Bitcoin price action has retraced its steps in an important macro week. Thus, BTC started to meet the downside targets of traders. Here are 5 things to know this week for Bitcoin and the rest of the crypto market.

Leading cryptocurrency started the week with a decline!

cryptocoin.com As you follow, Bitcoin experienced a classic burst of volatility at the weekly close of July 23. Thus, it gave the bulls an idea of a potential return to the $30,000 support. However, this was short-lived and hours before the weekly candle close, BTC gave back last-minute gains. Therefore, it closed the week almost exactly at $30,000. At press time, Bitcoin was trading near $29,000.

Popular analyst Michaël van de Poppe underlines what he calls the “key area” for the bulls to cross. The analyst said, “Bitcoin did not break the critical level. That’s why we’re going to continue the horizontal decline. The scenarios remain the same; – Long positions above $30,200-30,400 – Long positions when we reach $29,000,” he says.

BTC explanatory chart. Source: Michaël van de Poppe/Twitter

BTC explanatory chart. Source: Michaël van de Poppe/TwitterAnother analyst, Daan Crypto Trades, says that the rise to $ 30,300 has effectively opened. It also states that it has already closed a CME futures gap. That’s why she says, “Don’t be fooled by weekend diversions.”

BTC explanatory chart. Source Daan Crypto Transactions/Twitter

BTC explanatory chart. Source Daan Crypto Transactions/TwitterFed rate hike decision leads to ‘action-packed week’

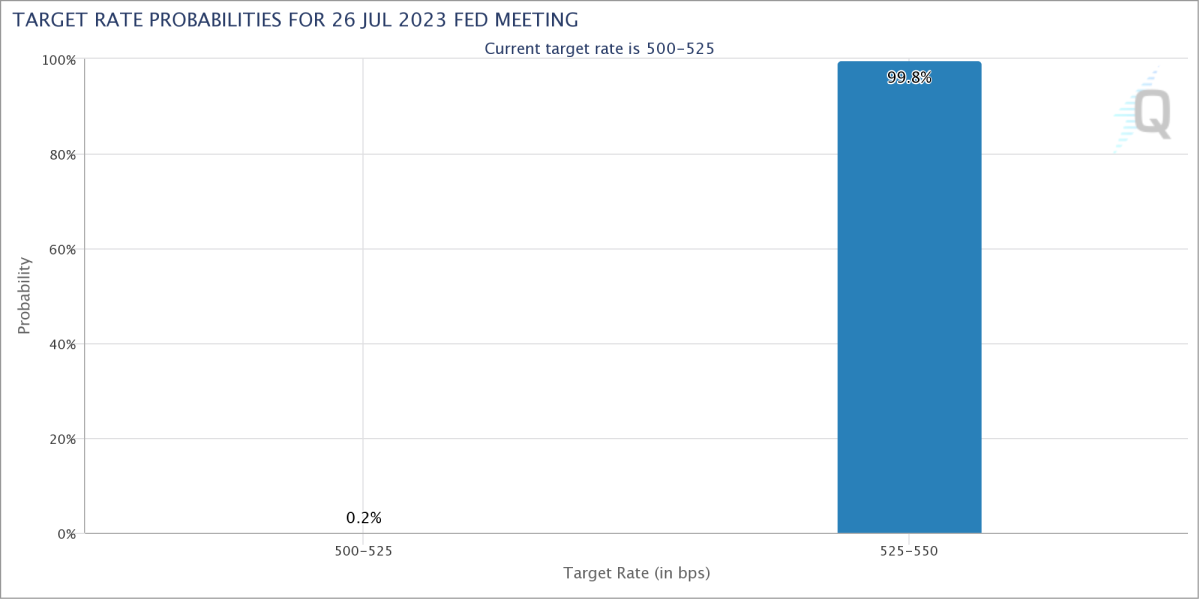

A single event stands out this week, not only in crypto, but also in the macro field. The Fed’s Federal Open Market Committee (FOMC) will meet on July 26 to decide how much to raise benchmark interest rates. Unlike last month, markets expect an almost unanimous 0.25% increase in Fed officials. According to the latest data from CME Group’s FedWatch Tool, the odds are currently at 99.8%.

Fed target rate probabilities chart. Source: CME Group

Fed target rate probabilities chart. Source: CME GroupThe week’s macro data releases will come only after the FOMC. It will also leave no room for these to influence a decision over time. However, the release of the 2nd Quarter GDP and Personal Consumption Expenditure (PCE) Index is no less important. Financial review resource The Kobeissi Letter comments:

There’s nothing like an action-packed week in the markets. 20% of S&P 500 companies will announce their earnings with the Fed meeting and inflation data. After a few weeks of low volatility, things will get interesting this week. It’s a great week to be an investor.

