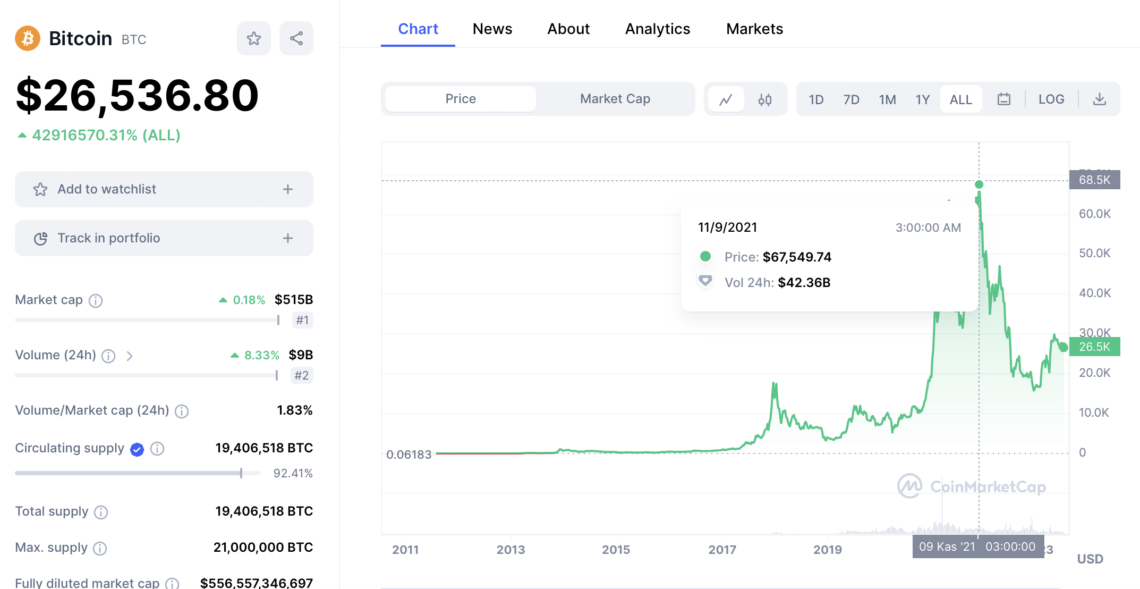

on October 16 SECAccelerating the bull run after approving the BTC Futures ETF, BTC reached $69,000 on November 9 at the All Time High ( ATH ) made. BTC, which broke its old ATH $ 64,000 under the influence of the ETF news, showed how important this action is for the rise.

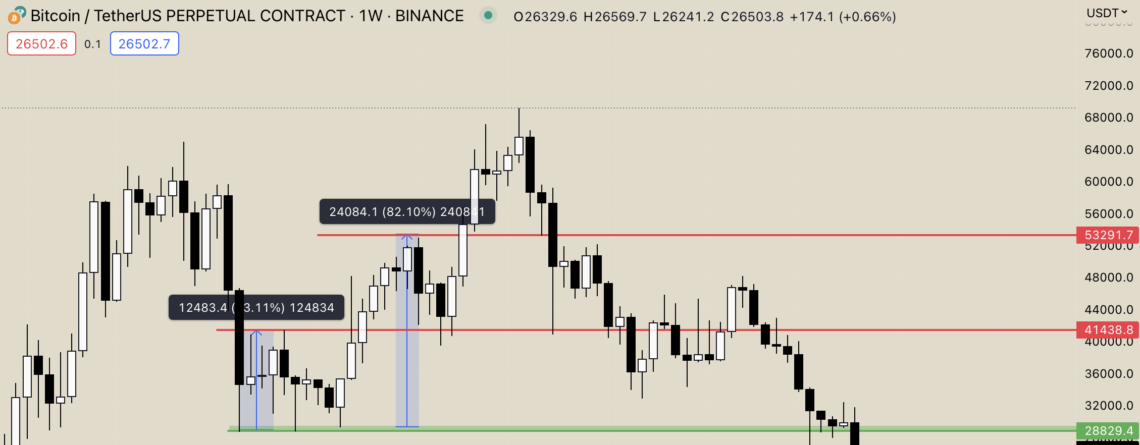

Testing $28,829 three times between May and August 2021, BTC managed to hold on to this level and reach $41,438 and $53,291 thanks to the support of ETFs. When it first tested $ 28,829, BTC, which created fear in the crypto ecosystem, became a lifeline for companies to apply for ETFs.

One of the biggest aids in the rise of BTC, which gained 43 percent in two weeks, came with news of an ETF. With this event, for the first time, trust and interest in ETFs increased greatly, creating a spring mood among investors and the market. In addition, companies that applied for ETFs increased their popularity by coming to the forefront on social media platforms.

After reaching $ 41,438, BTC, which was faced with a major collapse again, relaxed to the $ 28,829 band. Recovering with the release of ETF news, BTC managed to reach $ 53,291 in 7 weeks, performing 82.10 percent. ETF applications, which showed a remarkable effect in only 2 months, became a medicine for the market and investors.

