Allegedly, the Kannagi Finance team took away users’ assets worth $2.4 million. The incident was recorded as the first ‘rug-pull’ to affect the scaling solution zkSync Era. After these developments, the altcoin project lost almost all of its value.

Rug-pull, altcoin price collapsed on Kannagi Finance!

Adding to the woes of zkSync Era, Kannagi Finance, a yield aggregator protocol, saw its entire asset pool drained on Friday, July 28. This dubious exit marked the first ‘rug-pull’ in the zkSync Era, with Kannagi Finance disappearing online immediately. Blockchain security firm Solid Proof audited Kannagi Finance’s ERC20 contract in June. He later estimated that the cost of the robbery was around $2.4 million. However, it’s important to clarify that their audits do not cover Wallet contracts in this scam.

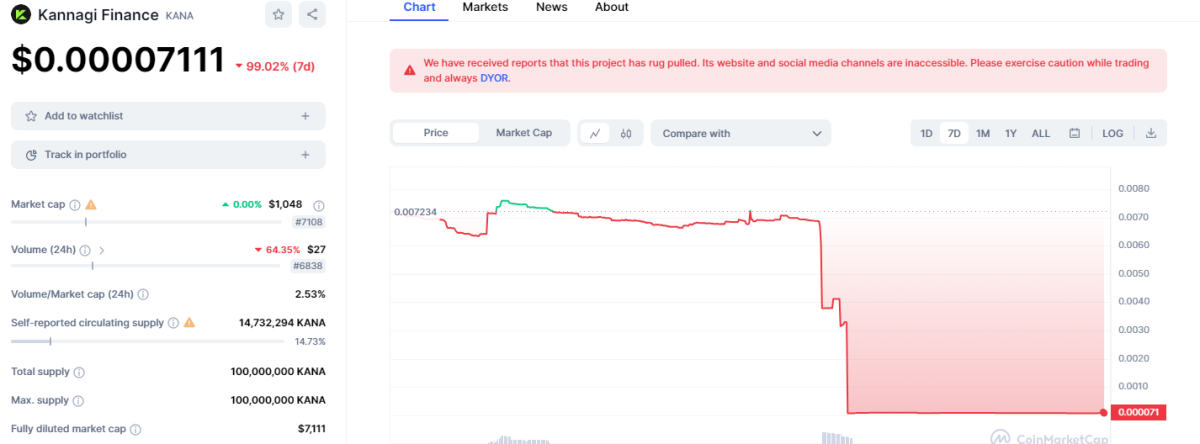

Solid Proof said, “We have identified that the scammer is most likely a person in the China region. “We will continue to monitor wallets and take further steps.” That responsibility fell to Source Hat, another organization that oversees the ERC-4626 token contract. Source Hat has yet to make any statement about the Kannagi debacle. Moreover, their respective GitHub repositories mysteriously disappeared. As of July 30, Blockchain watchdog MistTrack detected that a transfer of 600 ETH from the Kannagi event occurred via crypto mixer Tornado Cash. Meanwhile, amid the developments, the altcoin price has seen a vertical drop. The KANA price has lost almost all of its value on a weekly basis.

KANA weekly price chart. Source: CoinMarketCap

KANA weekly price chart. Source: CoinMarketCapThe road ahead for the zkSync era

Named zkSync 2.0 in beta, zkSync Era represents the second iteration of Matter Labs’ rollup-centric scaling solution. His method contrasts with second-tier solutions like Optimism. Both organizations streamline transactions by aggregating transactions before on-chain logging. However, their methodologies differ from each other. Optimism leverages optimistic rollups, while zkSync prefers zero-knowledge (ZK) rollups.

Since its debut in March, zkSync Era has been gradually solidifying its presence in the DeFi industry. It also wins projects with the promise of efficient transaction processing and negligible gas fees.

An interesting metric: Total Locked Value (TVL)

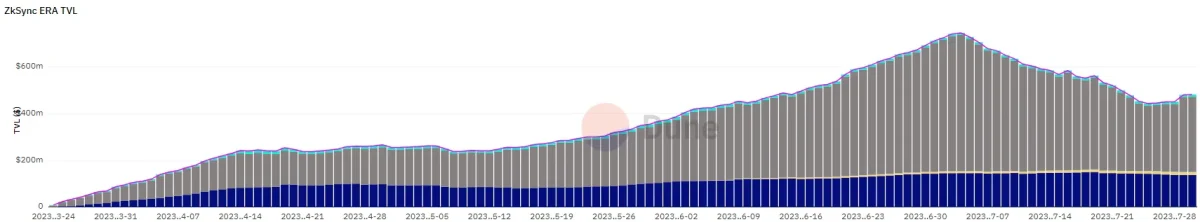

Notable support came last month when Kyber Network included its flagship KyberSwap in the zkSync Era ecosystem. An interesting metric for measuring the state of zkSync Era after these setbacks was Total Locked Value (TVL). TVL is a reliable barometer of user sentiment, which often declines after vulnerabilities.

Total Locked Value in the zkSync Period. Source: Dune

Total Locked Value in the zkSync Period. Source: DuneHowever, zkSync Era seems to have reversed this trend. Despite the turmoil over the past week, there has been no significant fund outflow. TVL metrics show it rose from $442.55 million on Monday to over $380 million at the weekend. This is a sign that the faith of the community has not been shaken to a large extent.