Markets are starting a critical week with high volatility. Especially the US, European and Japanese central banks’ interest rate decisions and statements are in the focus of investors.

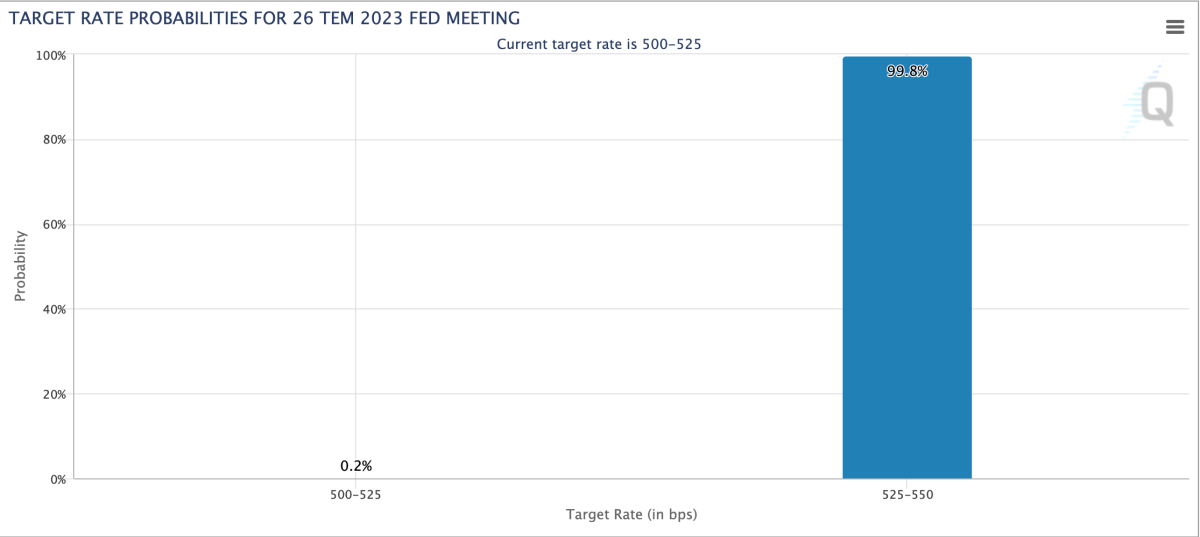

Market’s Expectation from the US Federal Reserve Regarding the July 26 Meeting

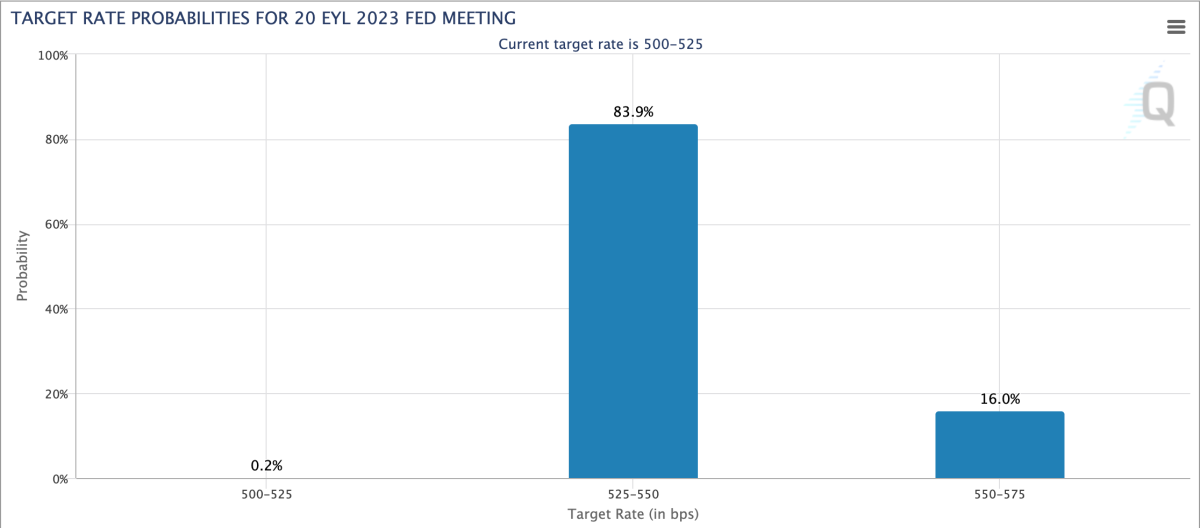

Market’s Expectation from the US Federal Reserve Regarding the July 26 MeetingThe US Federal Reserve (Fed) draws attention with its monetary policy decisions to be announced on Wednesday and the verbal guidance of Fed Chairman Jerome Powell after the meeting. In the money markets, it is considered certain that the Fed will increase the policy rate by 25 basis points, but it is predicted that the policy rate will be kept constant at the meeting on September 20. According to CME Group’s FedWatch data, on September 20, the probability of the Fed keeping rates unchanged is priced at 83.9 percent, while the probability of another 25 basis points increase is priced at 16 percent. Nevertheless, it is possible to say that expectations for the September 20 meeting may change after the Fed’s interest rate decision on Wednesday. Analysts state that despite the slowdown in inflation in the USA, the signals received from the labor market create uncertainty about interest rate hikes. Considering the risk of recession in the USA, it is thought that the Fed may put an end to interest rate hikes after this meeting.

Market’s Expectation from the US Federal Reserve for the September 20 Meeting

Market’s Expectation from the US Federal Reserve for the September 20 MeetingIn Europe, monetary policy decisions to be announced by the European Central Bank (ECB) on Thursday are followed. Inflation pressure in Europe remains stronger than in the US, and money markets are certain to raise interest rates by 25 basis points at this month’s meeting. The bank is expected to raise interest rates by 50 basis points in total until the end of the year.

In Asia, the interest rate decision of the Bank of Japan (BoJ) is in the focus of investors on the first day of the week. The fact that annual inflation was 3.3 percent in June, above the BOJ’s 2 percent target, leads to speculation. Although the BOJ is not expected to make any changes in its monetary policy, there are expectations that it may make policy adjustments at the meeting to be held on Friday.