Market watchers have spotted bullish patterns on multiple altcoin charts. These formations, which emerged with the moving averages, suggest a double-digit recovery in the short term.

Watch out for these 6 altcoins, bullish formation points to these levels

Ethereum (ETH)

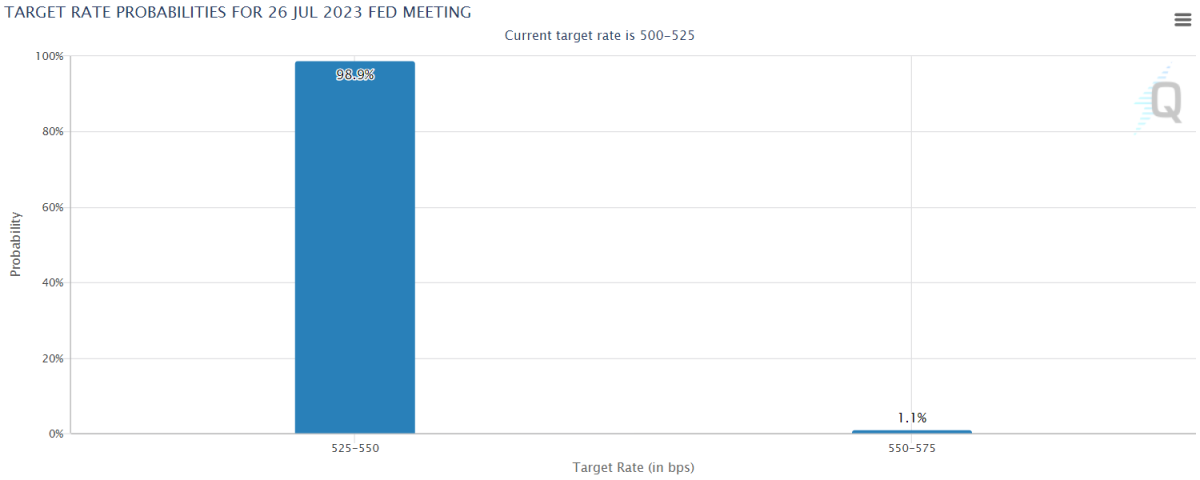

The crypto market is eagerly awaiting the Federal Open Market Committee (FOMC) meeting to be held at 9 PM tonight. Meanwhile, speculation is common about Bitcoin and its potential impact on the altcoin market. The FOMC will announce its decision on interest rates on Wednesday, July 26. He will then hold a press conference with Federal Reserve (Fed) Chairman Jerome Powell.

The CME FedWatch tool shows that the majority of the market (98.9%) expects a 25bps increase. However, the real question is after this decision and whether it means the end of the rate hike cycle.

The price of Ether reached $1,830 as the bulls tried to push the price above the 20-day EMA at $1,865. However, the bears are keeping strong volatility as ETH faced multiple rejections.

Currently, bearish traders are trying to push and hold the price below $1,820. This paves the way for serious negative movement. If the sellers are successful, ETH price is likely to start a correction towards $1,740. This drop indicates that the price could stay in the $1,650 to $1,750 range for a long time.

However, if the price continues to maintain its current rise and surpasses the 20-day EMA, that would indicate a strong buying at the lower levels. This would potentially lead to a rally towards $1,904. If ETH price rises above the critical resistance at $1,978, its next target will be $2,000.

Avalanche (AVAX)

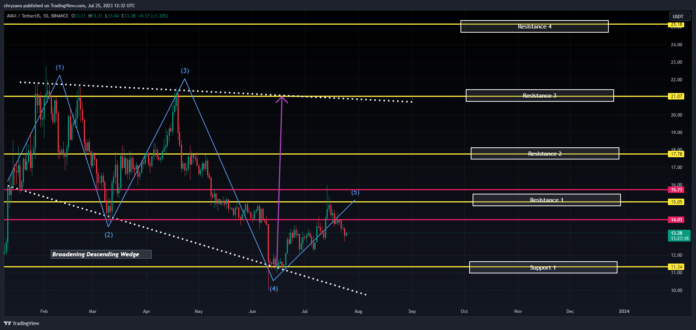

Avalanche has been dominated by bears for the past week. In the first four days of the week, it fluctuated in the red zone just below the opening market price of $14,108. It briefly broke out of the red zone several times before falling below the opening market price. However, last week it touched its maximum price of $14.22.

The chart below shows AVAX fluctuating in an expanding descending wedge. While the top trendline deviates a lot from the horizontal axis, the bottom trendline shows a large angle. Here altcoin price is making lower lows (HH).

