The price of the leading altcoin Ethereum dropped this week. A few data points are starting to show that the coin could be further downside. There was even a “death cross” concern for cryptocurrencies. Here are the details…

More drops for leading altcoin ETH?

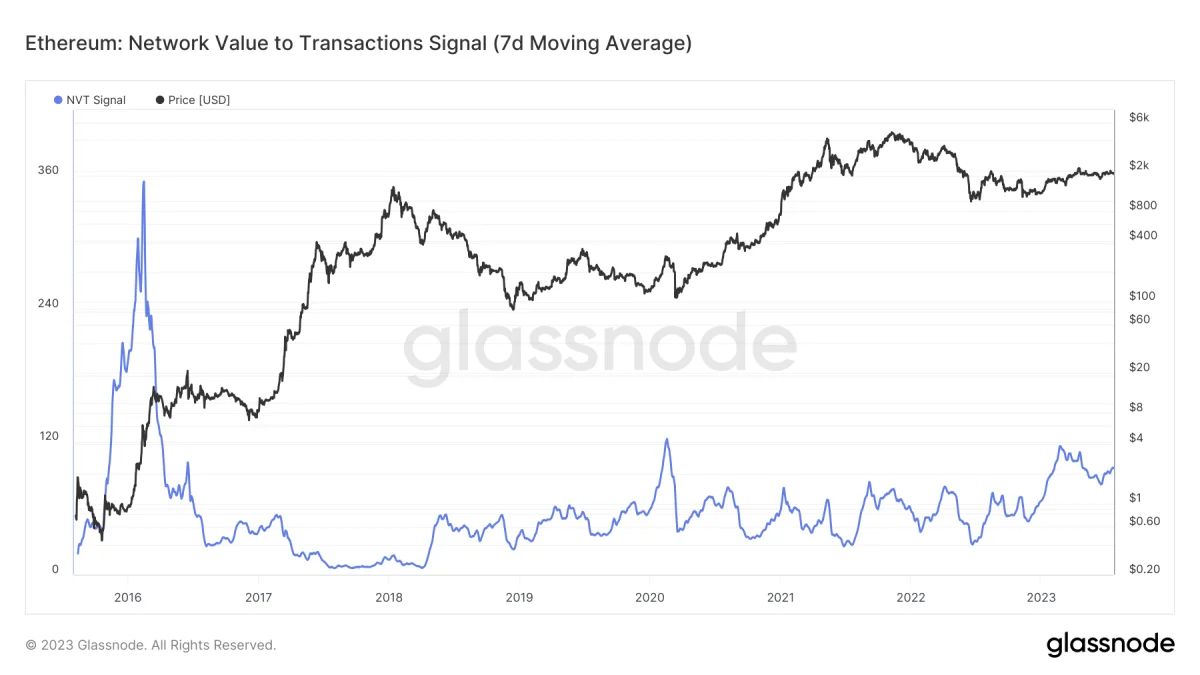

On July 24, Ethereum grappled with uncertainty over macroeconomic conditions and a potential whale sale. It therefore fell close to its monthly lows, reaching $1,825 amid Bitcoin’s downside price action. Various on-chain and technical indicators point to further declines in ETH prices. However, the scope of this downward move may be limited given the profit levels of current holders and the decrease in the liquid supply of ETH. Since the beginning of 2023, Ethereum’s network value to transaction value (NVT) metric has indicated that the asset may be overpriced.

Glassnode’s NVT signal compares the market price with the on-chain trading volume. Thus, it measures the relative value of the Ethereum network. A higher NVT value means ETH is trading at a premium. Glassnode’s NVT graph reveals that the metric typically fluctuates between 30 and 80. However, at the start of 2023, it had risen to 120, a three-year high. It has maintained higher levels since then. This suggests that there must be either a pullback in price or an increase in Ethereum’s on-chain activity to trigger a reset on this metric.

