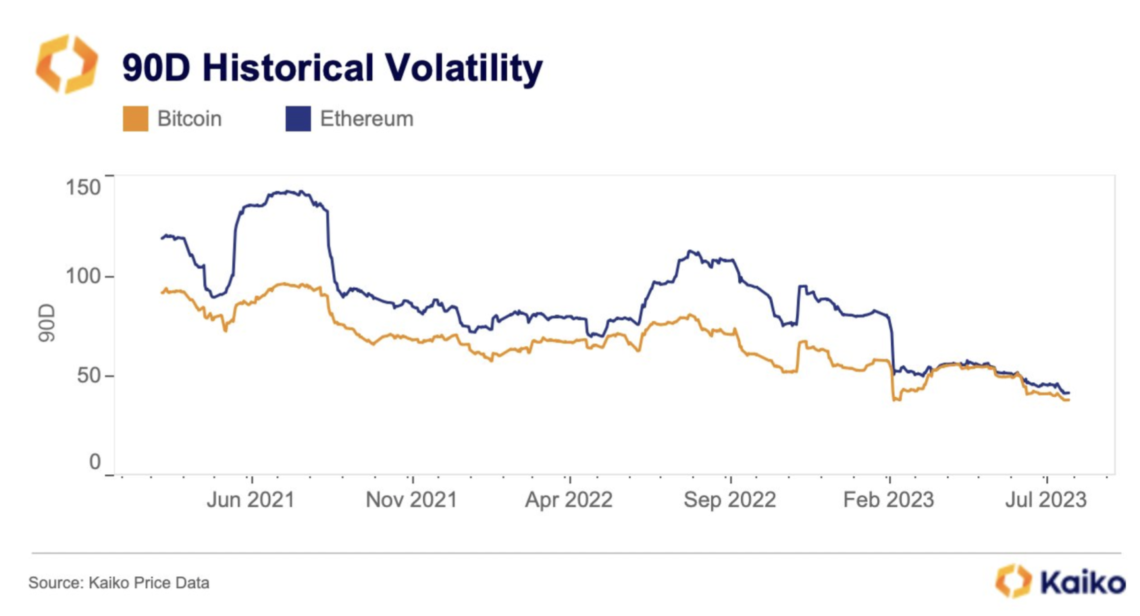

The US’s fight against inflation and the interest rate meeting in July did not seem to create the expected volatility in the crypto money market, and we are experiencing the most stagnant times of the last 2 years. However, the movements of whales, market trends and possible trends in this stagnant market will give us an idea about the market.

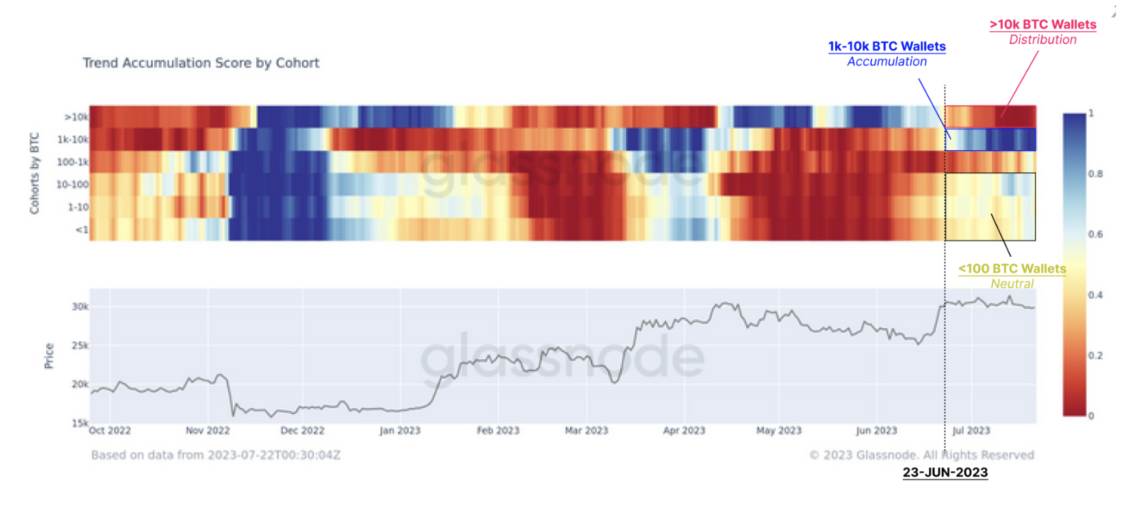

As we come to the end of July, analyzes on the Trend Accumulation Score of addresses holding Bitcoin show that at the time when Bitcoin rose to around $ 30,000, addresses holding 10,000 Bitcoins and above started to reduce the amount of Bitcoin in their hands and started distribution.

