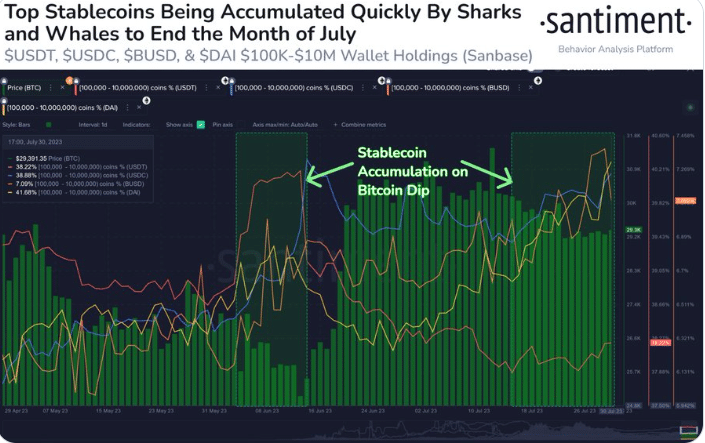

According to Santiment data, whales have started the Bitcoin BTC movement again. So what does this mean for the coming days?

Bitcoin whales collect stablecoins

There are reports of wallet holders known as whales that have a large number of stablecoins in them. He’s making an important move. Accordingly, Bitcoin is strategically benefiting from BTC falling below the $30,000 mark recently. Stablecoins like Tether, USDCoin, BinanceUSD, and Dai have all seen a shift in supply towards these major wallets.

It makes sense that the sharp increase in whales stablecoin holdings coincided with the price drop of Bitcoin BTC. It suggests that whales may be buying Bitcoin at lower prices in anticipation of a potential recovery.

Accumulation points to an uptrend

Another set of Santiment data this month revealed a massive spike in addresses for DAI and Paxos Standard (USDP), which have held between $100,000 and $10 million in stablecoins since June 27. In addition, the market intelligence site reported that since June 27, investors have added 2% of the entire DAI supply.

🐳🦈 Sharks and whales are watching the $30k to $31k #Bitcoin price ranging, just like the rest of traders. And it appears that they are accumulating #stablecoins like $USDP & $DAI quite rapidly, which increases the probability of future big #crypto buys. https://t.co/IsW0xJFsd9 pic.twitter.com/wkrr0bDQGL

— Santiment (@santimentfeed) July 12, 2023

How will this reflect on Bitcoin’s future pricing? Whales accumulating Bitcoin often signals an uptrend for the leading cryptocurrency. Major players can have a significant influence on the direction of the market because of the significant assets they hold. These whales have the potential to shift their major stablecoin holdings back to Bitcoin. Accordingly, increased demand will provide a significant boost to Bitcoin’s price.

The market should be prudent

On the other hand, the market value of these stablecoins is declining. Tether’s global market cap dropped 0.03% in 24 hours. USDC’s market cap decreased by 0.05% and BUSD’s market cap decreased by 0.02% in one day.

However, the market should act cautiously. A sudden Bitcoin sale by these big owners will cause prices to drop. It will also show the power these organizations have in the cryptocurrency market. At the time of this writing, Bitcoin is trading around $29,388, down 1.2% from last week.

Bitcoin miner reserve rises

According to data from CryptoQuant, BTC miner reserve has increased from 1,826 million on May 27 to 1,841 million as of July 30. Increasing BTC miner reserve and relatively stable and stable cryptocurrency prices indicate a sense of optimism among miners. This situation increases sensitivity and trust among miners. Accordingly, this could likely push prices higher and prevent sellers from pushing the coin further down. Currently, as mentioned earlier, Bitcoin is hovering below $30,000.

In the crypto space, the Bitcoin miner reserve measures all BTC held by all miners and mining pools. It shows the total number of BTC that has not been liquidated yet. For the price, this is important. Miners often sell their coins to cover operational costs and make a profit. For this reason, viewers often watch trading patterns for valuable insights into market sentiment.

Factors affecting the future prices of Bitcoin

Bitcoin miner reserve trends are important to traders. However, other critical factors may affect prices in the coming sessions. Also, some of them can have negative effects. How different countries decide to regulate cryptocurrencies, including Bitcoin, is an important consideration that can affect liquidity and investor perception.

In the United States, for example, the approval or rejection of a Bitcoin Spot ETF by the Securities and Exchange Commission (SEC) will significantly affect the price of Bitcoin in the coming months. Approving a Bitcoin ETF will inject capital into the crypto markets by enabling institutional players to include Bitcoin in their portfolios. It will also potentially increase liquidity. Currently, Grayscale’s GBTC allows institutions to switch to Bitcoin without buying BTC directly.

Other factors

Beyond price-related factors, Bitcoin BTC has a proof-of-work network factor. It has been criticized for consuming a significant amount of energy to maintain its operations. In response to environmental concerns, China has banned Bitcoin and crypto mining activities. This step caused a drop in the hash rate of the network. It also negatively affected BTC prices. It is not yet clear whether the US and Europe will follow a similar path in the future. All of this will have implications for Bitcoin’s price trajectory.

Bitcoin continues to face price stagnation. On the other hand, the growing miner reserve provides a glimmer of hope for optimistic sentiments. However, regulatory decisions and environmental concerns are having a significant impact. Therefore, the future of Bitcoin’s price trajectory remains uncertain. Traders and investors navigating the crypto market cryptocoin.comAs we mentioned, we follow these factors closely.