Panic sales are coming

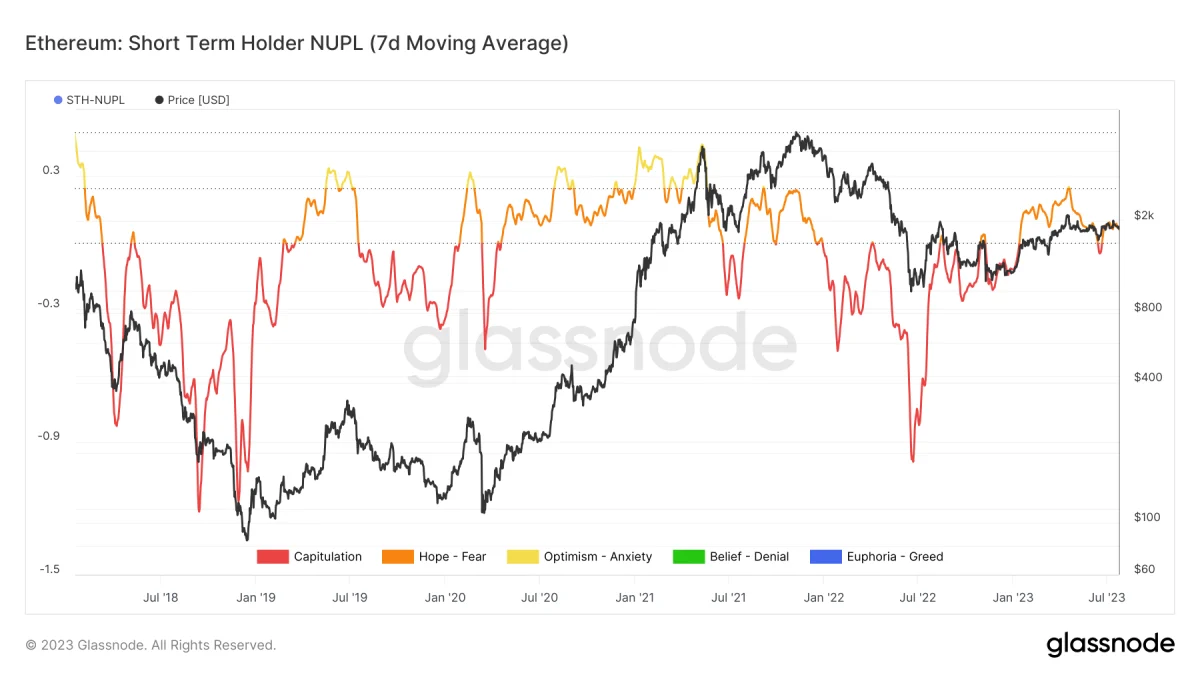

However, the profit levels of short- and long-term holders suggest that the decline may be limited. Ethereum’s negative price action often reverses when short-term holders’ net unrealized profit/loss (NUPL) metric is negative, i.e. short-term holders are at a loss. This causes some weak hands to panic sell, allowing buyers to buy the coins at a cheaper price. Currently, the short-term NUPL rate is close to neutral levels. However, there is some downside to historical levels.

