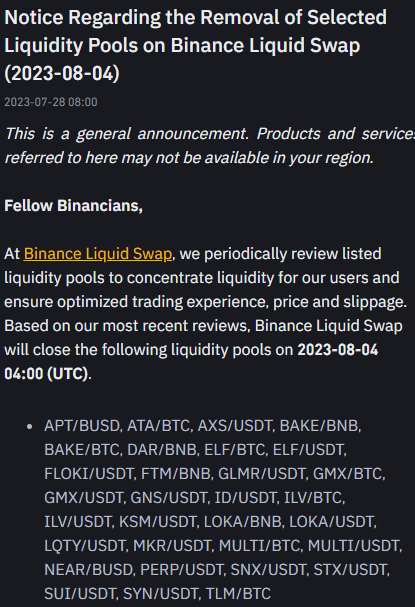

Binance announced that it will delist 31 trading pairs, including APT, AXS and FLOKI, from the Liquid Swap platform.

These 31 trading pairs are being removed from Binance Liquid Swap

According to the July 28 announcement, Binance is delisting a number of trading pairs, particularly against BTC, USDT and BNB. The delist in question contains the most important trading pairs of the Liquid Swap platform. Trading pairs to be delisted from the platform as of 07:00 on August 4:

- GMX/USDT

- ELF/BTC

- SYN/USDT

- GMX/BTC

- MKR/USDT

- STX/USDT

- ILV/USDT

- FLOKI/USDT

- LQTY/USDT

- ID/USDT

- BAKE/BTC

- LOKA/BNB

- PERP/USDT

- SUI/USDT

- MULTI/BTC

- GLMR/USDT

- ILV/BTC

- ELF/USDT

- MULTI/USDT

- TLM/BTC

- AXS/USDT

- SNX/USDT

- NEAR/BUSD

- LOKA/USDT

- DAR/BNB

- APT/BUSD

- FTM/BNB

- KSM/USDT

- GNS/USDT

- BAKE/BNB

- ATA/BTC

Binance attributed its delist decision to these inadequacies

According to the official announcement, “At Binance Liquid Swap, we periodically review the listed liquidity pools to concentrate liquidity and provide optimized trading experience, price and slippage for our users. According to our most recent reviews, Binance Liquid Swap will close select liquidity pools on August 4. From time to time, Binance reviews the listing of cryptocurrencies or liquidity pools and decides to close. Such decisions can be made for several reasons:

- Liquidity: If a particular coin has low liquidity and cannot provide sufficient trading volume, problems with an optimized trading experience for users arise. In such cases, the exchange delists the relevant cryptocurrency to increase liquidity.

- Security and compliance: In particular, some cryptocurrencies may have security vulnerabilities or regulatory compliance issues. Binance takes such a decision to protect users and ensure the security of the platform by delisting cryptocurrencies that do not comply with security and regulatory standards.

- Project failure: Cryptocurrency projects sometimes fail to meet their goals or make expected progress in terms of development. In such cases, cryptocurrency is no longer a viable investment or transaction tool for users due to the failure of the project.

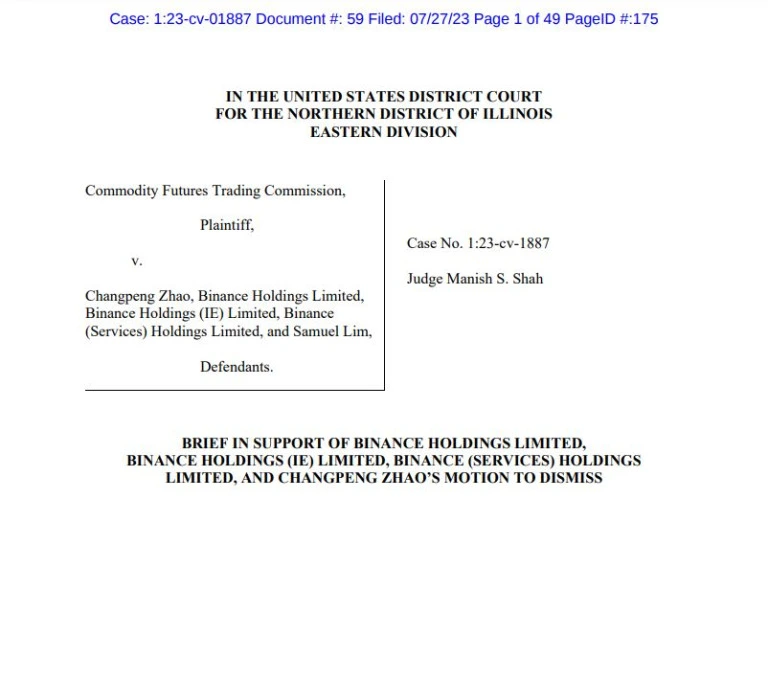

Leading exchange takes counter-step in CFTC lawsuit

cryptocoin.com As you follow, Binance took the opposite concrete step in the CFTC case today. The exchange claims that the US regulator has overstepped its authority, specifically over crypto companies. After due process began in March, Binance claimed that the CFTC acted outside of its jurisdiction. He further argued that both the exchange and its founder CZ are not located in the US, so they should not be subject to the law.

Meanwhile, in early March, the CFTC sued Binance, alleging that the company provides unregistered derivatives such as cryptocurrency trading services, futures and options products in the US. The regulator also accused Binance of lacking proper oversight, a trusted know-your-customer or anti-money laundering program. It also claimed that it did not register as a futures exchange, contract market or clearing execution company.