Bitcoin price is at risk of “boring” for up to a year and a half as the bull market picks up momentum, according to a new estimate. Here are the details…

What’s next for bitcoin price?

In the latest edition of its weekly newsletter, “The Week On-Chain,” analytics firm Glassnode predicted a “challenging” period ahead for BTC hodlers. Bitcoin, which gained 70% in the first quarter of this year, but then struggled to maintain its position, creates differences of opinion when it comes to future price movements. Some believe that with the 2024 halving, a dramatic rise will characterize the coming year. Others believe it will take longer to reach a new all-time high. There are even people who draw attention to 2025.

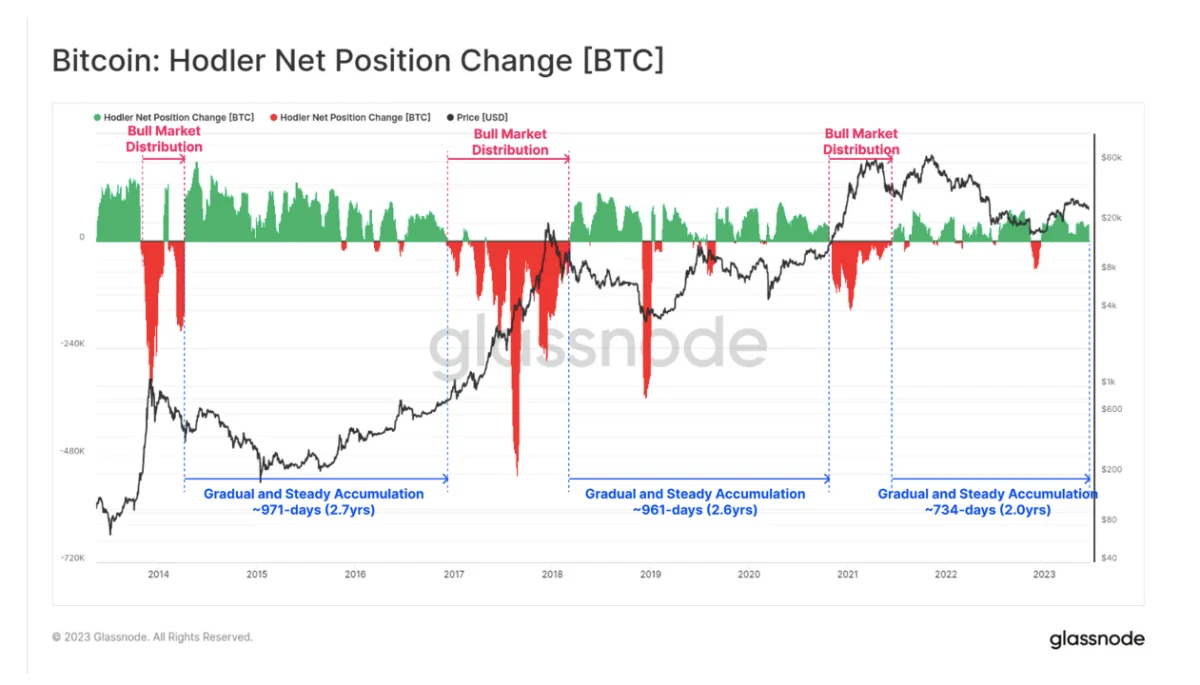

According to Glassnode, there are signs that a classic pre-bull market phase is underway, but long-term holders will still need to show great patience. Researchers examining the “viability” of the BTC supply, which he defined as “the tendency of Bitcoin holders to spend or hold their coins”, revealed mass accumulation. The following statements were included in the analysis:

Currently, the vitality is in a multi-year macro downtrend and peaked in May 2021, when the bear market first started. As coins are slowly but surely moved to cold wallets and removed from the market by the HODLer group, we can see a structure similar to the 2018-20 cycle forming. These HODLers are currently accumulating around 42.2k BTC per month, suggesting that the price-insensitive class is currently absorbing a not insignificant portion of the available supply. If we compare this behavior with previous cycles, we can see that this steady and gradual accumulation regime started a little over 2 years ago, suggesting that we may have another 6 to 12 months ahead of us.