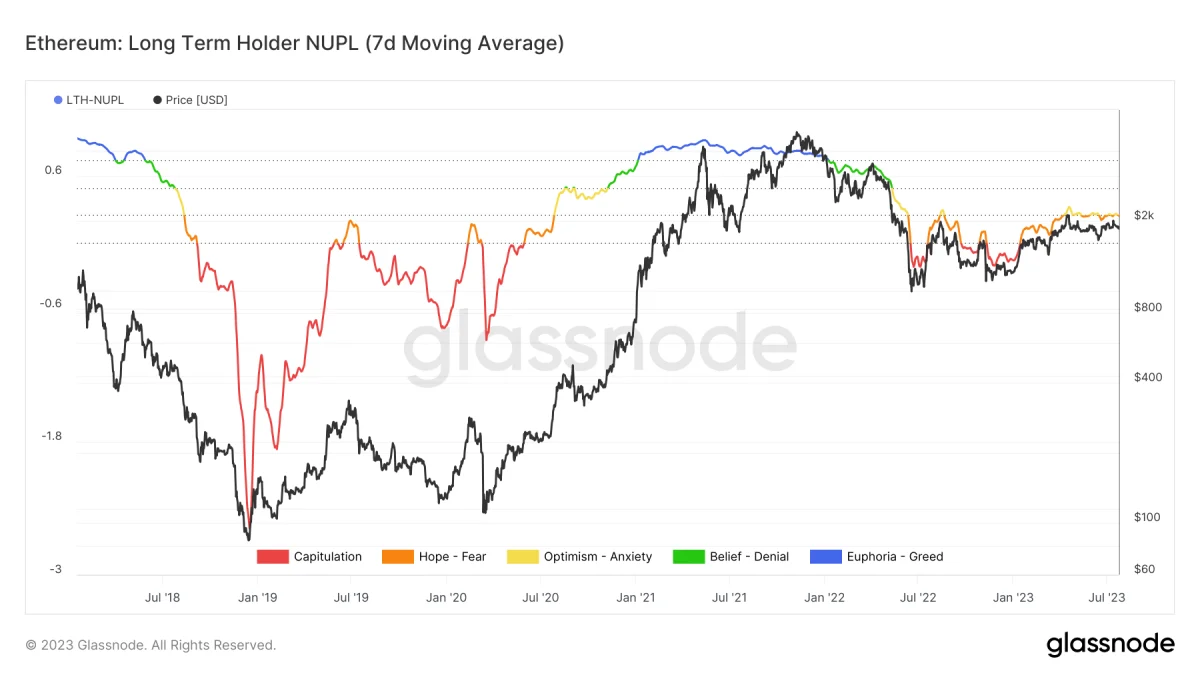

The realized profit/loss metric, which assesses the relative profitability of ETH transfers, paints a similar picture. On-chain analytics firm Santiment wrote in its latest analysis that “the ratio of on-chain transaction volume to profit-to-loss is still in favor of making profits,” but not by much. Similarly, the NUPL ratio of long-term holders is hovering near its peaks in 2019 and early 2020, suggesting that a pullback is likely. Santiment analyst Brian Quinlivan added:

If ETH drops further from here and threatens the $1,700-1,800 level again, panic selling will ensue to justify the buys.

ETH supply on exchanges is falling

Since the Shapella upgrade in April, the supply of altcoin ETH on exchanges has dropped drastically. At the same time, the amount staked for the verification of the proof-of-stake network has also increased. ETH locked in staking contracts has reduced the liquid supply on exchanges, making it more susceptible to selling compared to staked ETH. The realized price of ETH, which represents the fair value of the token based on the daily value carried on-chain, is currently at $1,507. In 2022, ETH quickly fell below the realized price metric as profit levels of long-term holders fell into negative territory.

On-chain metrics suggest that the price may be subject to some selling pressure from short-term holders and panic selling from investors frightened by relatively lower activity levels in 2023. However, the profit levels of short-term and long-term holders suggest that the decline may not be prolonged enough and the price could find support above the $1,500 level.

What does altcoin analysis point to?

Technically, the ETH/USD pair poses a bearish risk in the short-term with an impending “death cross” on a weekly scale, according to analyst Nivesh Rustgi. ETH has only witnessed a death cross between 50 and 200-period moving averages (MAs) on a weekly scale in June 2019 in the past. Then its price dropped 60 percent. On the daily chart, the ETH/USD pair is threatening to drop towards the 200-day MA at $1,761. This coincides with the lows of November 2022. Derivatives data for ETH show no significant change in open interest volume for futures contracts. This reflects the demand for these contracts. This shows that traders are not paying much attention to the recent lackluster price action at the moment.

Looking at the option data from Deribit, it is seen that contracts worth $1.1 billion will expire on July 28. The positioning in the options market points to a bullish trend with a notable concentration in call options between $1,900 and $2,400. As the expiry date approaches, the price is likely to remain under pressure around $1,850, which is the maximum pain level for option buyers. Based on on-chain and market indicators, it looks like ETH’s negative selling pressure will continue for several weeks. However, there is potential for a strong influx of buyers, especially near the $1,700 and $1,500 support levels.