Gold prices have dropped from their overnight highs but remain support above $1,850. Commodities analysts say the yellow metal is lacking in any direction as US markets are closed for Memorial Day.

Craig Erlam: Might be more bitter

Analysts say the precious metal is trading in the middle of its wider long-term range. As you’ve seen on Cryptokoin.com , gold prices continue to benefit from the weak US dollar, but the rising risk sentiment helping to strengthen equity markets is adding some shine to the yellow metal’s safe-haven appeal.

But some analysts say the bounce in the S&P 500 last week was a classic bear market. Analysts say growing fears of an impending recession will continue to weigh on stock markets. Craig Erlam, Senior European Market Analyst at OANDA, comments:

There could be more pain. But at these levels it’s natural for vultures to run in circles. There isn’t much to get excited about about inflation, interest rates and the economy, but that doesn’t mean there isn’t value out there.

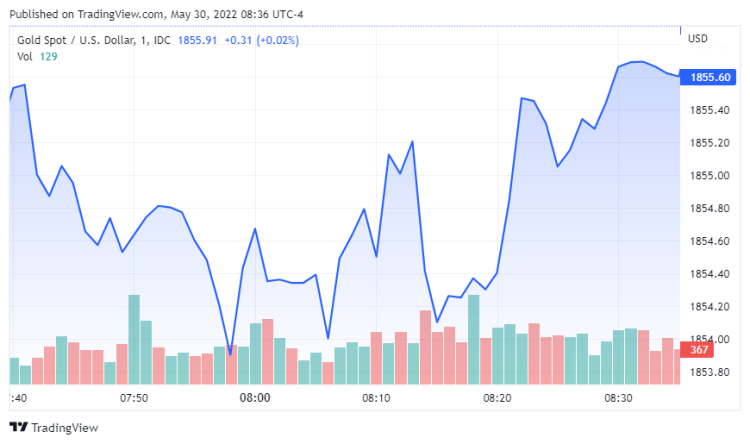

“Gold stuck between $1,840 support and $1,870 resistance”

Market analysts think recession fears will continue to support gold prices. In terms of technical analysis, analyst Diego Colman says that gold is stuck between the $1,840 support and the $1,870 resistance. Stating that a decisive move outside these levels is required for short-term guidance, the analyst draws attention to the following levels:

However, if prices explode to the upside, buyers may be encouraged to start an attack at $1,895. If gold decides to the downside and surpasses the $1,840 area, which currently sits with the 200-day simple moving average, the selling pressure could accelerate, paving the way for a drop to $1,785.

“Gold can easily fall below these levels”

However, not all analysts are convinced that gold prices are poised to rise or the US dollar has peaked. Bart Melek, head of commodities strategy at TD Securities, says he still prefers to rally in the gold market, explaining:

Repositioning could easily force gold to drop to $1,840 and then just below $1,800. It should be noted that the specifications have plenty of room to take new shorts and cut longs.