Electric car giant Tesla confirmed that it continues to trust cryptocurrencies with its balance sheet announced last night. Meanwhile, the name of the two coins in Tesla’s source code for payments is causing excitement.

These 2 cryptocurrencies came out of Tesla’s source code

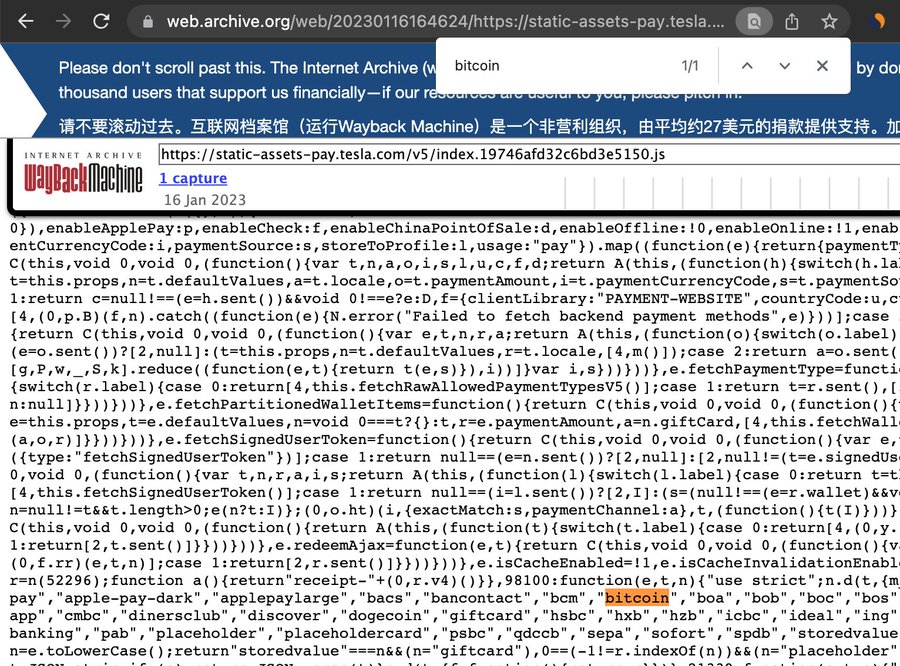

Rumors are spreading that Tesla is about to integrate Bitcoin (BTC) and Dogecoin (DOGE) as payment options. However, upon closer inspection of the codes, it was revealed that Bitcoin and Dogecoin were already available in the source code as early as January 2023. It was also found that the Tesla team did not remove this code when they terminated the option to pay with Bitcoin.

Tesla prefers to protect its crypto reserves

cryptocoin.com As you follow, crypto reserves on Tesla’s balance sheet remained stable. The company’s Q2 financial report, released yesterday, showed that it continues to hold $184 million worth of crypto. But despite being somewhat sluggish due to accounting rules prohibiting recording unrealized gains in crypto, it kept Bitcoin reserves flat despite a 7% price increase in the second quarter.

Interestingly, in February 2021 Tesla bought $1.5 billion worth of Bitcoin. It even announced plans to support it as a payment option. However, Musk later reversed his decision due to environmental concerns. Then the company sold about 75% of its Bitcoin holdings in the second quarter of 2022. Musk justified this with his concerns about the company’s overall liquidity.

How are investors reacting to the latest news?

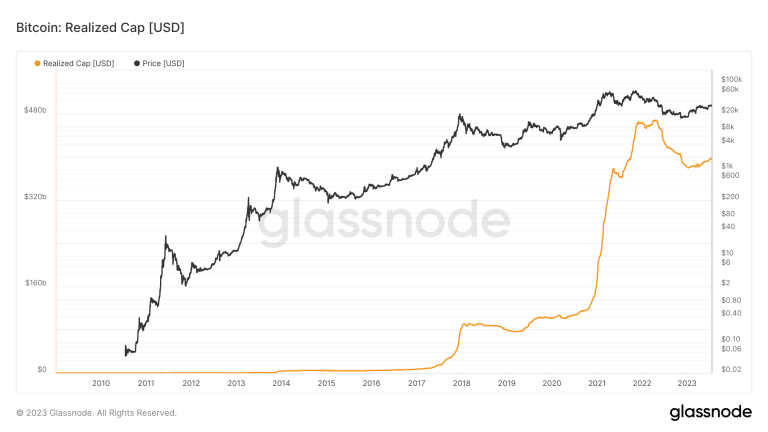

Glassnode recently shared a post revealing that Bitcoin is experiencing a significant flow of capital. Currently, Realized Cap has surpassed a staggering $394 billion. This indicates a consistent flow of capital to Bitcoin throughout 2023.

This bullish trend in Realized Cap shows that cryptocurrencies are trading at higher prices overall. This means a modest increase in new demand for Bitcoin this year.

During bear markets, Bitcoin typically witnesses significant capital outflows as investors seek to cushion their losses. However, the current scenario points to capital flows. One of the oldest and most widely observed on-chain metrics, Realized Cap is a powerful tool for assessing actual capital inflows into Bitcoin. Given the expanded capital flow, it leads us to consider the profitability of this asset.

How about the BTC price?

Bitcoin has been showing an unstable trend lately. It has been hovering in the $30,000 price range over the past few days. Surprisingly, it successfully held this range, demonstrating stability.