Crypto critic Peter Schiff described Bitcoin’s last run above $31,000 as the ‘end of rally’. “The rally ends when the lowest-quality stuff finally joins,” the famous economist says, adding that “there is no inferior quality to crypto.”

Bitcoin price hits year high

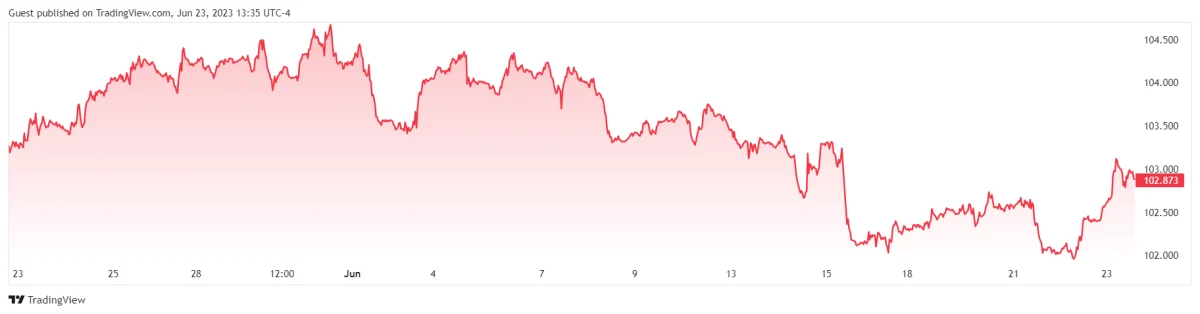

Before Peter Schiff’s latest statements, BTC reached a 2023 high of $31,431. The rally came after BlackRock and Fidelity Investments applied for spot BTC ETFs. Previously, the SEC’s lawsuits against Binance and Coinbase had dried up institutional interest. June 15’s BlackRock ETF news has been the main booster of Bitcoin price. cryptocoin.comSantiment data, which we have quoted as , show that ETF news largely overlaps with the last rally.

Another positive sign for bitcoin price is the cooling US dollar index (DXY). Historically, when the DXY index pulls back, sentiment increases for risky markets like Bitcoin. But Peter Schiff interprets the recent market rise of Bitcoin as the ‘end of the rally’. According to the famous economist, the lowest quality things rise last…

Peter Schiff criticizes BTC rally

In his comments on Twitter on June 23, Schiff said that the recent rally in risky markets did not include Bitcoin. He interpreted Bitcoin’s rally and climb to new local highs as “a sign that the party will soon be over.” Schiff’s statements that drew the reaction of the crypto community:

Until recently, the rally in highly speculative assets did not include Bitcoin. Now that Bitcoin has finally joined the party, this is perhaps a sign that the party will soon be over. Usually rallies end when the lowest quality stuff finally joins. There is no inferior quality to crypto.

Until recently the rally in highly speculative assets excluded #Bitcoin. Now that Bitcoin has finally joined the party, perhaps it's a sign that the party will soon end. Usually rallies end when the lowest quality stuff finally participates. There's no lower quality than #crypto.

— Peter Schiff (@PeterSchiff) June 23, 2023

Twitter’s @AtlasPulse wrote in Schiff’s statement above, “Bitcoin is much higher quality than the rest of crypto. If in doubt, see how Bitcoin equals other cryptocurrencies. Also, Bitcoin is leading the rally, not a flying turkey in this rally.”

What does technical analysis say about Bitcoin?

Bitcoin price action resolved to the upside on June 23. Buyers are currently trying to keep the price above the $31,000 level. If successful, the bulls’ first target in the short term will be $32,400. Then, they could quickly move towards the next major resistance at $40,000.

Also, the 20-day exponential moving average, or EMA ($27,561), is up and the relative strength index (RSI) is in the overbought zone, showing the bulls in control. This view will be rejected in the near term if the price stays below $28,500. According to technical analyst Rakesh Upadhyay, BTC could then enter a range-bound action between $31,000 and $24,800.