The Terra ecosystem caused one of the biggest debacle in crypto history in May as major investors of LUNA and UST started selling and the balancing mechanism broke. While many are putting forward “ponzi” claims about UST, one altcoin project is rushing to lead in this vacuum.

Luna made history with a billion dollar crash

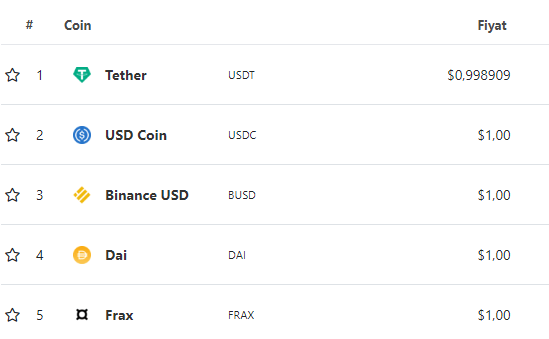

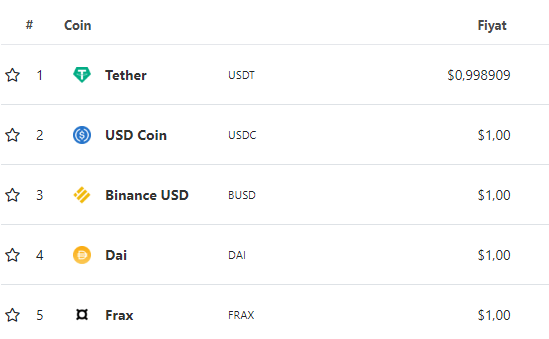

The Luna crash in early May caused Terra Luna to drop to a whole new low and its stablecoin TerraUSD ( UST) lost its 1 dollar peg, causing it to fluctuate sharply in terms of pricing. Both cryptocurrencies are currently out of the market. Now, MakerDAO’s stablecoin DAI is rising to the top in terms of market cap as the Terra team works towards a Luna recovery plan via fork.

What is DAI and how does it differentiate from other stablecoins?

DAI is an Ethereum-based stablecoin managed by MakerDAO. The price of DAI is pegged to the US dollar and each time a new DAI is minted it is secured by a mix of other cryptocurrencies deposited into smart contract vaults. DAI has become the second largest decentralized stablecoin by market cap after the UST collapse. So why is DAI different?

Dai stablecoin is a collateral-based cryptocurrency pegged to the US dollar. Users can generate Dai by depositing cryptocurrencies into Maker Vaults on the Maker Protocol. They can also access Maker Protocol and create Vaults through Oasis Borrow or other community-created interfaces. In Oasis Borrow, users can lock collateral such as ETH, WBTC, LINK, UNI, YFI, MANA, MATIC and more. Users can then borrow against their collateral at Dai as long as the collateral is within the range of 101% to 175% depending on the risk level of the locked asset. The main advantage of DAI lies in its soft pegging to the dollar.

Another important advantage of DAI is that it is not managed by a private company but by a decentralized autonomous organization via a software protocol. As a result, all token issuance and burn cases are managed by self-enforcing smart contracts powered by Ethereum and recorded publicly, making the entire system more transparent and less prone to corruption.

At the time of writing, DAI is the 15th largest cryptocurrency in the market with a market cap of approximately $6.6 billion. We have covered everything you need to know about Terra LUNA 2.0 in this article Kriptokoin.com .