Crypto whales selling massive amounts of Maker (MKR) today are causing volatility in the altcoin market. Reports also showed that stagnant names like PEPE are welcoming new billionaires. What are whales doing lately? Here are the highlights…

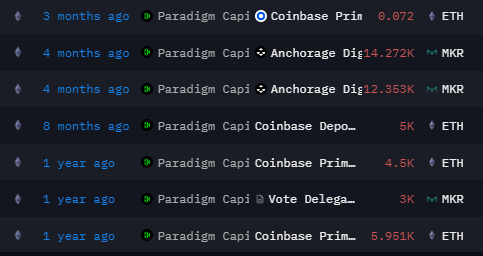

Paradigm prepares for MKR sale

According to Arkham’s report, Paradigm transferred 3,000 MKR (approximately $3.56 million) to its OTC transaction wallet address. The Paradigm address raised 3,000 MKR ($3.37 million) yesterday. Experts are worried that these purchases will turn into sales in the coming days. According to the data, the company chose this option in the past months.

While Maker is on the red list, these coins welcome new buyers

Pepe (PEPE)

The biggest Pepe whales have started billion-dollar purchases via centralized exchanges. These strong buys are causing significant volatility in the crypto markets. According to Lookonchain, PEPE witnessed staggering whale activity yesterday by two major investors collectively totaling 1,100 ETH ($2.06 million).

The first whale, operating under the alias “Yougetnothing.eth”, bought 874 billion Pepe for 600 ETH ($1.12 million). Then the second whale called “0x4631” stepped in, which spent 500 Ether ($936,000) to collect 685 billion PEPE.

2 whales bought 1.56T $PEPE with 1,100 $ETH($2.06M) today.

yougetnothing.eth spent 600 $ETH($1.12M) to buy 874B $PEPE at $0.000001286 ~12 hrs ago.

0x4631 spent 500 $ETH($936K) to buy 685B $PEPE at $0.000001366 ~6 hrs ago. pic.twitter.com/DQx3biCSh2

— Lookonchain (@lookonchain) July 27, 2023

WBTC and ETH

According to Ember’s report, a stETH whale bought 173.5 WBTC ($5.09 million) and 3616 ETH ($6.7 million) yesterday. Whale spent 11.79 million USDT on this purchase. Meanwhile, WBTC price was trading at $29,351. The whale’s average ETH purchase price was $1,851. Currently both coins are trading with roughly 3% gains with the whale making some profit.

一 $stETH 巨鲸昨天花费 1179 万 U 买进了 173.5 $WBTC($5.09M) 和 3616 $ETH($6.7M)。

• 使用 509 万 USDT 买入 173.5 WBTC,均价 $29351;

• 通过添加 Uniswap V3 单边 LP 的形式,将 670 万 DAI 兑换为 3616 ETH,均价 $1851。https://t.co/j8WQscqpPk推文由 @LionDEX_CN 赞助 pic.twitter.com/zAk9j1QloD

— 余烬 (@EmberCN) July 27, 2023

Dogecoin (DOGE)

Dogecoin, on the other hand, has been on the rise since the beginning of the week. This momentum came at a time when Elon Musk was accelerating Twitter’s transition to the “X”. It seems that the latest news is intrigued by the whales. The DOGE price rose by about 11% in a single day due to the spike in the whales’ performance.

The reason for this is once again based on Elon Musk. Whale addresses, i.e. addresses holding more than 0.1% of the entire circulating supply, observed a rather meager $83 million total net flow of 1.02 billion DOGE.

Meanwhile, the supply swirling around has led to a 110k-fold increase in the number of short-term holders (addresses holding supplies for less than a month).

As a result, their percentage increased from 0.02% to 2.6% within two weeks. These investors now pose a threat to Tuesday’s 11% rally. They may prefer to take profits from higher levels in the coming days.

Recent activity around Dogecoin has been linked to Elon Musk’s new super app “X”. cryptocoin.comAs we have reported, it is estimated that Dogecoin will be the primary payment in the new application.