Technically, it could find resistance at the pink line where the (2) section meets the lower trendline before it goes up. However, it represents an excellent entry zone for these buyers. If AVAX breaks Resistance 1 at $15, it will also touch Resistance 2 at $17. If the bulls don’t come back, AVAX has the potential to reach Resistance 3 at $21. cryptocoin.comThe 50 million dollar venture news of July 25, which we have reported as AVAX, helped AVAX to reach these resistances.

Shiba Inu (SHIB)

The SHIB chart has caught the attention of investors recently as it forms an ascending triangle pattern. However, the excitement lies in the potential breakout from this ascending triangle pattern that could lead to a new and protracted recovery. The ascending triangle is a technical chart formation characterized by higher lows and a horizontal resistance line. Traders often interpret this as a potential bullish signal.

If a bullish breakout occurs and the price of the Shiba Inu breaks through the overhead resistance, it will lead to a surge in buying momentum. Technical analysis suggests that a successful breakout from the ascending triangle pattern could push the price of SHIB up to $0.00001, representing a potential gain of 25% from its current level.

Meanwhile, the SHIB is starting to gain popularity, in part because of the Shiba Inu dog logo. Elon Musk indirectly mentioned SHIB on Twitter earlier this week.

The impact of #SHIB will be felt at

X if Elon will give Shiba INU instead

of FIAT for ad revenues . Imagine the desire of these big mouth digital creator cheering for $SHIB because they also have it ? #SHIBARMY will grow #SHIBARIUM will be used#SHIBARMYSTRONG @elonmusk pic.twitter.com/RzX6TJp1IV— Lola (@CryptoLollla) July 25, 2023

XRP

According to Mr. Huber, an XRP proponent analyst, there is a huge demand for XRP right now. The analyst noted that one to four billion dollars worth of XRP is being requested per day. Huber was responding to another analyst. According to Mobarak, Ripple is buying significant volumes of XRP on the open market. He believes that in case of a general bull run, XRP will not react to the market.

Replying to Mobarak, Huber stated that the demand for XRP has increased by 800% last year than Ripple could offer through its sales. Using a screenshot from TradingView’s analytics platform, Huber revealed that Ripple has increased the supply by 10% by selling its XRPs. He stated that during the same time frame, the price of XRP rose 80% organically.

Wrong, there is a major market demand for XRP, between one and 4 billion dollars per day. But in the past year the demand grew "only 800%" more than Ripple was able to offer through their own sales. Ripple increased the supply by 10% by selling their xrp while in the same… https://t.co/NTG0u81X2C pic.twitter.com/qVqzHce5zy

— Mr. Huber🔥🦅🔥 (@Leerzeit) July 25, 2023

To support his view, Huber stated that during the 80% increase in the price of XRP, there were no funds, ETFs or other investment vehicles for the digital token in the United States. He also clarified that there are no incentives, returns or staking rewards for holding and not selling XRP.

Will the XRP price hit $10 by September?

According to some market watchers, the XRP price will hit $10 this year. This is based on technical chart analysis, not underlying fundamentals. According to past trends, if the monthly percentage sees the same trajectory as in the past, the price could reach $1.70 earlier this quarter, $6 in August and above $10 in September.

While this price prediction looks like a big move from the current $0.70, it will still be far from another target that some have. Based on a popular Simpsons meme, crazy online speculations about XRP have come in at $589 per coin.

Dogecoin (DOGE)

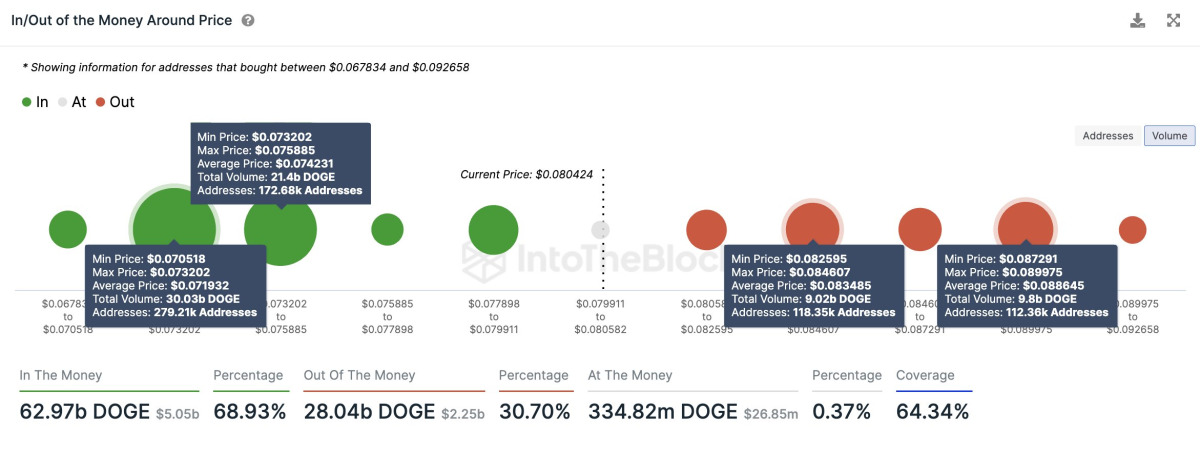

Dogecoin’s price continues to surge, leading the list of top earners after Maker (MKR). As the broader cryptocurrency market faces selling pressure, Dogecoin recorded a reverse move last week, up 16%. It is currently trading in the $0.07876 region, where it is up 2.5%.

