Leading cryptocurrency bitcoin As of the night hours, it exceeded the level of $ 30,000. Investors were excited by the fact that BTC, which last reached these figures in May 2022 and April 2023, made another trial after 2 months.

Predicting the future direction of the market on-chainexperts started to share their analyzes after the upward movement.

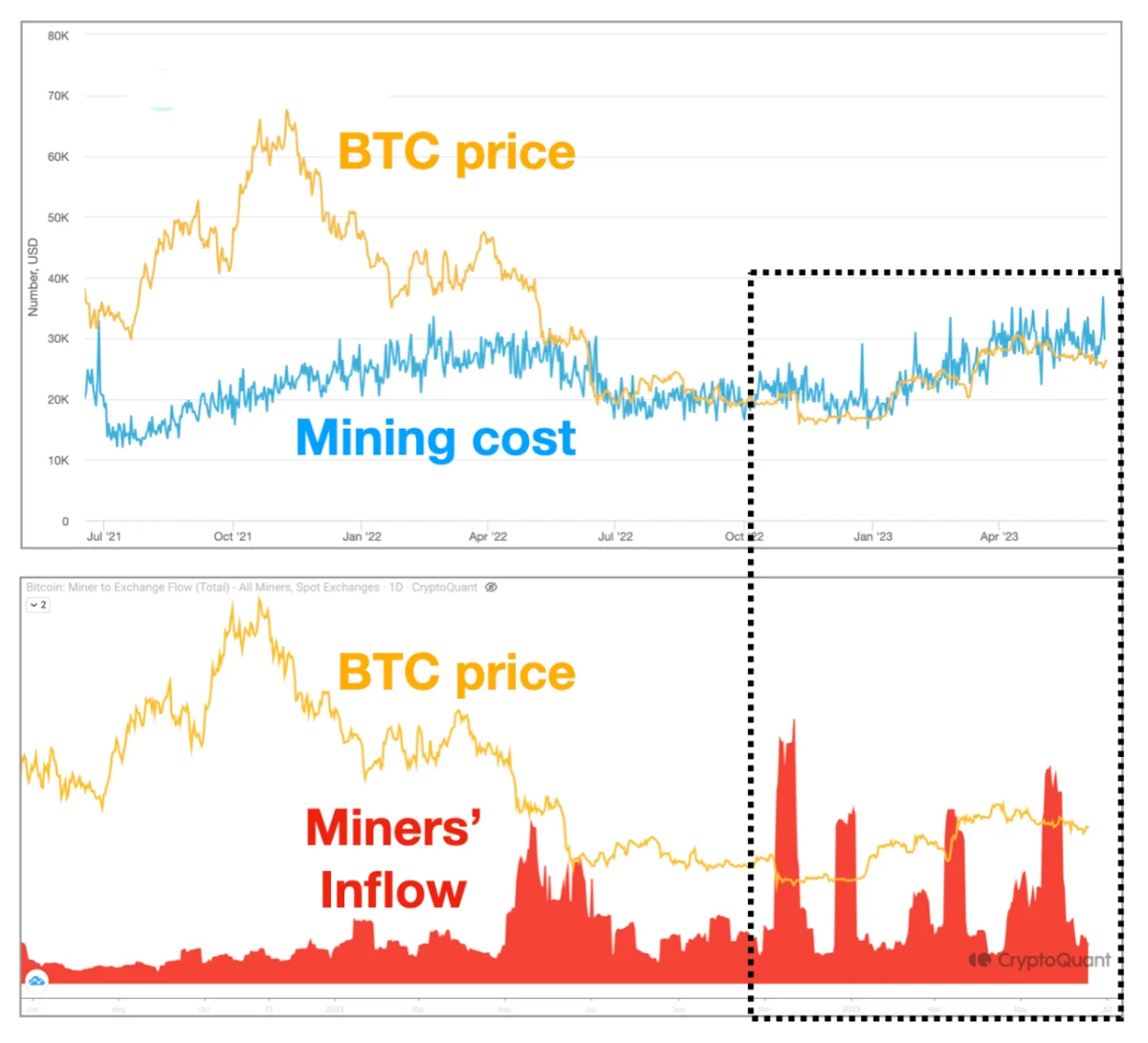

BTC Price Equalized With Mining Cost!

Posting on the on-chain data platform CryptoQuant, the analyst alias SignalQuant revealed the sale of miners. last 2 months BTCEmphasizing that the price does not cover the costs, SignalQuant commented that miners send and sell Bitcoin to exchanges to cover their operating expenses.

The analyst believes that if the BTC price persists above cost, the sale of miners will decrease. The average cost of producing one Bitcoin is currently $30,000, according to CryptoQuant data. If the leading cryptocurrency rises a little higher, miners will start to profit.

Bitcoin Analysis

Bitcoin, the largest cryptocurrency by market cap, has gained more than 14% since the beginning of the week.

The cryptocurrency market bled last week due to news from Binance. Falling as low as $25,000, Bitcoin is on its way to its annual peak after the exchange’s agreement with the SEC.

Bulls that broke the $25,400, $26,780 and $27,450 levels, respectively, pushed the price to $30,000. If the leading crypto stays above $29,800, it may continue to rise.

Although price action signals a fresh rise, it is worth taking a look at technical indicators. The Relative Strength Index RSI is hovering at 83.45 on the 4-hour chart. A number over 80 means that the financial product is overbought.