At the same time, it shows that addresses holding between 1,000 and 10,000 Bitcoins begin to accumulate Bitcoin. Addresses holding less than 100 Bitcoins seem to remain neutral, meaning there doesn’t seem to be a big change in their mobility.

If the red areas start to increase, it may create selling pressure, but according to the current distribution and accumulation data, the market may be facing a positive effect. Because while distribution areas designated as red areas have decreased, accumulation areas in blue and neutral areas in yellow have increased.

Looking at the behavior of long-term investors, it seems that the number of long-term investors holding Bitcoin has reached a new all-time high, reaching 14.52 million Bitcoins. This shows that long-term investors trust the market and keep the hodl strategy.

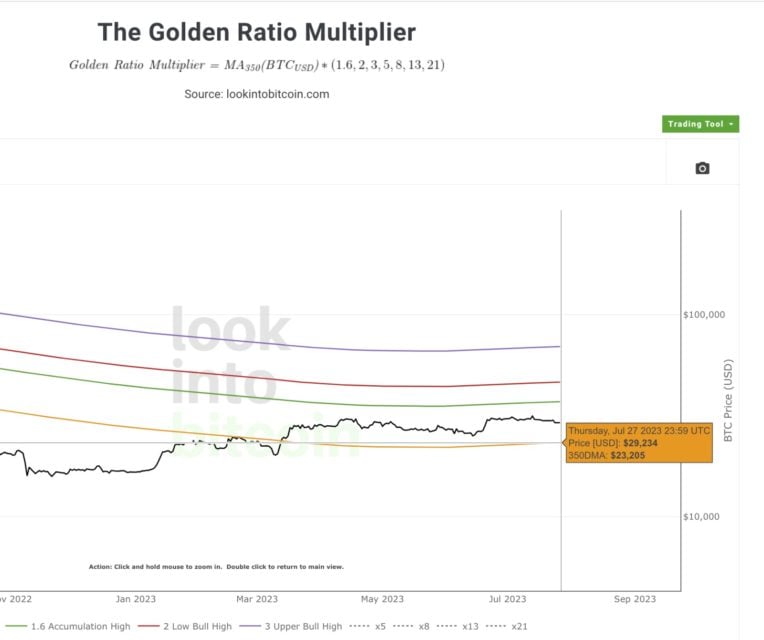

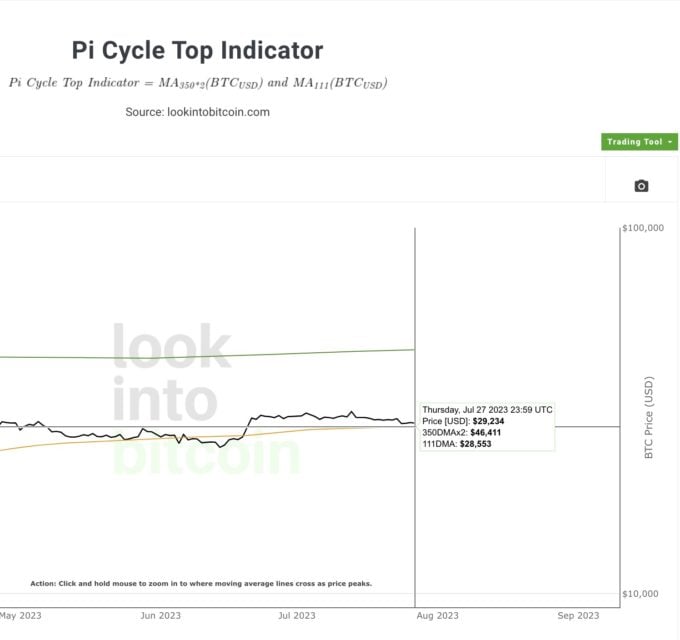

Since the monthly closing will take place this week, volatility may increase, 111DMA 28,553, 350 DMA 23.205 and Realized Price 20,429 onchain supports should be considered.

References:

https://www.lookintobitcoin.com/charts/

https://research.kaiko.com/