Key Events This Week:

1. Consumer Confidence data – Tuesday

2. New Home Sales data – Wednesday

3. Fed Interest Rate Decision – Wednesday

4. Q2 2023 GDP data – Thursday

5. PCE Inflation data – Friday

6. ~20% of S&P 500 companies report earnings

Action packed week ahead.

— The Kobeissi Letter (@KobeissiLetter) July 23, 2023

Finance commentator Tedtalksmacro states that global central bank liquidity conditions are at their lowest macro level, despite possible interest rate hikes. Alongside the comparative charts, he comments, “After the free fall since March, global CB liquidity may have found a bottom here.” “Historically, this has been good for BTC + risk,” he says.

Global central bank liquidity and BTC chart. Source: Tedtalksmacro/Twitter

Global central bank liquidity and BTC chart. Source: Tedtalksmacro/TwitterWhat does ‘Hash Ribbons’ say about the leading cryptocurrency?

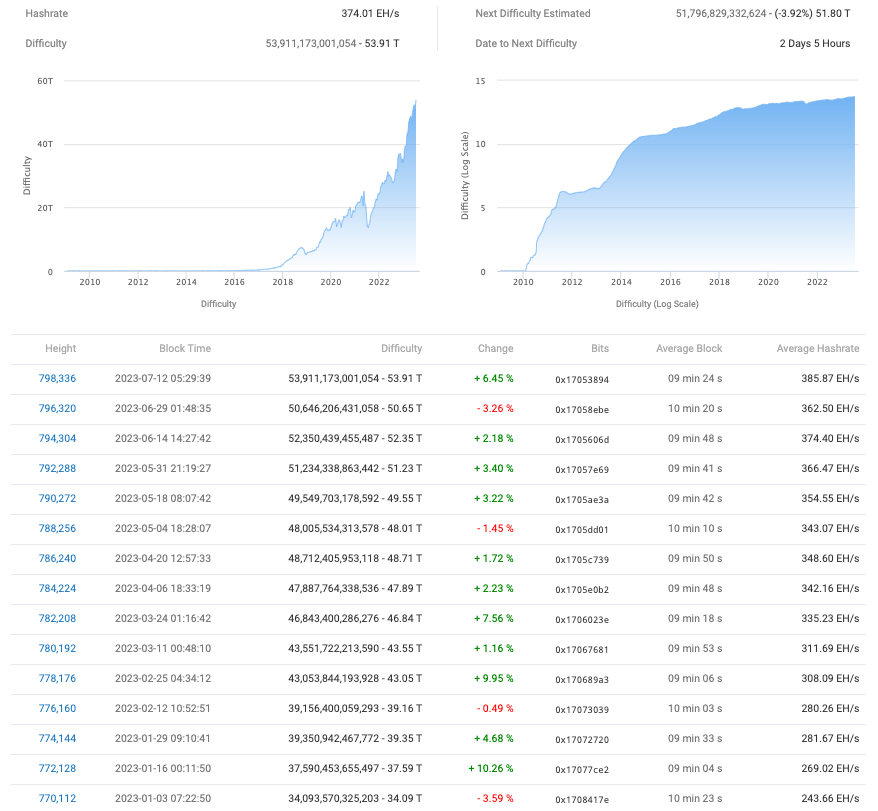

Bitcoin’s stubborn trading range is once again undermining network fundamentals as fierce competition among miners cools. According to the latest predictions from BTC.com, Bitcoin’s mining difficulty will decrease by about 4% in the next automatic recalibration on July 26. Difficulty is currently at all-time highs. It’s only had a few drops this year. Also, this week’s drop could be 2023’s biggest ever drop.

Overview of Bitcoin network fundamentals. Source: BTC.com

Overview of Bitcoin network fundamentals. Source: BTC.comThe hash rate tells a similar story of consolidation after hitting an all-time high this month. Analyzing the hash ribbons metric, Charles Edwards, founder of crypto-asset manager Capriole Investments, marks a new phase of “capitulation”. While it hasn’t been on the market since late 2022, when Bitcoin is still experiencing the consequences of the FTX collapse, Edwards argues that a capitulation is not something traders should be afraid of. Despite this, he describes the explosive growth in hash rate over the past seven months as “unsustainable.” In this context, Edwards shares the following comment:

We have a Hash Ribbon capitulation. In other words, there is a slowdown in Bitcoin’s Hash Rate growth after an unsustainable 50% increase in 2023. HR capitulation is not a sell signal. However, it is not a bullish signal. Risk management is guaranteed until growth resumes.

