Consulting giant Motley Fool says that despite making progress in the DeFi space, Cardano (ADA) is still lagging behind its rivals as an investment vehicle.

Are you considering buying Cardano (ADA)?

The ADA price was on the rise for the first four months of the year. It gained 80% by mid-April. But June’s SEC lawsuits completely turned things around for the ADA. Meanwhile, the annual return on investment has shrunk drastically.

In early June, the SEC filed suit against Binance and Coinbase. In the lawsuits, the SEC specifically stated that it views Cardano as one of the unregistered securities that these exchanges offer to customers. As might be expected, this started shock waves in the crypto industry. In just one week, Cardano dropped 30%.

That’s why Motley Fool analysts warn those considering buying Cardano of high regulatory risks. Until regulatory issues are resolved, crypto may have a very difficult time regaining the trust of investors. By comparison, Ethereum has so far remained in the eyes of regulators. While there are rumors that the SEC is going after Ethereum, that has yet to happen. Purely in terms of regulatory risk, Ethereum is a safer investment.

Which altcoins are a better option than ADA?

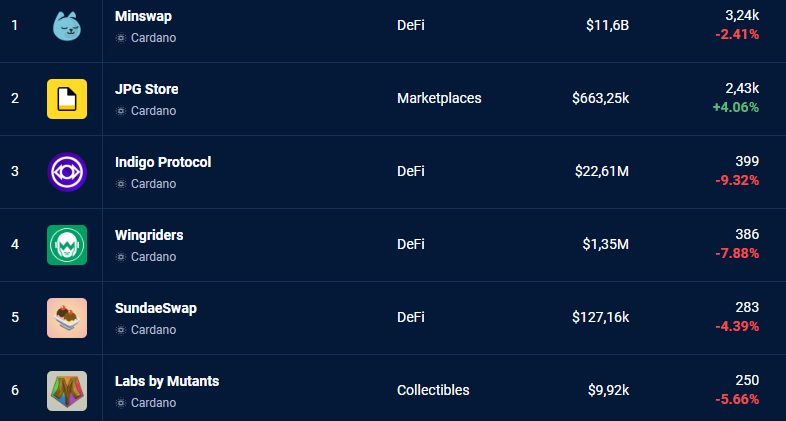

Cardano excels in NFT and DeFi in the Blockchain industry. Both of these were the reasons for Cardano’s bull run at the beginning of the year. As for NFTs, Cardano is closing the gap with Ethereum. In terms of DeFi, Cardano is finally starting to make a splash after years of not being a gamer.

But analysts are now of the opinion that Cardano has made real progress when it comes to NFTs. In particular, the emergence of Bitcoin Ordinals has heated up the competition in the industry well. On the DappRadar website, which tracks NFT sales volume, Cardano only has two NFT collections in the Top 20. However, Ethereum has 18 collectibles in the Top 20.

However, Ethereum still rises above Cardano when it comes to TVL. Ethereum ranks #1 with a TVL of $24.5 billion. On the other hand, Cardano is ranked 19th with a TVL of just $135.9 million. While Cardano has made a lot of progress on the DeFi front, it is still far from challenging Ethereum.

Stacks (STX)

Analysts’ selection addresses the well-known limitations in smart contract functionality and scalability driving another Cardano competitor, Stacks, DeFi, and NFTs. Let’s compare Stacks with other entities in the industry to give a concrete example. For example, Wrapped Bitcoin (WBTC) is the token version of Bitcoin that exists on Ethereum. It allows Bitcoin holders to participate in DeFi activities and use Bitcoin within the Ethereum ecosystem.

Given Stacks’ ability to interact directly with Bitcoin and not need custodians, the platform has significant potential to achieve similar, if not greater, adoption than Wrapped Bitcoin. Even better, at the height of the previous bull market, WBTC reached a market cap of over $15 billion as demand for DeFi-enabled Bitcoin increased. If Stacks can position itself as the true Bitcoin-DeFi platform, there really is a chance to rise to levels previously reached by WBTC. For this to happen, a Stacks price must rise by more than 1,800% to reach $10.

cryptocoin.com As STX, we have included other Bitcoin-oriented crypto money in this article. Motley Fool analysts expect Cardano to go through tough times ahead due to falling TVL and increasing regulatory pressure. Analysts point out opportunities for Ethereum (ETH) and Stacks (STX) at this point.