Social Metrics Take Flight

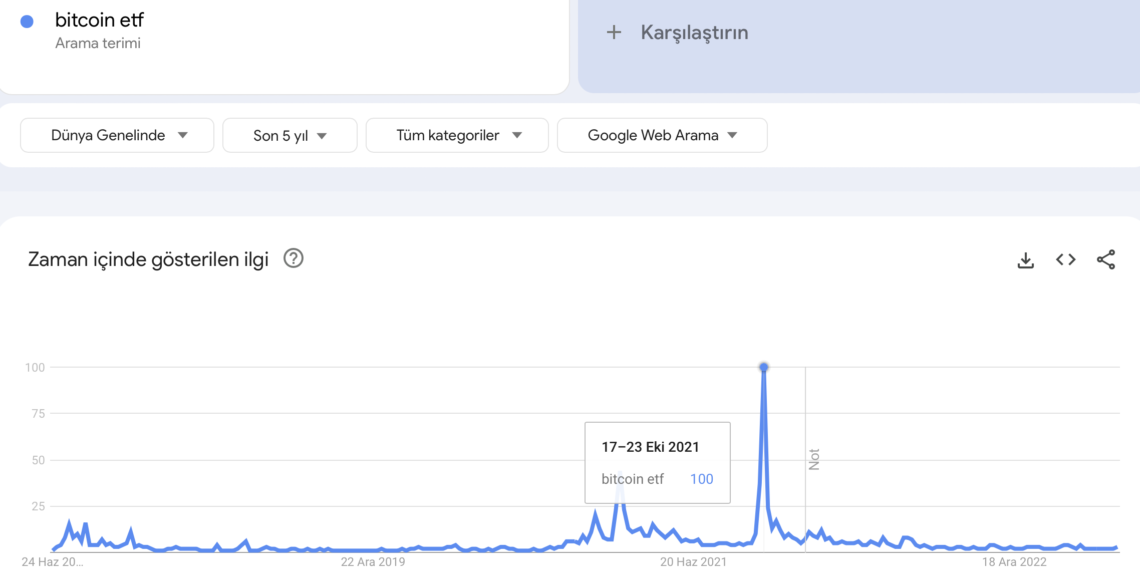

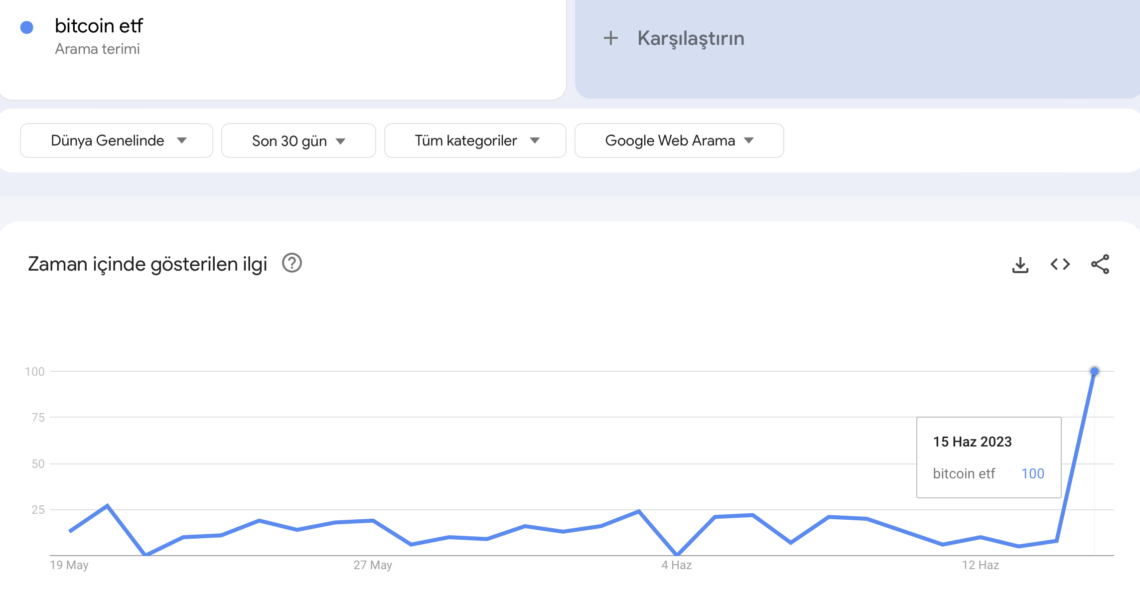

Announcing its application for a BTC ETF on June 15, BlackRock took social metrics to flight. The words “Bitcoin ETF” peaked that day, reaching 100 Google Trends points. This move, which was a pioneer in the rise of BTC, created a great global repercussion. The ETF issue, which creates discussion topics on Google and social media channels, continues to be interpreted positively.

Between 14-20 February, 44 Google Trends points were reached. However, this momentum could not be sustained by the effect of the fud news. The “bitcoin etf” Google Trends score, which reached 100 points for the first time on October 17-23, 2021, actually laid the groundwork for ATH. The ETF issue, which created a huge frenzy at that time, managed to attract a huge investor base from outside. However, the bull signals in the market got stronger and a new ATH came in BTC.