Bitcoin hash strips chart. Source: Charles Edwards/Twitter

Bitcoin hash strips chart. Source: Charles Edwards/TwitterThe leader reached the peak level for crypto money

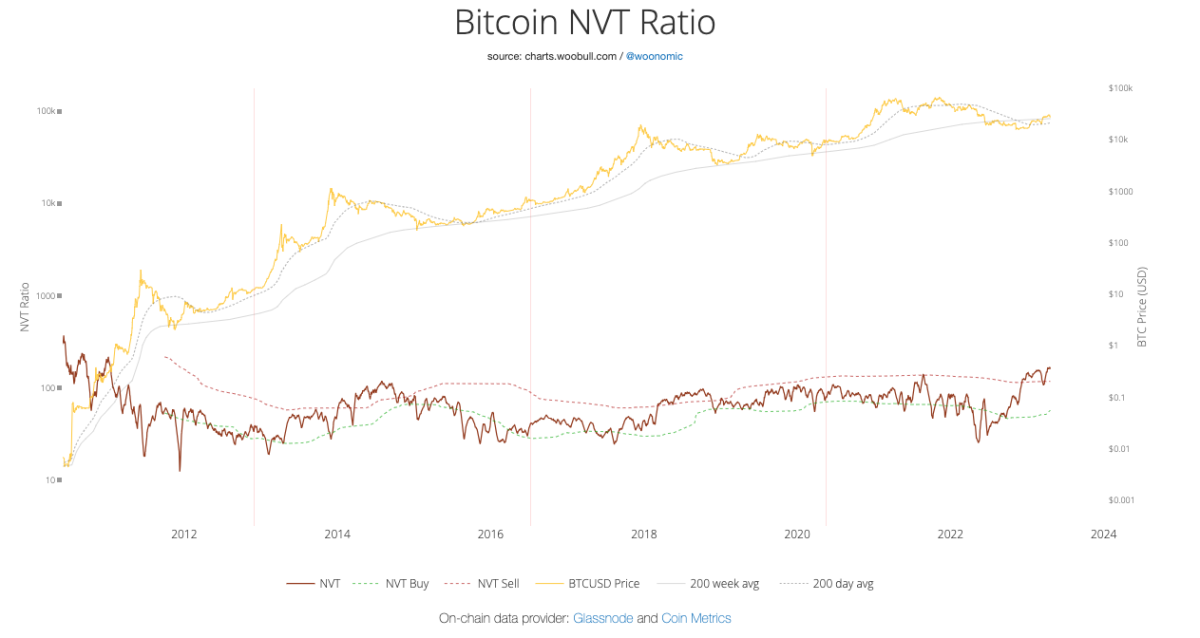

As Bitcoin issues its 800,000th block, a classic on-chain metric gives a similar signal that BTC price conditions may be overheating. The network value-to-transaction (NVT) ratio, which divides Bitcoin market capitalization by the US dollar value of daily on-chain transactions, has reached its highest level in four years. As analyst Willy Woo explains, NVT spikes can occur both in bull markets and during periods of “unsustainable” price increases. In an introductory article accompanying the metric, Woo underlines:

When Bitcoin’s NVT is high, it indicates that the network valuation has exceeded the value transmitted in the payment network; this can happen when the network is in high growth and investors consider it a high yield investment or alternatively when the price is in an unsustainable bubble.

Bitcoin NVT rate chart (screenshot). Source: Woobull

Bitcoin NVT rate chart (screenshot). Source: Woobull75% of BTC supply is with long-term holders

Is there a ray of hope? The current supply of Bitcoin continues to shrink behind the scenes. As various market participants have pointed out, the amount of BTC available for purchase demonstrates a persistent belief among its most ardent hodlers. According to data from analytics firm Glassnode, 55% of supply has been inactive for at least two years, and 29% has been inactive for five years or more. Glassnode shares the following review:

Bitcoin Long-Term Holder Supply has reached a new ATH of 14.52 million BTC, equivalent to 75% of the circulating supply. This shows that HODLing is the preferred market dynamic among mature investors.

Bitcoin long-term hodler supply explanatory chart. Source: Glassnode/Twitter

Bitcoin long-term hodler supply explanatory chart. Source: Glassnode/Twitter