Meanwhile, traders looking to capitalize on the current Dogecoin momentum should watch these levels before making any new entries. DOGE is currently facing stiff resistance at $0.083. Ali Martinez announced that 452,000 wallets have purchased 51.4 billion DOGE in the region of $0.070 to $0.076. This means current levels are the floor for $0.083.

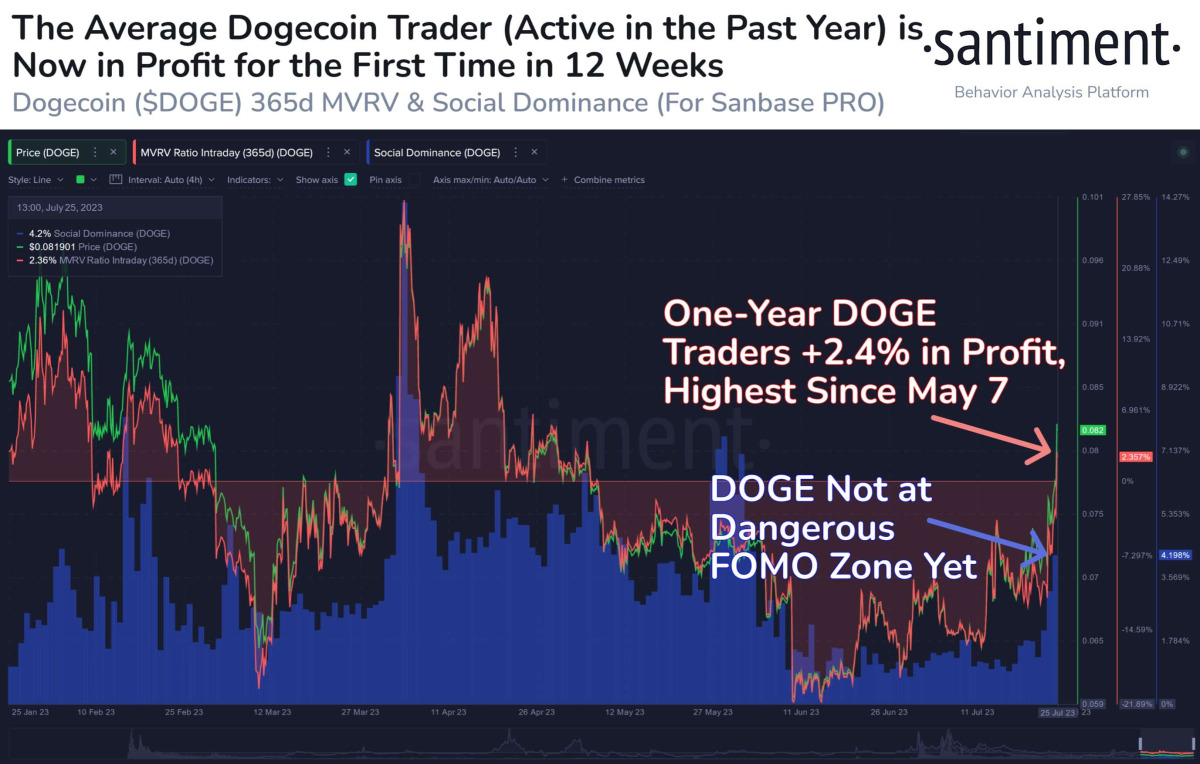

Also, Santiment’s latest data showed that the altcoin price has increased by more than 25% over the past two weeks. This proved to be delivering substantial profits for many average Dogecoin investors. The analytics platform also accounts for 2% of DOGE investors active last year. He also stated that he achieved a return on investment of over 4. He also predicted that these investors could potentially see even higher gains when DOGE enters a risky FOMO zone it has yet to reach.

Other on-chain metrics also support the altcoin price rally. DOGE price formed a strong technical break above $0.08. If it continues above these levels, it will lead to a 20,000% price rally.

DOGE short-term goals

With the above, DOGE is currently heading towards its next target above $0.09. It will initially try to secure upper targets above $0.1. Also, the number of daily active addresses has been rising for more than a month. This indicates that a new bullish wave may be on the horizon.