Bitcoin wealth transfer continues “uninterrupted”

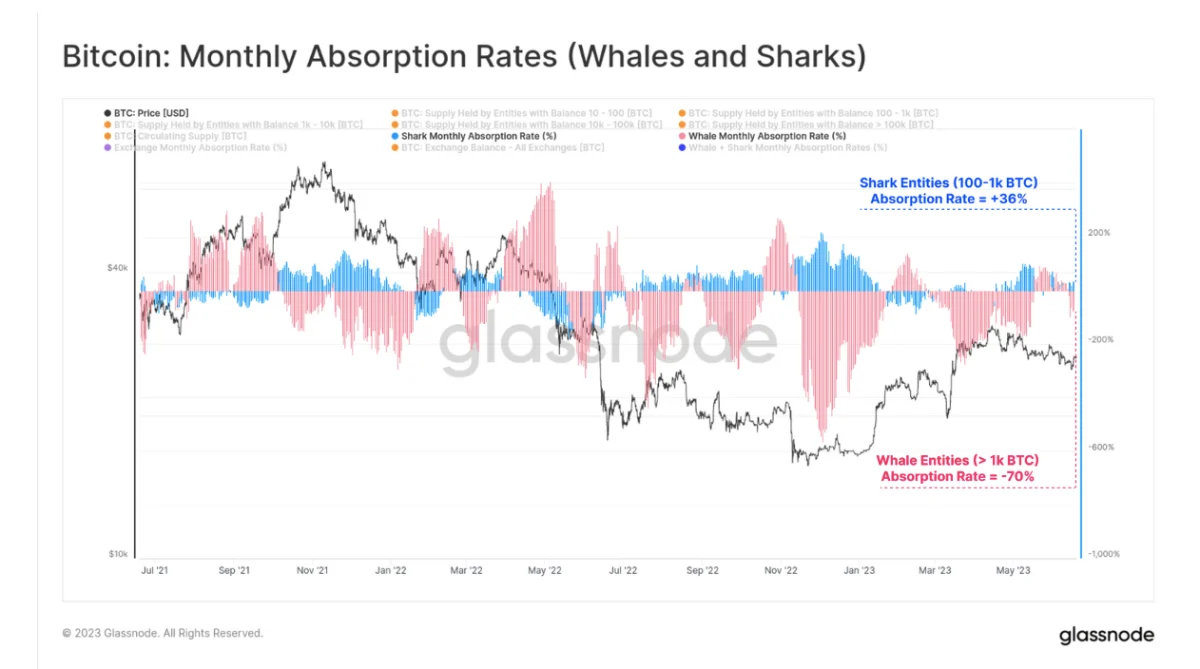

The more speculative end of the Hodler bottom (short-term holders) is also in focus right now. These investors have accumulated coins for a maximum of 155 days. Total cost bases – around $26,400 – are on the radar as a short-term support zone. Glassnode continued, noting that not everyone is in accumulation mode based on wallet asset size, while whales, the largest volume assets, are currently “net distributors”. “Overall, the market appears to be in a quiet period of accumulation, indicating an influx of demand despite recent regulatory headwinds,” he said, citing recent US regulatory pressures affecting major stock markets. However, researchers believe that for a seismic trend change to occur, another halving must occur. Glassnode says:

By most measures of market energy, the crypto-asset markets show little excitement. While liquidity and excitement leave its place to investor indifference, volatility, volumes and realized value are at their lowest levels in recent years. But below the surface, the classic pattern of wealth transfer continues unabated towards the price-insensitive cohort of HODLers. If past cycles are any guide, this suggests that a period of indifferent horizontal boredom, potentially lasting 8 to 18 months, could define the path ahead.