A trader made significant moves in altcoins. The wife, on the other hand, is astonishing. Exactly 400 thousand dollars. Let’s look at the details.

Altcoins that bring 400 thousand dollars profit

Blockchain analytics firm Kaiko noted that blue-chip DeFi tokens have performed “outstanding” over the past 30 days. The value of many digital assets has increased during this time as the market has witnessed an influx of institutional interest. A crypto trader has purchased native tokens of major decentralized finance (DeFi) projects, including Uniswap’s UNI, Lido’s LDO, and Aave’s AAVE. Afterwards, he made a profit of $427,000 in a month.

According to Lookonchain, the trader made these profits without trading meme coins. He has achieved it just by taking advantage of the bull run of crypto assets over the past month. Using the address ox123d, the trader bought 71,891 UNIs on June 16 at $4.34. He also bought 6,371 AAVEs at $50 and 189,255 LDOs at $1.64. He spent $942,000 on all this.

huge snow

As of July 15, the price of UNI reached $5.85. Also, AAVE was valued at $79 and LDO was trading at $2.37. This meant that the investor sold all the tokens for $1.37 million, earning 40% profit from their trades.

This transaction is an excellent example of smart money movements. However, it also highlights how well DeFi tokens have performed over the past 30 days. On July 10, blockchain analytics firm Kaiko revealed an important case. He reported that blue-chip DeFi tokens have performed exceptionally well over the past month.

Altcoins maintained their positive outlook over the past month

On the other hand, this positive price performance was not limited to DeFi-focused altcoins. That’s because the broader crypto market also rose during this period. Bitcoin and Ethereum, the two most important digital assets, rose to annual highs during this period.

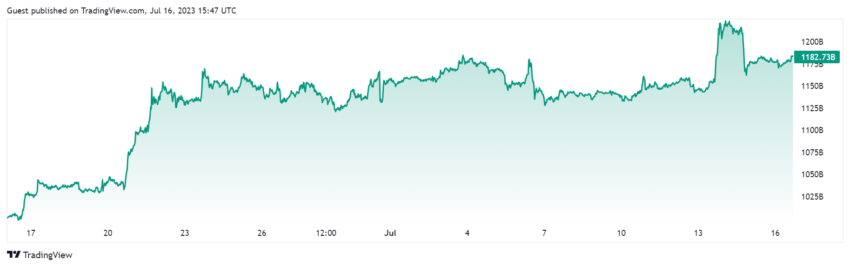

Meanwhile, many mid-cap digital assets such as Bitcoin Cash, Solana, and others have also seen their values soar into uncharted territory. According to Tradingview data, there is an increase. During this period, the market cap of all crypto assets rose 17% to $1.18 trillion. This positive price performance is actually quite normal. Because in the last 30 days, there have been several positive developments in the crypto industry.

Those positive developments

Towards the end of June came the move by several traditional financial institutions led by BlackRock. Accordingly, it has applied for a spot Bitcoin exchange-traded fund (ETF). During this period, EDX Markets, an institutional crypto exchange supported by Wall Street giants, started its activities.

cryptocoin.com On the whole, the positive mood in the market continued in July, with crypto payment company Ripple winning a significant victory over the SEC. However, the momentum has waned as the market has seen slight decreases in the last two days. Still, most digital assets remain green due to the positive trend over the past 30 days.